RNS Rate Decrease

ISO-NE’s regional network service (RNS) rate is set to decrease by about 1% in 2026, dropping from $185.28/kW-year in 2025 to $183.71/kW-year in 2026.

The slight decrease in the rate primarily is the result of a regional true-up and a year-over-year increase in load, which lowered the unit rate, Jim Augelli, representing the region’s transmission owners, said at the summer meeting of the NEPOOL Reliability and Transmission Committees on July 15. He added that these factors were partially offset by ongoing transmission system investments.

The rate increased by about 20% in 2025, which the TOs attributed to increased revenue requirements. (See NEPOOL Reliability/Transmission Committee Briefs: Aug. 13-14, 2024.)

Over the next five years, the TOs forecast the RNS rate to increase to $220/kW-year by 2030, driven by growing transmission investments. However, the TOs reduced their RNS rate projections for 2027-2029 compared to the five-year forecast presented in 2024, lowering the forecasted 2029 rate from $217/kW-year to $210/kW-year.

Dave Burnham, also representing the TOs, stressed that the five-year forecast is based solely on “incremental revenue requirements attributable to forecasted capital investments” and “should be used for illustrative purposes only.”

According to the data presented by the TOs, asset-condition projects make up 72% of the forecasted regional investments in 2025 and 2026, accounting for about $1.67 billion of $2.31 billion in anticipated capital spending.

Rising asset-condition costs are a key concern of states and consumer advocates in the region, and ISO-NE is working to establish a new non-regulatory “asset condition reviewer” role at the RTO to help increase transparency and oversight on the spending. (See ISO-NE Open to Asset Condition Review Role amid Rising Costs.)

Costs Associated with FERC Order on Interconnection Complaint

Following up on a FERC ruling in December 2024 that TOs cannot charge interconnection customers for operations and maintenance costs associated with network upgrades, the TOs estimated that compliance with the order will increase the RNS revenue requirement by about $11.6 million and local network service revenue requirements by about $5.3 million across New England (EL23-16). (See FERC Sides with New England Developers on Interconnection Complaint.)

Regional Energy Shortfall Threshold

Also at the meeting, ISO-NE presented tariff changes associated with its proposed Regional Energy Shortfall Threshold (REST), which is intended to quantify “the region’s level of risk tolerance with respect to energy shortfalls during extreme weather.”

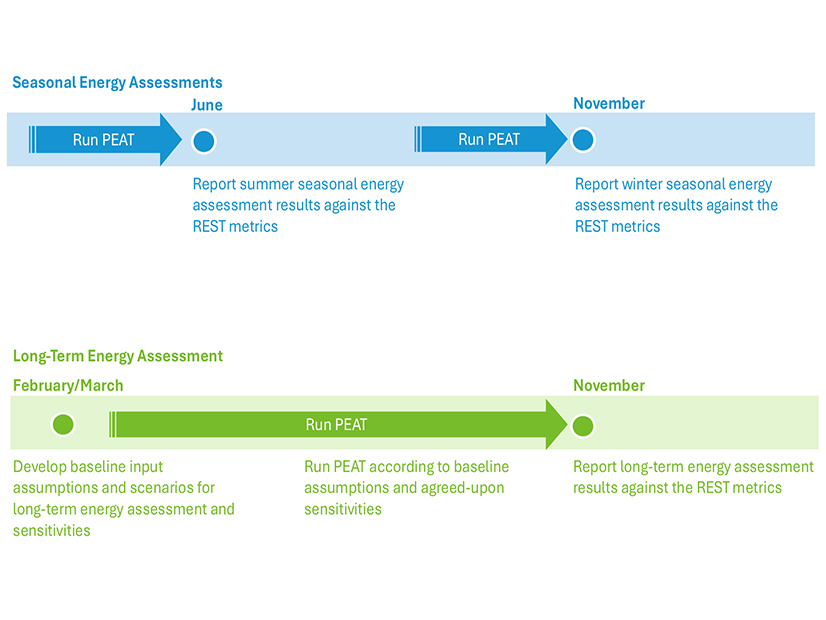

ISO-NE proposes to use the REST for short-term reliability assessments, performed ahead of upcoming summer and winter seasons, and for annual long-term assessments, looking five to 10 years into the future. The RTO plans to rely on two metrics, focused on shortfall magnitude and duration, to quantify shortfall risks against the threshold. (See ISO-NE Details Regional Energy Shortfall Threshold Metrics and “Regional Energy Shortfall Threshold,” ISO-NE Cuts Winter, Summer Peak Load Forecasts for 2033.)

The RTO plans to focus the REST on the 0.25% most extreme 21-day cases it evaluates and proposes setting the threshold at 3% shortfall magnitude and 18-hour shortfall duration. The REST would be violated if the probability-weighted average shortfall duration and magnitude of the tail cases exceeds these thresholds.

It plans to publish seasonal assessments in June and November, ahead of the summer and winter seasons, and long-term assessments in November.

ISO-NE will continue stakeholder discussions at the Reliability Committee meetings in August and September.

Order 2023 Conforming Changes

Alex Rost, director of interconnection services at ISO-NE, discussed potential changes related to deliverability assessments for resources not subject to the RTO’s interconnection procedures.

Rost noted that ISO-NE’s compliance with FERC Order 2023 “removed milestones related to the assessment of deliverability” and the establishment of capacity network resource capability (CNRC) for interconnecting resources under the RTO’s jurisdiction, adding that “these milestones now reside fully within the ISO interconnection process” (ER24-2009, ER24-2007).

Rost said ISO-NE will need to clarify its deliverability monitoring process for interconnecting resources not subject to the RTO’s interconnection processes in advance of the 2026 interim reconfiguration auction qualification process.

“The ISO is proposing to formalize the concept of ‘equivalent CNRC’ for all resources not subject to the ISO interconnection procedures … to avoid confusion when tracking assignment of deliverability capability,” Rost said.

ISO-NE also has proposed to align deliverability analysis screenings for non-RTO-jurisdiction resources with the deliverability screenings performed in interconnection cluster studies and would perform these screenings “right after the conclusion of a cluster study.”

Rost said the RTO is considering tariff changes to set milestones for resources seeking to establish “equivalent CNRC,” to ensure these resources “will likely achieve commercial operation.” He asked for feedback from stakeholders by the end of July on potential “demonstrable commitment milestones” for these resources.