IESO continued a smooth rollout of its nodal market, opening day-ahead trading for Ontario on Friday, May 2.

IESO’s Market Renewal Program is intended to improve the way IESO supplies, schedules and prices power by creating a financially binding day-ahead market (DAM) and adding about 1,000 locational marginal pricing (LMP) nodes. The previous day-ahead commitment process was not financially binding, resulting in uncertainty for generators.

“The market transition has succeeded,” the ISO declared Friday, calling an end to the market suspension it had issued during the transition to the new market. “The IESO confirms that there will be no rollback to the legacy market.”

Day-ahead zonal prices for Ontario ranged from zero to $14.35 on Saturday, May 3, the first day of DA trading, rising only as high as $6.54/MWh on Sunday, May 4. With the return of the work week, DA prices topped out at $51.20 for 8 p.m. Monday and $58.61 for 7 p.m. Tuesday.

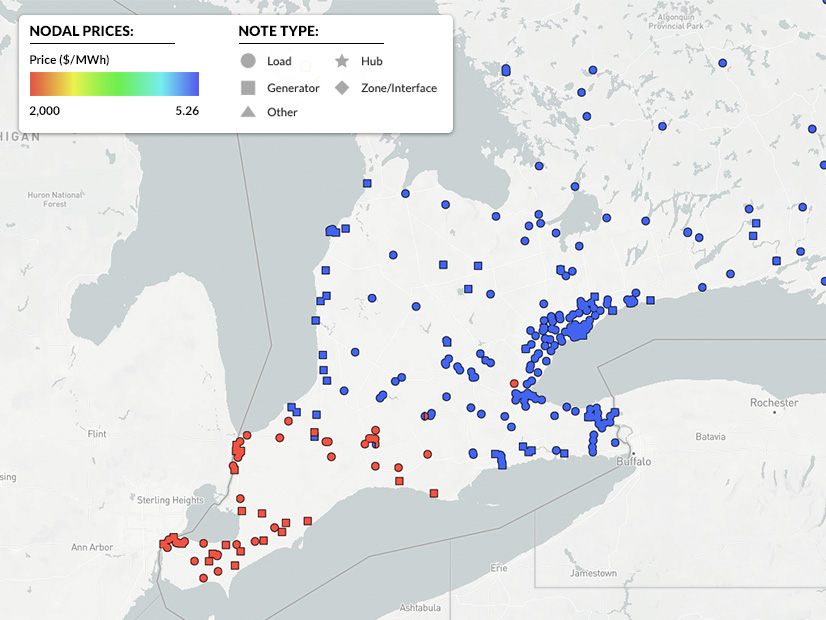

DA LMPs since May 3 have ranged from $0/MWh to $85.60 — at hour ending 21:00 May 6 from an intertie in the Northwest zone.

Real-time prices for the Ontario zone have ranged from near zero to a high of $389/MWh at 3:25 p.m. May 5.

Peak demand for the first five days of the nodal market ranged from less than 15.1 GW (May 3) to almost 16.3 GW (May 1) with a projected peak of 16.4 GW for May 6.

On May 5, RT prices in the West electrical zone north of Lake Erie hit the $2,000/MWh price ceiling for intervals ending 7:40 a.m. EPT to 7:55 a.m. EPT.

The cause of the spike is unclear, partly because Ontario publishes much of its constraint data on a six-day lag.

On Saturday, the ISO announced its Commercial Reconciliation System had been updated and was fully operational, meaning the ISO’s rules for settlement of the renewed market were in effect.

The ISO experienced a couple technical glitches, reporting on Saturday that its day-ahead market phone line was not working and referring urgent issues to its real-time operations.

On Sunday, it reported that an “unplanned tool outage” had made its Energy Market Interface (EMI) and Energy Market Administration Tool (EMAT) inaccessible.

As of late Monday, May 5, IESO had not posted any subsequent notices saying the problems had been corrected. IESO did not respond to a request for comment. [Note: After initial publication of this story IESO spokesman Andrew Dow said the EMI/EMAT access problem had been resolved on Sunday May 4 . “The other issue is related to the day-ahead market phone lines not working on the weekends, and we are working to resolve it before this upcoming weekend,” he said.]

The nodal market launched May 1 should save Ontario $700 million over the next decade through reduced out-of-market payments and increased efficiency, according to IESO.