After years in the making, CAISO released a price formation proposal intended to reduce “unnecessary” market power mitigation, strengthen reliability and provide consistent pricing incentives in the WEIM and future EDAM.

After years in the making, CAISO has released a price formation proposal intended to reduce “unnecessary” market power mitigation, strengthen reliability and provide consistent pricing incentives in the Western Energy Imbalance Market (WEIM) and future Extended Day-Ahead Market (EDAM).

Release of the straw proposal, which was followed by two workshops Sept. 3 and 4, is part of CAISO’s Price Formation Enhancements initiative, started in 2022 to focus on two key subjects around real-time market pricing: balancing authority area-level market power mitigation and scarcity pricing.

BAA-level market power mitigation is “a ‘nickname’ for market power mitigation applied to WEIM transfer constraints and, in the future, EDAM transfer constraints,” James Friedrich, CAISO policy developer, said at the Sept. 3 workshop.

“So instead of saying that mouthful, we just call it BAA-level market power mitigation,” Friedrich said at the workshop. “And what it’s doing is ensuring that, when transfer constraints bind between balancing areas participating in the regional markets, that we ensure that there is competitive pricing inside the balancing areas that are price-constrained from the broader market due to these constraints.”

The market power mitigation process “essentially prevents suppliers from within these constrained BAAs from exercising market power over the constrained balancing area,” Friedrich added.

To improve its BAA-level market power mitigation process, CAISO’s proposal is considering using a “grouping approach” for a market power mitigation (MPM) test, one that will try to increase competitive pricing when a participating BAA becomes price-separated from the broader market due to binding transfer constraints, the proposal says.

Currently, during a MPM test, each BAA is modeled individually. This means that power supply from neighboring BAAs is not accounted for during a MPM test. Therefore, this practice could be overestimating market power and could lead to unnecessary mitigation, the proposal says.

The individual MPM test approach “was acceptable when the WEIM had fewer participating entities, but it has become a concern in today’s larger, more interconnected market,” the proposal says.

BAAs rarely operate as fully isolated “islands,” the proposal says. With dozens of BAAs participating in the regional markets, a “rigid one-by-one test could mischaracterize competitive conditions and reflect an outdated methodology,” the proposal says.

On the other hand, a group of BAAs in a MPM test would become a combined region, allowing the market to assess the BAAs with spare transfer capability, according to the proposal.

Scarcity Pricing Improvements

The second main subject of the proposal is scarcity pricing, a mechanism meant to “create really powerful market incentives,” Friedrich said during the Sept. 4 workshop.

Scarcity pricing incentives coordinate the behavior of all market participants to improve reliability in tight conditions by encouraging generators to be and stay online, getting flexible demand off the system, and incentivizing storage resources to defer charging, Friedrich said.

“More reserves generally means a more reliable system. Fewer reserves mean a less reliable system,” Friedrich said. “When you get in scarce conditions, each incremental megawatt is valued not just by the cost of production for the unit to produce [electricity], but also in valuing its role in preventing a system outage.”

Currently, CAISO’s scarcity pricing mechanisms include:

-

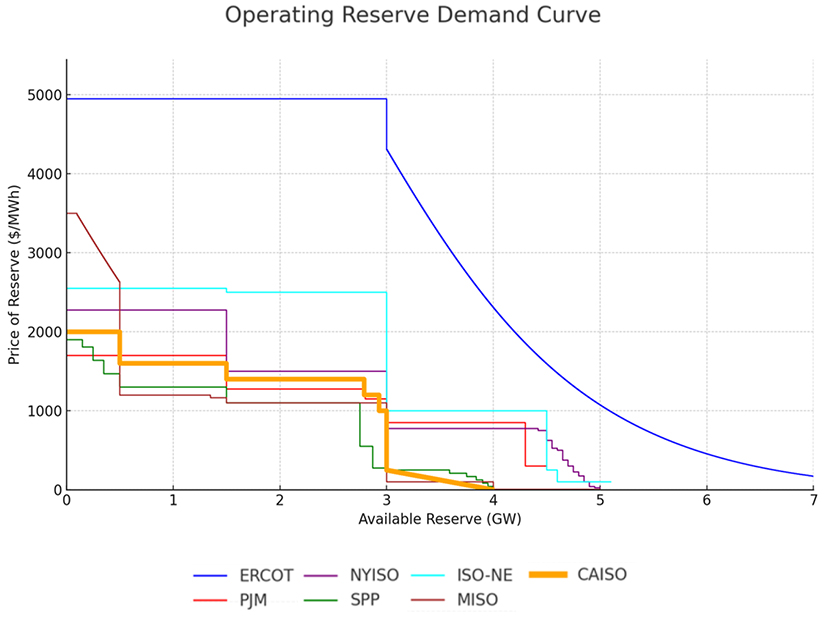

- a tiered scarcity reserve demand curve (SRDC) that provides the marginal prices of ancillary services when the availability of this type of power supply is low.

- a Flexible Ramping Product (FRP) demand curve that provides the scarcity pricing signal in the real-time market.

- an imbalance reserve demand curve for the extended day-ahead market that allows the market to forgo procuring imbalance reserve.

However, CAISO has found problems with each mechanism. The SRDC applies inconsistently in the real-time market, meaning real-time energy and reserve prices do not consistently incorporate the scarcity value of reserves and “thus do not consistently reflect short-term operating conditions,” CAISO said in the proposal. This issue can result in inadequate price signals and increase reliability risks.

“The scarcity reserve demand curve is not really a great tool for scarcity pricing the way we traditionally think about it … because it’s not designed to trigger unless there is an actual shortage,” making it a reactive rather than proactive price signal, Friedrich said.

“And the gold standard for scarcity pricing are designs that are intended to be proactive, meaning they kick in before the actual shortage condition occurs, which is the whole point,” he added.

CAISO staff and stakeholders said the ISO should consider “re-optimizing” ancillary services in the real-time market. Doing so would “allow the market to better reflect real-time system conditions and costs by releasing ancillary services capacity procured in the day-ahead market that could be more valuable for energy or other services in real-time,” CAISO said in the proposal.

CAISO and stakeholders are considering extending procurement of ancillary services into the five-minute market to provide more consistent price signals, the proposal says.

CAISO also is looking to improve scarcity pricing mechanisms so they gradually increase energy and reserve prices ahead of supply shortages. CAISO’s Department of Market Monitoring suggested extending use of the Flexible Ramping Product (FRP), which could help the real-time market better position resources and improve pricing signals ahead of potential scarcity conditions, the ISO said in the proposal.