GE Vernova’s gas power and electrification businesses continue to surge amid growing power demand.

The company on July 23 reported second-quarter financials that exceeded projections and offered an optimistic message that sent its stock price soaring to all-time highs.

CEO Scott Strazik said GE Vernova’s backlog for gas-fired turbines grew from 50 GW of orders and manufacturing slot reservations to 55 GW in the second quarter, and he expects to end the year at 60 GW. The longer-term expectation is 80 to 100 GW of backlog.

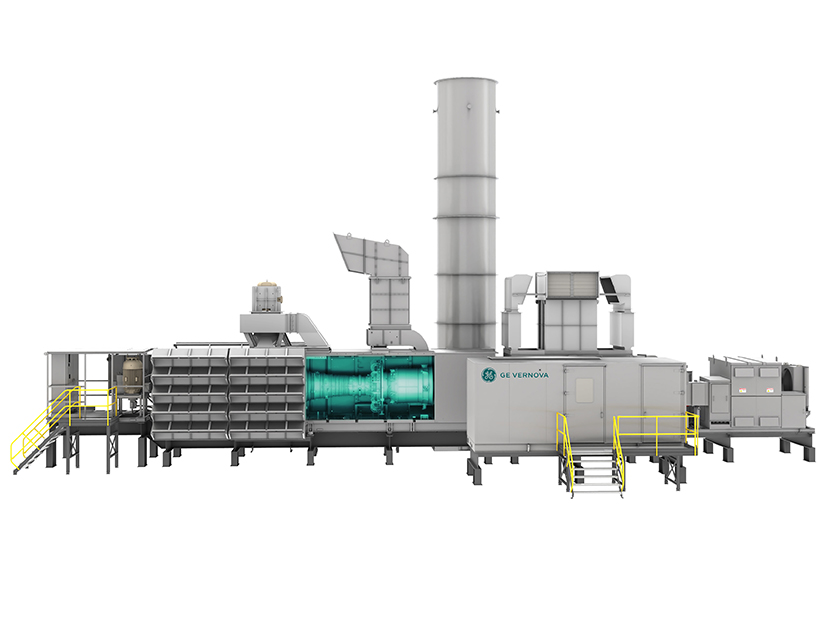

The company’s large heavy-duty gas turbines are in high demand, but there also is growing demand for its small aeroderivative gas turbine packages that leave the factory 95% preassembled.

Just a day earlier, GE announced it would sell 29 of these smaller units rated at 34 MW each — nearly 1 GW in total — to Crusoe for its AI data centers.

This technology — essentially a modified jet engine with emissions controls — is quick to deploy, quick to start up and can provide a bridge solution when the interconnection queue is moving more slowly than the customer wants to. Eventually, the aeroderivative turbines can become backup power sources for a facility or connect to the grid, Strazik said.

GE Vernova also has its name on a massive installed generation fleet built by General Electric and is seeing strong growth in its service business, Strazik said.

“Our services backlog also grew approximately $1 billion in the second quarter,” he said. The company has been incrementally increasing its pricing on new equipment orders and will be doing so with its service business.

During an earnings call July 23, an analyst asked what effect sharp changes in federal energy policy are having on GE Vernova.

The reconciliation bill was finalized only a few weeks ago, Strazik said, so it is early to draw conclusions. However, GE Vernova has seen accelerated interest — but not yet orders — for grid equipment supporting wind and solar generation, he said. That is near- to mid-term interest, he said, which would match with the impending end of federal tax credits for wind and solar energy development.

“There also is very clear market sentiment that into the next decade, there’s going to be a need for more gas,” Strazik said. “I would say our pipeline of activity for gas demand is only growing, but it’s growing at even more healthy levels for ’29 deliveries, ’30, ’31 — periods of time where, maybe prior to the bill being signed, some of our traditional customers may have been intending more wind or solar.”

GE Vernova’s second-quarter results surpassed projections, pushing first-half 2025 revenue, earnings, free cash flow and backlog higher than year-ago levels. The company has increased its projections for the second half of 2025.

The price of GEV stock soared throughout the trading day, closing 14.6% higher than July 22 and 349.3% higher than on the close of its first day of trading in April 2024.

Also with its second-quarter financial results, GE said:

-

- Steam power service orders jumped on efforts to upgrade existing nuclear reactors and extend their operation.

- Even larger growth was seen in hydropower, again due to upgrades.

- Progress continues on development of the 300-MW small modular reactor that is the first SMR being built in North America; more customer announcements are expected in the second half.

- Demand for synchronous condensers, a longstanding but minor line for the company, is expected to grow with the need for grid-stabilizing technology, Strazik said. “We see this as a credible $5 billion market opportunity a year.”

- Onshore orders in North America drove an increase in revenue for the wind business, offset by continued losses offshore; it may approach the break-even point in the second half.

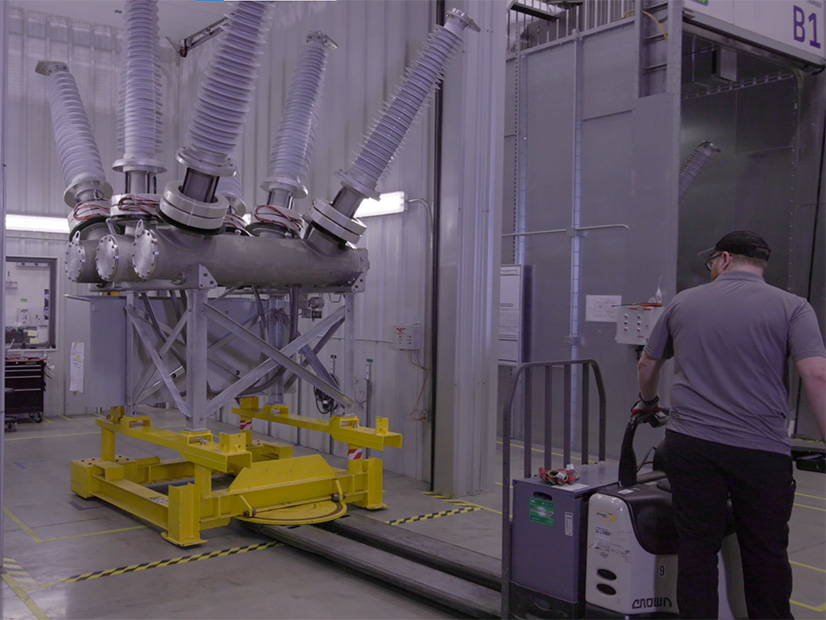

- The electrification business saw a $2 billion increase in backlog, driven by switchgear and transformers.