WIRES Group has released a report looking into advanced transmission technologies (ATTs) and how they can help cost-effectively expand the transmission grid.

Prepared by London Economics International, the report includes a survey of 20 WIRES members, including transmission owners and technology providers, on their experiences with ATTs and best practices. It refers to “ATTs and innovative practices” collectively as “ATT+.”

“Transmission capacity will need to expand in order to support economic development and meet the rapid increase in electricity demand, while also maintaining system reliability and resiliency in the face of more frequent extreme weather events across the country,” the report said. “ATT+ can help TOs address various needs in certain situations and should be thought of as one of the tools in the toolbox to complement and supplement traditional transmission system capital investments.”

The definition of an ATT can vary depending on who is using the term and can include grid-enhancing technologies (GETs) and advanced conductors. But the paper considered a broad range of technologies that it put in three categories: siting and design, construction, and operations.

Siting and design ATTs include artificial intelligence-powered software that can speed up permitting; compact line designs that use less space for high-voltage transmission; and innovative approaches to expediting permitting processes.

For construction, the report looks into exoskeletons that add additional circuits above existing lines, helicrane construction that can install equipment in hard-to-reach areas, and modular tower raising systems that can lift up transmission towers without de-energizing lines.

The operations side of ATTs involves the most diverse range of technologies and is broken down into three subsections. Hardware components include advanced conductors, advanced flexible transformers and digital substations. GETs include dynamic line ratings, advanced power flow controllers and topology optimization.

Compact lines use new designs for towers that take up less space. The report cites a design used by American Electric Power from BOLD Transmission in Indiana in 2019. The towers were shorter and narrower, allowing for smaller easements, cutting costs and helping to minimize impacts on neighborhoods. It also allowed for more capacity than traditional designs.

Modular tower raising uses hydraulics that are mounted on the inside body of an existing transmission line, which can raise the tower to allow new framing to be installed without de-energization. Ampjack’s Tower Raising system has completed more than 750 tower raises, the report said.

Transmission asset inspections and maintenance typically are conducted by engineers climbing up pylons or using helicopters, but drones and robotics can do the same work for less money, especially in areas that are hard to reach. Using drones and robots for such work is safer, cuts down time and can enable more data collection on asset conditions.

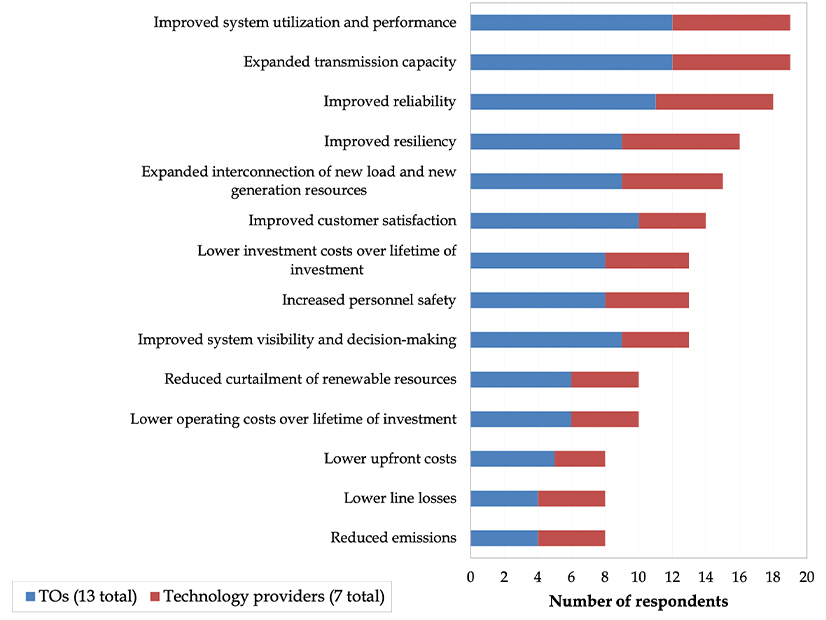

The survey asked 13 TOs and seven technology providers about the benefits of ATTs. The top responses were improved system utilization and performance, expanded transmission capacity, improved reliability, improved resilience, and expanded interconnection of new load and generation. ATTs also can lower costs for customers by minimizing the need for capital investments and cutting operating costs, they said.

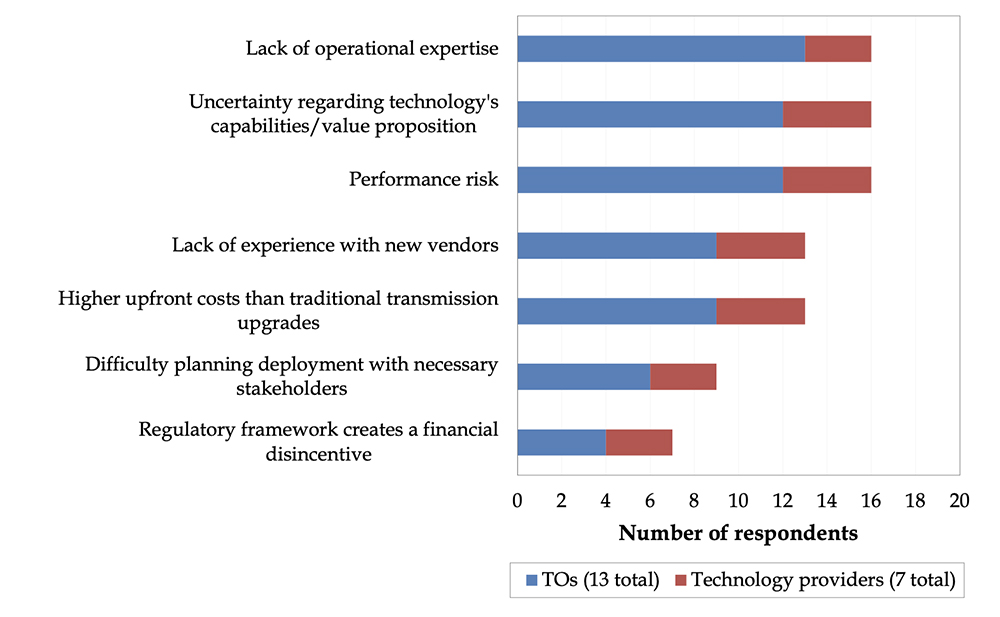

The survey asked what is holding companies back from deploying ATTs. The top answers were a lack of operational expertise, uncertainty about the technology’s capabilities and value proposition, and performance risks. Some firms listed the regulatory framework’s disincentives, but it was the lowest-ranked answer.

“Preference for technologies with low uncertainty (and therefore known benefits and costs) is not unique to the electric transmission sector,” the report said. It cited the diffusion of innovations theory by sociologist Everett Rogers, which was focused on the field of communications and posits that widespread adoption of new technologies occurs only as uncertainty decreases.

“LEI observed similar themes throughout interviews with technology providers and TOs,” the report said. “Regulators, system planners and TOs, by the nature of their priorities (where providing reliable electricity service at reasonable cost is paramount), tend to prefer technologies with proven track records over new technologies that are not yet commercially available or widely deployed under various real-world conditions due to uncertainty around performance under unexpected future operational conditions, and also potential ambiguity in future benefits and costs.”

The current regulatory structure in many regions tends to focus on nearer-term planning horizons of five to 10 years, which can lead to incomplete cost-benefit analyses for some ATTs that put more weight on near-term benefits. That is not helped by uncertainty around longer-term projections of benefits, which can make regulators overly cautious about using them, the report said.

Some opponents of transmission investments have argued that utilities are biased against ATTs because their earnings are lower than spending on wholly new infrastructure.

“It is inaccurate and overly simplified to claim that TOs do not benefit financially from ATTs that impact operating costs because of the cost-of-service environment,” the paper said. “In fact, regardless of whether a TO operates under stated rates or transmission formula rates, there is often some regulatory lag inherent in a cost-of-service environment, so TOs can reap some financial benefit from operating cost savings. Furthermore, the financial incentives and business factors that drive investment and operating decisions of TOs are much more complex because of the multiple objectives that TOs need to meet (reliability, policy and overall cost minimization) and constraints they face in their regulatory and business environments.”

Still, aligning financial incentives and implementing regulatory mechanisms that can level the playing field between operating versus capital investment-oriented ATTs, and between ATTs and traditional investments, would make cost impacts more transparent and encourage focusing more on the benefits side of the equation, the report said. That would lead to greater use of the technologies, it argued.