Western Energy Imbalance Market prices increased sharply in the second quarter of 2025 compared with the same period in 2024, mostly due to higher natural gas prices at Western hubs — with some seeing 80% gains.

That was a key finding in a report CAISO’s Department of Market Monitoring (DMM) delivered at the Western Energy Markets Governing Body’s general session Sept. 9.

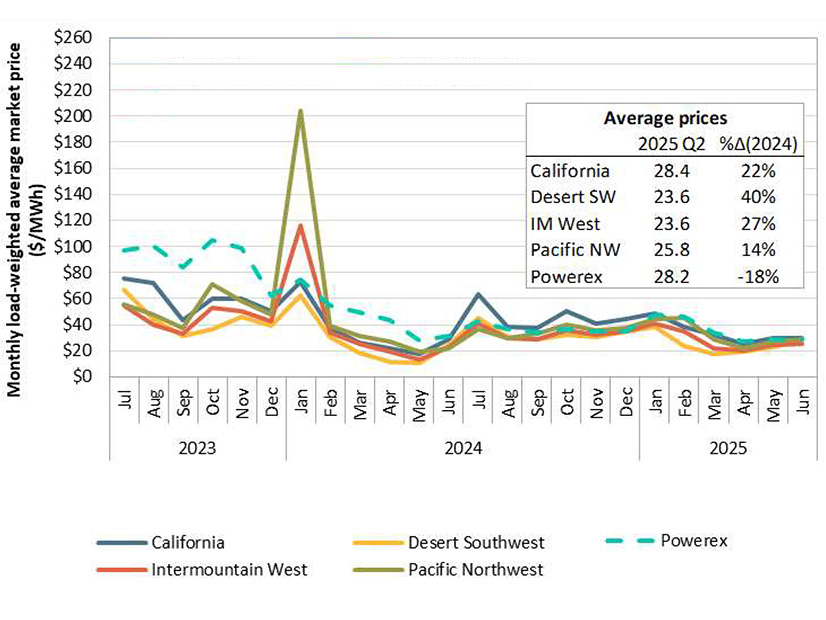

The report showed 15-minute market prices across the WEIM averaged $26/MWh during the quarter, a 12% increase compared with 2024.

California experienced the highest electricity price in the market — about $28.40/MWh, marking a 22% increase. The Desert Southwest region saw the biggest gain at 40%, while Pacific Northwest prices were up 14%.

Rising gas costs and higher load drove the price gains, Eric Hildebrandt, DMM executive director, said in the report.

Natural gas prices at most major Western hubs were “up significantly compared to the second quarter of 2024,” with the average prices at Henry Hub, PG&E Citygate, SoCal Citygate, and NW Opal Wyoming increasing by 55%, 27%, 80% and 64%, respectively, compared with the second quarter of 2024, Hildebrandt said in the report.

Asked by RTO Insider to provide more insight into the causes of gas price increases, CAISO said it “doesn’t monitor these markets directly.”

“Our regulator, FERC, would be in a better position to answer this question,” the ISO said. “We generally treat gas prices as inputs.”

Demand increased in the WEIM, too, but not by much: Total system load averaged 74.7 GW, which was about 1.4% greater than the load in the second quarter of 2024. The Pacific Northwest region’s average load came in at about 21 GW, up 1% from the second quarter of 2024. CAISO’s average load was about 22 GW, up 1.9%.

Policy Project Updates

Speaking during the session, WEM Governing Body Chair Rebecca Wagner said the WEM’s policy projects are “back on track” after a “hiatus due to the work on the congestion revenue rights [initiative].”

Wagner said the WEM Governing Body was changing its approach to policy updates at its meetings.

“Rather than having a detailed policy initiative update, you can find that information in our informational reports … and so what we’re going to do instead is just policy hot topics,” Wagner said. “What are the key topical items that are rising to the top for ISO management and most importantly with stakeholders?”

Becky Robinson, CAISO director of market policy development, said the ISO plans to potentially bring certain policy initiative decisions to the next WEM board meeting in October.

Specifically, Robinson said CAISO could have a proposal ready for a decision associated with the ISO’s gas resource management initiative. That initiative has “set out to determine what parts of our market design may limit the ability of gas resources from participating in the WEIM or the EDAM when it’s up and running next year,” Robinson said.

The goal of the new proposal is to address what factors might be restricting gas resources’ ability to accurately reflect their gas cost and availability, she said.

The proposal could include three parts.

First, it could provide updates to day-ahead advisory market runs, so that “we are providing that information to market participants … potentially in advance of the day-ahead market,” Robinson said.

The second part could include providing more options for cost inputs and cost recovery for gas resources better accommodate variables such as extreme weather, she said.

The third part of the proposal could include more options for managing certain limits encountered by gas resources, Robinson said.

No Joint General Session

The WEM Governing Body general session was held a day before the body’s joint executive session with the ISO Board of Governors, but no joint public meeting between the boards will be convened in September — just as in July.

Asked about the reason, a CAISO spokesperson said: “General session meetings are held only when there are planned topics of discussion. Since there are no general session topics for the joint meeting or the Board of Governors meeting this month, those two general sessions were not scheduled.”