With FERC having fully blessed the Markets+ tariff, SPP has begun the day-ahead market’s transition to Phase 2 with the first of two webinars designed to educate potential participants on what lies ahead.

“We’re really moving forward into … actually building out Markets+ and the systems, processes and procedures necessary to implement the tariff,” said Jim Gonzalez during the May 21 webinar. (A second webinar is scheduled for June 30.)

“We’re ramping up that pre-planning work in order to hit the ground running full steam ahead when Phase 2 starts in earnest,” Gonzalez added. SPP’s senior director of seams and Western services since May 1, he said staff is gathering a list of potential market participants to understand who will participate in building system requirements and developing a readiness program to help work through the implementation effort.

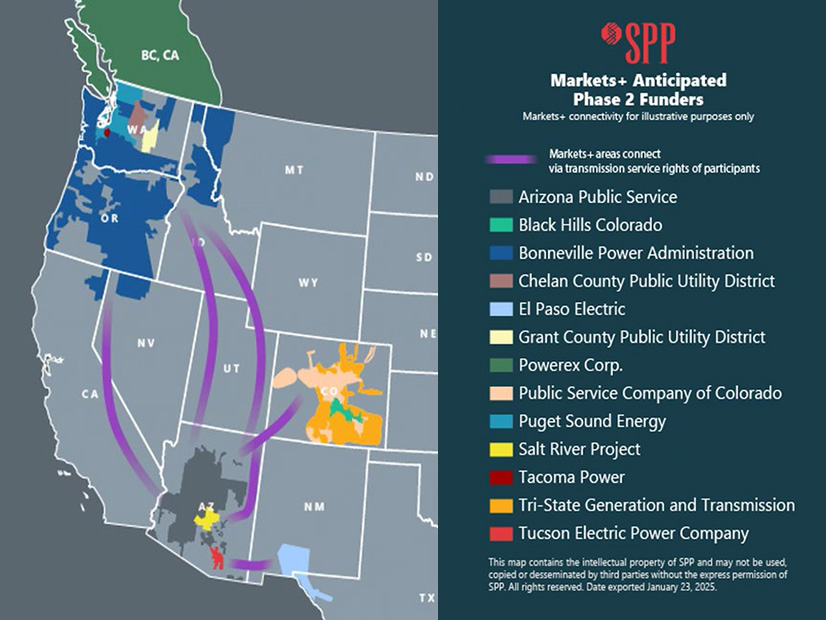

The RTO expects 13 entities initially to help fund Phase 2, most notably the Bonneville Power Administration, the Pacific Northwest’s 800-pound gorilla. (See BPA Chooses Markets+ over EDAM.)

Those entities and other interested stakeholders must sign and submit one of three agreements through SPP’s Request Management System to continue engaging and voting as rostered members in the various Markets+ stakeholder groups:

-

- Funding agreements, for balancing authorities and their embedded entities. Under that agreement, they will provide collateral in the form of a letter of credit or cash that allows SPP to use debt to build the systems.

- Stakeholder agreements, for non-governmental organizations and others that don’t expect to be active market participants.

- Participation agreements, for entities in a BA without a funding agreement and that register the utility’s load.

The stakeholder and participation agreements both come with $5,000 one-time fees, similar to SPP’s RTO participation model. The grid operator will waive the fee for nonprofit NGOs that can prove their status.

SPP has set a soft deadline of July 23 for submitting the agreements and retaining seats on stakeholder groups. The Markets+ stakeholder groups must submit their roster nominations on that date. The rosters will be posted for the stakeholder-led Markets+ Participant Executive Committee’s approval and then confirmed by the MPEC during its Aug. 12-13 meeting in Portland, Ore.

The Interim Markets+ Independent Panel, composed of three SPP board members that are overseeing the market’s development, then will confirm the chairs.

“If you intend to participate with Phase 2 governance, we will need an executed agreement in any one of these three [categories],” SPP’s Kelli Schermerhorn said.

She warned attendees that participants who don’t sign one of the agreements will lose their seat on working groups or task forces.

“Those Phase 1 agreements are going to cease to be effective,” Schermerhorn said. “Independent governance is a cornerstone of all SPP offerings. Our Markets+ design has been largely accomplished by these task forces and working groups.”

Three other decision dates have been set as deadlines for balancing authorities, transmission providers or market participants if they want to be part of the initial market launch: Sept. 1 (BAs), Oct. 1 (transmission providers) and Dec. 1 (MPs).

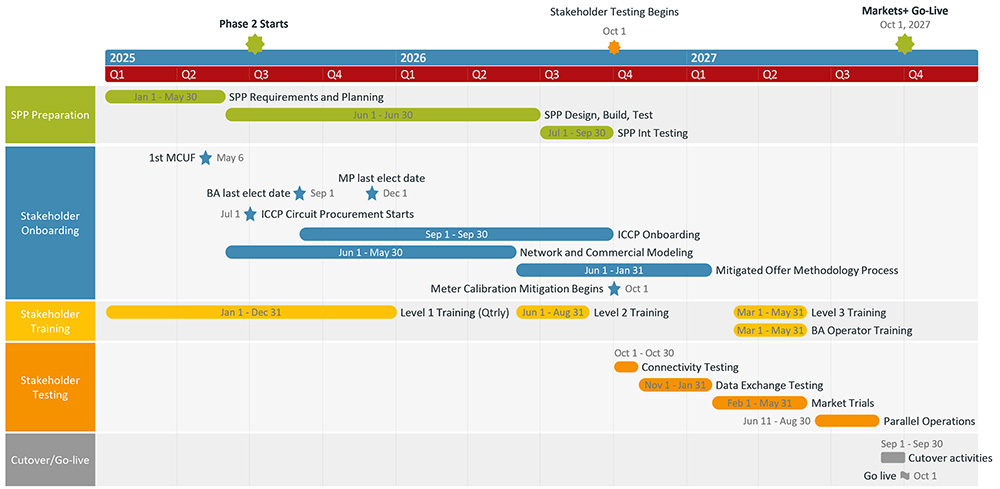

FERC in April approved the Markets+ $150 million funding agreement and its recovery mechanism. The commission also granted SPP’s request to issue debt securities to cover the agreement and fund the market’s implementation over three years until its scheduled Oct. 1, 2027, go-live date. (See SPP MPEC Members Celebrate Markets+ Funding Order.)

The funding agreement requires the entities to provide the collateral backstop to SPP’s lender in supporting the RTO’s financing. The collateral is equal to the amount of the entities’ Phase 2 obligations.

SPP says the cost to repay the financing will be incorporated into Markets+ rates and will relieve participants from the burden of providing “large sums of money to directly fund Phase 2.” SPP is splitting the phase into two stages, with participants required at first to provide collateral equal to two-thirds of their Phase 2 obligation. The first stage expires six months after the initial funding threshold has been met, at which point participants must provide collateral equal to their full Phase 2 obligation.

Funding participants withdrawing from the agreement must pay their Phase 2 obligation to SPP, protecting the remaining participants from the withdrawal.