In the spring, as questions swirled about potential Trump administration tariffs on electricity from Canada, power flows from Québec to New England declined substantially, causing some concerns that the tariff threat was causing Québec to limit power exports to the U.S.

While these concerns appear unfounded — the drop in imports likely was driven largely by low power prices in New England — the low import levels illustrate a series of growing challenges on both sides of the border.

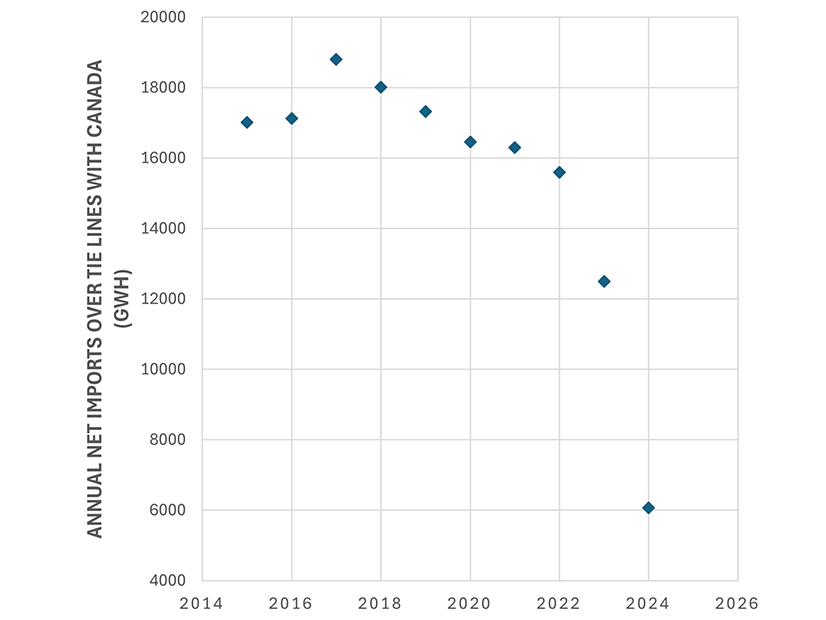

Imports from Québec historically have played a significant role in the ISO-NE system, accounting for an average of about 11% of net energy for load in New England between 2015 and 2022. But net imports over tie lines with Québec have dropped drastically over the past two years, making up just over 5% of net energy for load in New England in 2024 and sitting at a similar level through the first four months of 2025, according to ISO-NE data.

The largest factor driving Québec’s multi-year reduction of exports appears to be an extended drought, which began in early 2023 and has caused declining water levels in Hydro‑Québec’s major reservoirs.

“It’s the third year of a deep drought,” said Robert McCullough, principal of McCullough Research. Data collected by the firm indicate water levels of Hydro-Québec’s largest reservoir systems have declined significantly since the start of 2023.

Hydro-Québec’s exports also have been affected by a pair of looming, long-term power contracts the company signed with U.S. states: the 1,200-MW New England Clean Energy Connect (NECEC) project, anticipated to come online at the end of 2025, and the 1,250-MW Champlain Hudson Power Express transmission project, expected to come online in mid-2026. Both projects are intended to procure over 1,000 MW of baseload power on an annual basis from Hydro-Québec.

“When we talk about exports, an important firm energy commitment we have to take into account is the two new contracts that we will have with New York and Massachusetts,” said Maxime Nadeau, senior director of system control and grid operations at Hydro-Québec.

Over the past two years, the company has reduced its allowed amount of non-firm exports to ensure it has enough water to meet all its long-term firm power commitments, Nadeau said.

Québec, like much of North America, faces its own load growth; Hydro‑Québec’s most recent electricity supply plan forecasts power demand to grow by 14% between 2022 and 2032. While the company has announced plans for major long-term investments in new generation, the impending addition of new export commitments could pose a challenge over the next few years if drought conditions persist.

Declining Water Levels

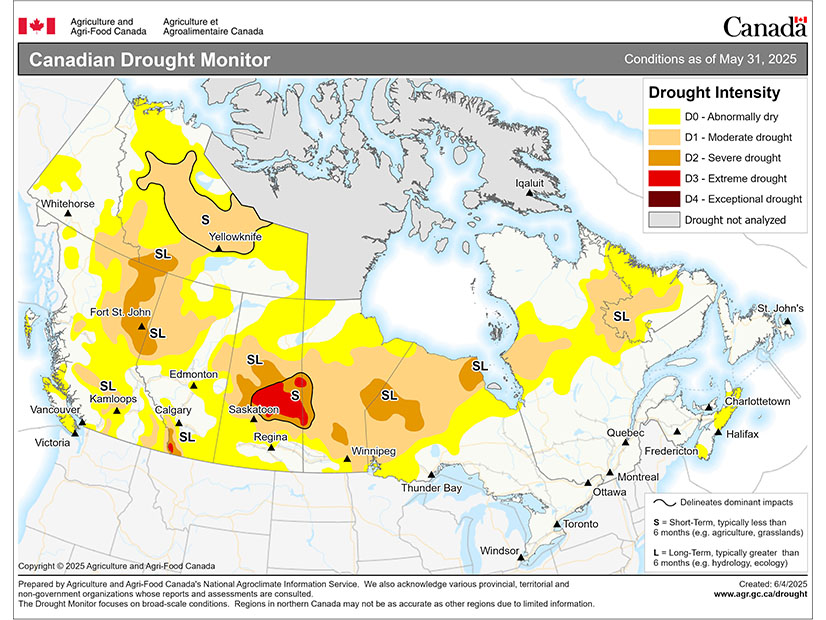

On the La Grande watershed in northern Québec, home to more than 17,000 MW of installed hydroelectric capacity, 2025 inflows are tracking between 2023 and 2024 levels, according to data from McCullough Research. Meanwhile, the Canadian Drought Monitor indicates that a significant portion of northern Québec is facing moderate drought or abnormally dry conditions, according to the May 31 update.

“We’re having even lower inflows than we had last year,” McCullough said. “If they go into a fourth year of drought, [Hydro‑Québec] may be forced to reduce their external commitments.”

Despite low water levels, representatives of Hydro‑Québec expressed optimism that inflows will return to typical levels this year, bringing the region’s reservoirs back to historical norms. The company has maintained it will have enough energy to meet all its firm commitments in the coming years.

“The very low inflows observed in 2023 and 2024 have had a lasting impact on 2025 overall levels,” said Lynn St-Laurent, spokesperson for Hydro‑Québec. “However, the combination of a revised production strategy and normal inflows should help restore water levels to more typical values.”

St-Laurent said it is normal for the region to experience fluctuating water levels and that the company has faced multiyear droughts on a similar scale in the past.

She stressed that “inflows remain around normal levels for 2025” and said it can be misleading to compare inflows at an isolated point in time, noting that “the low water availability of the last two years at La Grande was not due to weak spring runoff, but rather to low precipitation during the summer and fall of previous years.”

Climate Impacts and Uncertainty

While it is difficult to pinpoint exactly how climate has affected the current drought and water levels, scientists expect precipitation variability — both over multiyear stretches and intra-year periods — to increase in Québec as the planet warms.

“We expect droughts to be more frequent and more persistent in the future, related to climate change,” said Christopher McCray, climatologist at Ouranos, a climate research organization funded by the Québec government.

Although most studies indicate northern Québec will see increasing average annual precipitation, multiyear drought periods could create increasing challenges for water management, McCray said.

While Québec always has seen a fluctuation between dry and wet years driven by large-scale weather patterns, warming temperatures are “accentuating the effects of those patterns,” McCray said.

“The same weather pattern that caused a drought 50 years ago, now it’s a little bit warmer … and there’s a greater capacity for evaporation than in the past,” McCray said. “And so, the soil dries out, and that can cause a feedback loop that leads to a persistent period of dry conditions.”

Hydro‑Québec expects to see “more overall water supply in the northern part of the province,” Nadeau said. “That’s good news, because that’s where we have all of our major main reservoirs.”

He added that the company recently began working with experts on studies to better understand how climate change will affect inter-annual variability.

Researchers also anticipate climate change will cause seasonal shifts in precipitation. Ouranos predicts average winter precipitation to increase and more frequently fall as rain. This likely would increase stream flows in the winter and move the spring high-runoff period earlier in the year.

McCray said there is more uncertainty around how climate change will affect overall summer precipitation but that there could be an increased “whiplash” between dry periods and extreme rainfall events within summer seasons.

While long-term scientific studies consistently forecast increased precipitation for the province, McCullough said the impact of climate change on the jet stream has created significant new challenges for forecasting precipitation and water levels.

“We’ve been doing this for about 40 years,” McCullough said. “I would’ve sounded a lot more confident 20 years ago.”

The jet stream — a strong west-to-east flow of air typically located five to nine miles over the U.S.-Canada border — causes droughts when larger-than-normal north-south waves in its flow push precipitation away from a region for an extended period, said Jennifer Francis, a senior scientist at the Woodwell Climate Research Center.

“A growing body of research is finding that wavy jet-stream patterns are occurring more often, in part because the Arctic is warming three to four times faster than the globe as a whole, which reduces the north-south temperature difference that fuels the jet stream,” Francis said. “A weaker jet stream is more easily deflected from its west-to-east path by things like mountain ranges and abnormal temperature patterns, which causes larger north-south excursions and increased waviness.”

Increasing disturbances to the jet stream will cause more temperature and precipitation extremes in the northern hemisphere, Francis explained.

“When it comes to Québec’s reliance on rainfall to fill rivers and reservoirs to generate electricity, this aspect of human-caused climate change is indeed a concern,” Francis said. “Some years will bring extended droughts. Others will bring prolonged rains. Both extremes are expected to occur more often as we continue to add heat-trapping gases to the atmosphere.”

As increased temperatures and decreased snow cover dry out soil, wildfire risks also are increasing in Québec, creating additional reliability risks on the power system, which can have knock-on effects on reliability in the U.S. In 2023, a forest fire caused the shutdown of a transmission line in Québec during New England’s evening peak, triggering an ISO-NE capacity deficiency. (See Canadian Wildfires Trigger ISO-NE Capacity Deficiency.)

According to an analysis by World Weather Attribution, an academic research group, “climate change made the cumulative severity of Québec’s 2023 fire season to the end of July around 50% more intense, and seasons of this severity at least seven times more likely to occur.”

‘More Dynamic Changes in Flow’

In the coming decades, with the anticipated growth of intermittent renewables across the Northeast, Hydro-Québec expects its reservoirs to be used less as a baseload power resource and more as a massive balancing resource, allowing the company to conserve water during periods of high renewable production. (See Québec, New England See Shifting Role for Canadian Hydropower.)

The economic justification for a large-scale two-way exchange of power between regions likely will not occur until a significant number of offshore wind projects come online, which may not be until the mid-2030s or later. However, Vineyard Wind and Revolution Wind appear on track to eventually deliver about 1,500 MW of capacity to the New England grid, which could drive more frequent power exchanges between regions during periods of high production.

“With all that renewable energy that is being integrated in the electrical grid, we will see more dynamic changes in flows on the interties,” Nadeau said, adding that it is harder to forecast changes to the overall balance of imports and exports.

This phenomenon could help the region address a major need for clean firm energy to help meet state climate targets in the coming decades. (See ISO-NE Study Lays Out Challenges of Deep Decarbonization.) A 2021 study found that increased transmission capacity between regions would significantly reduce the overall costs of decarbonization by 2050 and limit the need to overbuild intermittent renewables.

However, if Canadian hydropower ultimately is to help displace fossil units in New England, the region must be able to rely on the power when it is needed.

While imports from Québec have performed during capacity deficiencies in the region in recent years (aside from the 2023 wildfire-induced line outage), the decrease in overall import levels since 2023 has given fuel to arguments that imports from Québec are not as reliable as in-region generation.

In NEPOOL debates over the development of a new capacity accreditation framework for ISO-NE, representatives of generation companies have argued the RTO overestimates the benefits of its interregional transmission lines during emergency events, noting that these tie benefits are not backed up by capacity supply obligations. (See ISO-NE Discusses Details of New Prompt Capacity Market.)

Generation companies in New England also have expressed concern about the overall annual level of imports the region can expect to receive from Québec.

While the NECEC transmission project is intended to provide firm supply from Hydro-Québec, skepticism about how much incremental power the project will provide the region dates back to state regulatory proceedings for the power procurement. Multiple groups voiced concern in the proceedings that the contracts do little to guarantee net imports above the historical levels to New England.

In its approval of the contracts in 2018, the Massachusetts Department of Public Utilities wrote that the NECEC power purchase agreements would guarantee firm power deliveries incremental to what Hydro‑Québec “would otherwise be expected to deliver to New England through its ongoing, largely non-firm commercial trading activities (D.P.U. 18-64).”

Ultimately, when NECEC comes online, flows from Québec to New England are poised to increase; the NECEC contract requires the company to send 9.55 TWh of power annually, compared to the 6.3 TWh of power imported to New England in 2024.

The export commitments, coupled with the addition of Vineyard Wind and Revolution Wind, may correspond with an increase in Québec’s spot market imports from New England, potentially mitigating the change to the overall balance of power exchanges. Beyond its export commitments, the total amount of power Québec sends back to New England may depend in large part on how long the drought conditions persist.

“At the moment, given the forecasts of a significant deficit at Hydro-Québec, I don’t think [NECEC] will change the balance at all,” McCullough said. “There’s nothing in the contract to prevent them from buying cheaply in New England, storing it and sending it back to New England.”