Ontario’s energy regulator is learning new ways to identify inefficiencies and malign behavior under IESO’s Market Renewal Program, which introduced LMPs and a financially binding day-ahead market.

The Ontario Energy Board said its Market Surveillance Panel (MSP) has developed “new tools and indicia” in response to IESO’s nodal market, which launched May 1. (See Ontario Nodal Market Nearing ‘Steady State’ After Nearly 4 Months.)

OEB said the MSP will continue to track “market participant conduct and the efficiency and competitiveness” under the new market. “However, the complexities of the renewed markets have increased relative to the legacy markets,” it said.

The MSP, which transferred from IESO to the OEB in 2005, has three members: Chair Ken Quesnelle, former vice chair of the OEB and former chair of the Electricity Distributors Association; Brian Rivard, an adjunct professor at the Richard Ivey School of Business at Western University and a principal at Charles River Associates and IESO’s former director of markets; and Darren Finkbeiner, IESO’s former director of rule compliance and market surveillance. The MSP is supported by OEB staff and uses data provided by IESO’s Market Assessment Unit.

The MSP’s previous recommendations have been adopted by both the OEB and IESO — including some of the changes implemented under Market Renewal. MSP reports also have led to action by the IESO’s Market Assessment and Compliance Division, resulting in settlement repayments and financial penalties.

New Market: Locational Marginal Prices and Single Clearing

Under Market Renewal, day-ahead market (DAM), pre-dispatch and real-time prices are calculated at about 1,000 LMP nodes, instead of Ontario-wide. With a financially binding DAM, there now is a single dispatch schedule.

Here are some of the other changes under the new market, and how the MSP plans to respond:

-

- Congestion Management Settlement Credit (CMSC) payments: CMSC payments encouraged participants to follow dispatch during transmission constraints under the former two-schedule system. They were replaced by LMPs — which embed the cost of congestion — and make-whole payments (MWPs), which compensate for lost opportunity costs when IESO dispatches resources out-of-merit.

- While continuing to use the highest-cost peaking natural gas generators as an initial screen, the MSP also will use statistical models to identify anomalous LMP differences not explained by losses or congestion. “This type of monitoring analysis will replace the monitoring of legacy CMSCs to assess potential market flaws or inappropriate conduct not explained by grid conditions,” OEB said.

- The MSP will monitor large MWPs, as well as MWPs to individual market participants or for specific facilities, to identify anomalous results or market manipulation. A new MWP Anomaly Index will put MWP levels in perspective relative to resource margins in the day-ahead and real-time markets. The index is calculated as: MWP ÷ (Resource Revenues + MWP) x 100. “This metric will tend to filter out changes in the level of MWPs due to variations in fuel costs … as well as those due to the frequency with which particular types of units are committed, to better identify potential anomalies and changes in behavior,” OEB said.

- Congestion Management Settlement Credit (CMSC) payments: CMSC payments encouraged participants to follow dispatch during transmission constraints under the former two-schedule system. They were replaced by LMPs — which embed the cost of congestion — and make-whole payments (MWPs), which compensate for lost opportunity costs when IESO dispatches resources out-of-merit.

-

- Reserve Shortage Penalties: IESO now is using reserve shortage penalty prices (a maximum operating reserve area penalty price, a penalty price for 30-minute operating reserve and an area minimum operating reserve penalty price) to ensure that day-ahead, pre-dispatch and real-time calculation engines respect mandatory reserve requirements, that prices reflect those requirements, and to encourage market participants to meet their reliability obligations.

- The MSP will review all applications of reserve shortage penalty prices to identify the causes of the shortages and potential anomalies in market design or inappropriate market conduct.

- Reserve Shortage Penalties: IESO now is using reserve shortage penalty prices (a maximum operating reserve area penalty price, a penalty price for 30-minute operating reserve and an area minimum operating reserve penalty price) to ensure that day-ahead, pre-dispatch and real-time calculation engines respect mandatory reserve requirements, that prices reflect those requirements, and to encourage market participants to meet their reliability obligations.

-

- Operating Parameters: The renewed market requires non-quick-start gas generators, hydro and variable generation to submit additional data on their operating parameters.

- The MSP will monitor changes to individual facility data for their effects on dispatch and economic efficiency. “Changes to this data may be part of a broader strategy by a market participant to inappropriately influence market outcomes, MWPs and prices to the benefit of the participant [at the expense] of other market participants and consumers,” OEB said.

- Operating Parameters: The renewed market requires non-quick-start gas generators, hydro and variable generation to submit additional data on their operating parameters.

IESO Market Power Mitigation

IESO introduced a three-pronged market power mitigation (MPM) scheme to prevent suppliers from market power due to their location on the transmission grid:

-

- An ex-ante (before-the-fact) approach applied in the day-ahead, pre-dispatch and real-time scheduling processes to police the energy and operating reserve markets.

- An ex-ante mitigation process to prevent market power in the settlement of make-whole payments.

- An ex-post (after-the-fact) mitigation of market power to address physical withholding and economic withholding on uncompetitive interties.

OEB’s surveillance unit will evaluate the effectiveness of the MPM framework through its own three-part market power screen: a conduct test (for withholding activity); a material price impact test (determining whether the conduct of a market participant significantly impacted market prices), and a profitability test (whether the MP’s conduct benefited the participant).

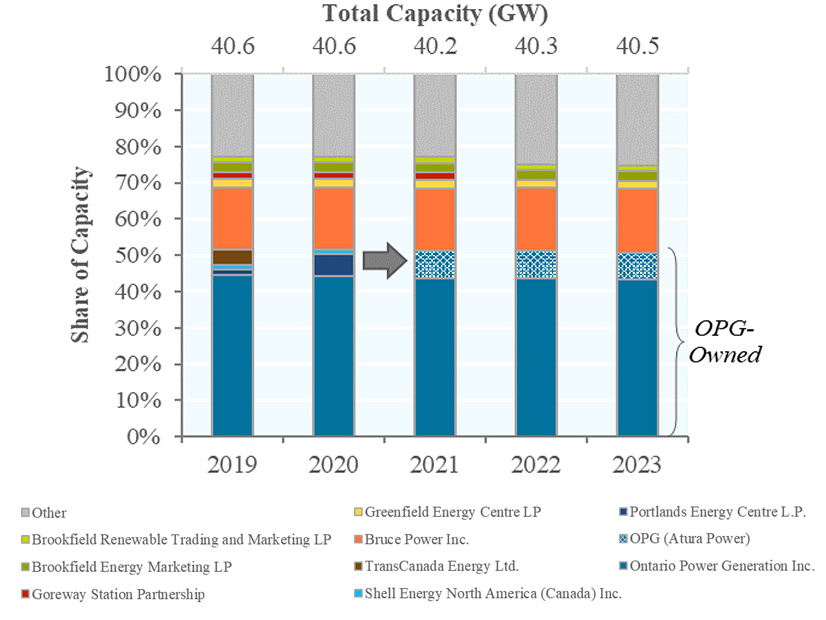

Market Control Entities

IESO will use data from market control entities — companies that control generators and other market participants (dispatchable and price responsive loads, electricity storage resources, energy traders or virtual traders) — to assess physical withholding by examining in aggregate the offer quantities of resources that share a common MCE.

The MSP will incorporate the data in calculating structural measures of competition such as the Herfindahl–Hirschman Index and Residual Supplier Index.

OEB said the MSP will monitor persistent price differences between DAM and RT to ensure they are not a result of illiquid markets or gaming.

New Tool for IESO

To assess the effectiveness of the renewed markets and identify potential solutions to unintended outcomes, the IESO developed the Market Analysis and Simulation Toolset (MAST), which enables it to conduct “but-for” analyses of market outcomes through inputs into the market calculation engines.

OEB said the MSP also may use MAST in its assessment of the market’s efficiency in its annual State of the Market reports, as well as to analyze anomalous market outcomes and identify potential market flaws.

“In an upcoming State of the Market report, after sufficient data has been collected to permit such an analysis, the MSP intends to provide a comparison of the relative efficiency and competitiveness of the legacy markets to the renewed markets,” OEB said. “This analysis is not intended to be an audit of MRP at achieving its objectives. Instead, it is intended to offer insights into the overall efficiency implications of the changes, including where certain efficiencies may or may not have been realized and where improvements in design may be desirable.”