NYISO has proposed the metrics for identifying operating reserve suppliers that consistently underperform as part of its plan to remove them from the market.

The ISO first presented the proposal in January, but it had not yet specified the thresholds for determining whether a supplier was underperforming. (See NYISO Explains How It Would Put Poorly Performing Resources in Time-out.)

One metric is aimed at frequently called poor performers and examines how they performed during Reserve Pick-up (RPU) events — defined as when the area control error exceeds 100 MW — and audits.

The other targets those that are qualified to provide reserves but are rarely called to do so and examines their performance when dispatched in the energy market. “We’re looking at their energy dispatch in the cases where they weren’t picked up for an RPU but are still a provider,” NYISO Associate Engineer Andy Bean told the Installed Capacity Working Group on April 24.

Bean explained that the first metric would be a snapshot of the last three months of RPU performance data. The ISO would divide the difference of the expected basepoint and energy provided by the total sum of the expected basepoints for the three months. Generators that fall below 70% of their expected performance would be subject to a rebuttable presumption of removal from the market.

The metric would be applied any time a resource eligible to provide 10-minute operating reserves is dispatched during an RPU event and during manual audits of eligible resources.

The energy performance metric is structured similarly, but instead of comparing an expected basepoint to energy provided, it uses the same formula to compare energy requested to energy provided over the past three months. Bean said this metric would be assessed any time a resource in the operating reserves market is scheduled, but not when it is providing regulation. If energy performance falls below 50%, it would be subject to a rebuttable presumption of removal.

Resources that fail to meet these thresholds would be eligible for removal from the market for at least 30 days.

Richard Bratton, representing the Independent Power Producers of New York, asked how the ISO had come up with the thresholds.

Bean said NYISO staff had looked at historical data, and those percentages were where they saw “natural breaks” and the worst-performing units separating out. These units, Bean said, were also aligned with what the Market Monitoring Unit identified as the worst performers.

The ISO found that in 2024, roughly 550 MW of operating reserve suppliers would have failed one or both of the metrics and would have been subject to the threat of removal from the market. If all of them had been removed for three months, this would mean that operating reserves would be down 100 MW each month in 2024.

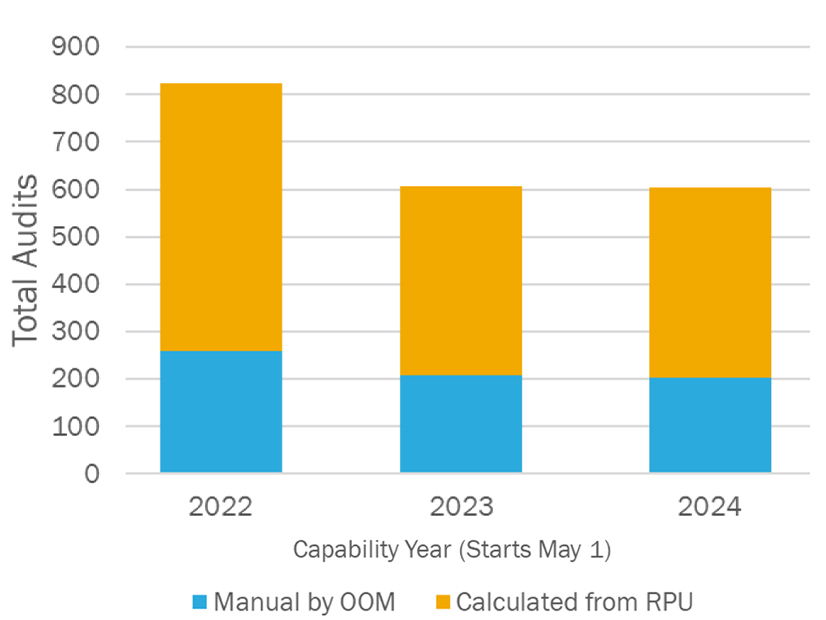

Bean presented a slide showing historical audit data, demonstrating that between the 2022 and 2024 capability years, there were about 80 audits stemming from RPU issues.

Resources may rebut the metrics by showing that the data are incorrect, they were in an outage or their basepoints are inconsistent with what they can provide. Extreme circumstances outside of operator control would also rebut the ISO’s presumption that the resource was performing poorly.

If the resource is unable to rebut, they would be removed from the operating reserves market for 30 days in the first instance and 90 days in subsequent instances. The ISO would retest resources to allow them back on the market.

Mark Younger of Hudson Energy Economics, representing generators, asked whether there would be a mechanism for permanently removing a resource from the operating reserves market. Bean said that was currently not part of the proposal.

Bean said NYISO would consider stakeholder feedback before finalizing the metrics, mentioning several times that he had “starred” comments and questions in his notes over the course of the meeting.