As the West-Wide Governance Pathways Initiative dives into its next phases, a wide variety of stakeholders will serve as advisers — including representatives of the distributed energy resource sector.

“Developing the rules for resources participating in the market will … be shaped by that DER sector representative — something that doesn’t exist anywhere else in the country,” said Brian Turner, Western regulatory director for Advanced Energy United. Turner serves on the Pathways Launch Committee.

Turner’s comments came during a Sept. 23 meeting of Nevada’s Regional Transmission Coordination Task Force (RTCTF).

Distributed energy resources include rooftop solar and storage, electric vehicles and smart devices such as thermostats, Turner said. They can be aggregated into virtual power plants (VPPs) that can provide a boost to the grid at critical times.

AEU argued in a 2024 report that VPPs should play a greater role in resource planning in Nevada. (See NV Energy Should Do More to Tap VPP Potential, Report Says.)

Pathways stakeholder committee members from the DER sector “will help represent the interests of what will be hundreds of thousands of devices across Nevada being dispatched into the market,” Turner said.

During its Sept. 23 meeting, the RTCTF heard updates on the Pathways Initiative as well as the Western Resource Adequacy Program and activities at CAISO and SPP.

The group, created through Senate Bill 448 of 2021, advises the governor and state legislature on energy issues, including those related to utilities joining an RTO.

Governance Transition

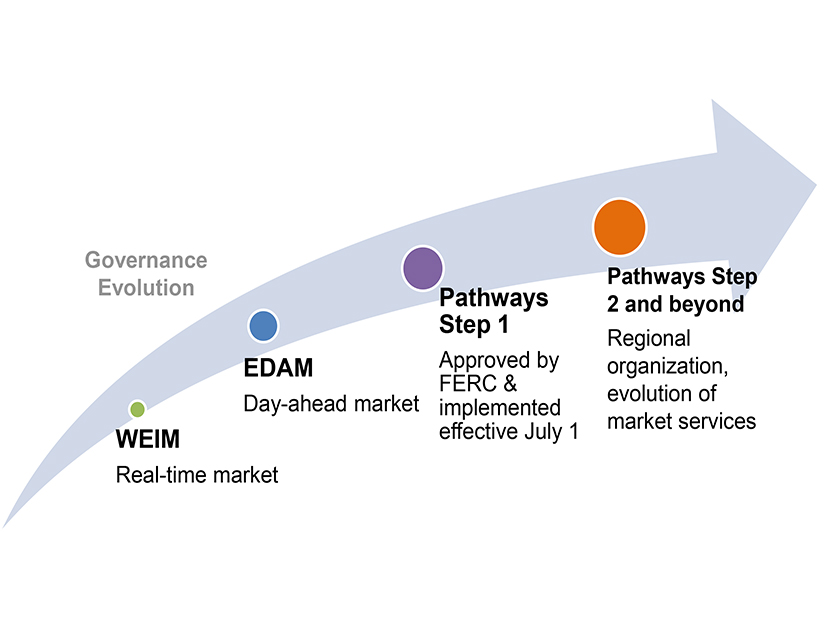

The Pathways Initiative aims to transition the governance of CAISO’s markets from a board appointed by California’s governor to an independent “regional organization” (RO). One goal is to remove what some see as a barrier to wider participation in CAISO markets, including the Extended Day-Ahead Market (EDAM) expected to launch in 2026. CAISO also runs the real-time Western Energy Imbalance Market (WEIM).

California Gov. Gavin Newsom on Sept. 19 signed Assembly Bill 825, which helps clear the way for the transition to RO governance. (See Newsom Signs Calif. Pathways Bill into Law.)

Kathleen Staks, co-chair of the Pathways Initiative’s Launch Committee and executive director of Western Freedom, told the task force that Pathways is hoping to file incorporation documents with the IRS in January 2026. Once the RO board is seated, it will negotiate with CAISO on a contract to provide market services.

Representatives from nine sectors will participate in the nominating committee that chooses RO board members as well as a stakeholder committee that will identify and prioritize initiatives for the RO, Staks said. Some of the sectors represented will be new for the West, she said. In addition to DER sector representatives, the large industrial and commercial customer sector and the customer advocate sector will be represented.

Other sectors represented on the Stakeholder Representatives Committee include EDAM entities; WEIM entities; CAISO participating transmission owners; and independent power producers, independent transmission developers, and marketers, according to the Launch Committee Step 2 final proposal in November 2024. Some sectors may have more than one representative on the committee.

SPP Responds

Following a presentation from SPP, RTCTF Chair Jennifer Taylor of Enel North America asked what impact the passage of AB 825 would have on SPP. SPP’s Markets+ is competing with CAISO’s EDAM for day-ahead market participants, and SPP has pointed to the governance of Markets+ as one of its advantages.

Jim Gonzalez, SPP’s senior director of seams and Western services, said SPP had been “built on a foundation of independen[t] governance.”

“We’ve had decades of experience administering regional multi-state governance, delivering energy solutions across diverse jurisdictions,” Gonzalez added. “That’s something that’s been a constant throughout not just the RTO but these different contract services.”

With CAISO markets now moving toward independent governance through the Pathways Initiative, some are urging utilities that planned to join Markets+ to rethink their decision.

In Colorado, for example, California-led governance has been a key barrier to the state’s large utilities joining a West-wide market, according to a Sept. 22 news release from Advanced Energy United, Western Resource Advocates and the Environmental Defense Fund. Public Service Company of Colorado received state regulatory approval in July to join Markets+. (See Colo. PUC Approves PSCo’s Markets+ Participation.)

Passage of AB 825 means “the pathway to a bigger, better regional electricity market has opened in the West,” the groups said.

“Colorado decision-makers and utilities should be rethinking prior decisions in light of this development so the state can have the strongest, most reliable, flexible, clean and affordable grid,” Turner of AEU said in a statement.

But some market participants seem unlikely to budge from their Markets+ choice. Bonneville Power Administration previously told RTO Insider that despite the passage of AB 825, it believes Markets+ will provide greater customer benefits. (See New Challenges Await Pathways After Success in Calif. Legislature.)

In Nevada, NV Energy has expressed a preference for participating in EDAM, a step that requires approval from state regulators.