ERCOT’s Board of Directors has approved staff’s recommended methodologies for acquiring minimum ancillary service requirements in 2026, but not before revisiting the same discussions that stakeholders have over conservative operations and target procurement levels.

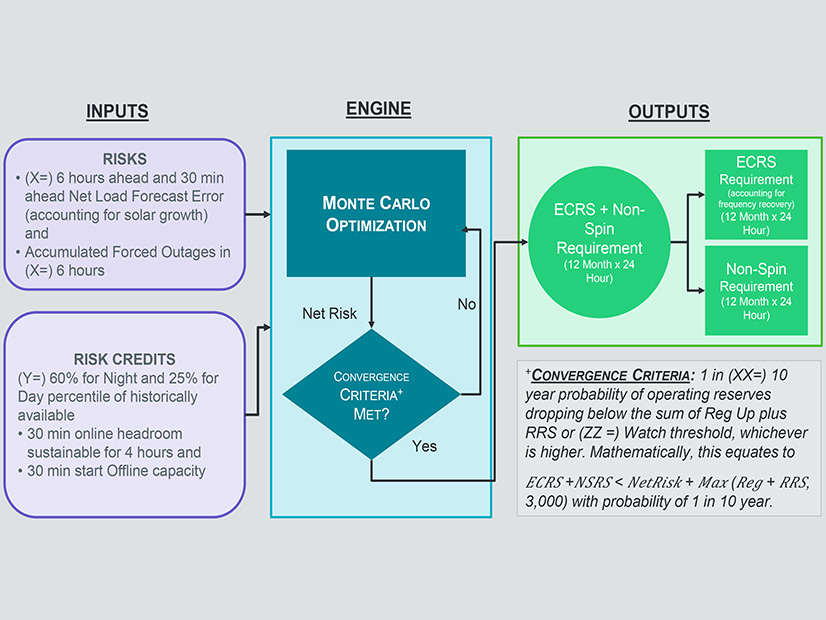

The board’s Sept. 23 approval allows ERCOT to use a probabilistic methodology — an analytical approach incorporating randomness and uncertainty by assigning probabilities to outcomes and events — to calculate hourly ERCOT contingency reserve service (ECRS) and non-spinning reserve service quantities. The probabilistic model aligns ECRS and non-spin requirements with the risk profile, where higher risk equals a higher requirement and lower risk equals a lower requirement.

Staff’s proposal also makes minor changes to regulation service and responsive reserve service (RRS).

“I appreciate the tension between reliability and efficiency and cost effectiveness,” ERCOT CEO Pablo Vegas said as the hourlong discussion, scheduled for 20 minutes, wound down. “That’s a tension that I think we all deal with in what we do day to day.”

The Independent Market Monitor again made the case that ERCOT is over-procuring non-spinning reserves and other long-lead-time ancillary services. It offered a compromise that halved the length of staff’s recommended look ahead at forecast errors or forced outages, from six hours to three, saying it would be just as reliable as staff’s proposal but for less cost.

The Monitor also joined the consumer stakeholder segment in suggesting an end to the grid operator’s conservative operations approach, which stockpiles operating reserves in anticipation of tight conditions.

“Somebody needs to figure out what the offramp is from conservative operations, so that we’re not just doing this forever,” IMM Director Jeff McDonald said. “I feel for ERCOT having been put in a situation where they have to incorporate that kind of an unwritten policy directive into their actual reliability operations, but there’s got to be an offramp for that.”

ERCOT Director John Swainson pushed back against the Monitor’s recommendation. He questioned McDonald’s suggestion after ERCOT staff had said they were following the Texas Public Utility Commission’s criteria. In a 2024 report on ancillary services, PUC staff found conservative operations should be maintained to balance system improvements made since the February 2021 winter storm until additional data are available.

“We have no idea how you calculated or what the hell you’ve done, and you come up with a different answer,” Swainson said. “We just can’t believe you. I mean, your credibility with us as directors is zero.”

“I’m not really sure how to address that,” McDonald said in response.

PUC Chair Thomas Gleeson offered McDonald a lifeline, saying the IMM and Potomac Economics’ David Patton have spent “a lot of time with me” on the issue as recently as the prior weekend.

“I’m in agreement with the IMM that we need to look at all of this,” he said. “I don’t think we should ignore the price formation aspects of the posture that we’ve taken … to ignore the price-formation impacts of the conservative operations posture that we’ve taken would be foolish, at least as I sit here as a commissioner.”

Gleeson pointed to ERCOT’s Real-time Co-optimization + Batteries (RTC+B) project, to be deployed in December, and reliability standard analysis that will take up much of 2026 as reasons to wait before making further market changes.

“While I agree that we need to look at this and potentially make some changes in this direction, I think it is more prudent to wait until next year,” he said. “I think this needs more discussion.”

Adding “real time co optimization + batteries into the market is going to be one of the biggest market changes economically and operationally that we’ve gone through in over a decade,” Vegas said, agreeing with Gleeson that “it’s very prudent to see the impact of that over multiple cycles.”

In the end, the board agreed with staff and other stakeholders to wait until 2027 to revisit and further examine ancillary service methodologies for potential adjustments.

RTC+B Completes Major Test

“It feels like if it’s a football game, we’re first down and goal from the 8-yard line,” ERCOT’s Matt Mereness said in briefing the board on the RTC+B project. “There’s still a way to go, but things have been going pretty well.”

Mereness, senior director of market operations and implementation and the RTC+B project manager, said the initiative is five months into market trials and testing and stabilizing systems. The first of two planned production tests was conducted Sept. 11; ERCOT operators controlled the real-time market and frequency for two hours, and market participants were able to submit accurate telemetry, bids, offers and follow RTC+B dispatch, he said. The RTC+B systems were able to award and dispatch energy and ancillary services in real time every five minutes.

A second production test is scheduled for Oct. 30. ERCOT’s most significant market redesign since the switch from zonal to nodal in 2010, RTC+B is scheduled to be deployed Dec. 5.

“We don’t normally take six months to implement something, but when you implement a major redesign of your real-time market and your four-second control of the system, you need to test it,” Mereness said. “It’s not just about ERCOT being successful. It’s about 95 other companies that are batteries, resources and generators that have to move their machines.”

During the first production test, solar and wind energy dropped by 3,000 MW and two units tripped offline, but “other things” picked up.

“It wasn’t necessarily an easy-peasy test like some of us thought it would be,” Mereness said. “The good news is that the operators and engineers are now looking at how [our system reacted]. The nice part of actually doing a dress rehearsal is people look at the money; they look at the megawatts; and they see if they can follow.”

ERCOT plans to publish a market notice Nov. 5 to alert market participants that RTC+B is live and the transition has begun.

Another ‘Mild’ Texas Summer

Barring an unseasonable warm spell during the fall, ERCOT will go a second straight year without setting a new demand peak, Vegas said during his update to the board. The grid operator recorded a high of 83.68 GW on Aug. 18, less than 2 GW from the all-time peak of 85.51 GW set in August 2023.

While no new peaks were set during a “mild” summer — the June-July period was only the 43rd-hottest in recorded history — ERCOT’s energy consumption has grown year over year. Vegas said the consumption, which increased 2.53% from 2010 through 2020, has doubled to 5.12% since then.

“This is a little bit like the proverbial frog that’s boiling slowly in a pot of water … and doesn’t realize that it’s actually boiling,” he said. “This is what’s happening here. Under the surface, we’ve got energy growth growing very rapidly, but because we haven’t had extreme weather events in the last couple of years, we have not seen new peak demands push up that peak demand level any higher. It’s important to not ever be lulled into complacency.”

Vegas said ERCOT is at an “inflection point of an acceleration of demand growth.” Fortunately for the ISO, staff are analyzing 6,000 MW of new generation that will be synchronized to the grid in the first quarter of 2026. That’s the most ever studied at one time, Vegas said.

Energy storage resources (3,042 MW) and solar (2,055 MW) account for much of the generation, with four gas projects accounting for the remainder (1,103 MW). Vegas said the first three Texas Energy Fund projects are among the gas projects under study. (See NRG Energy Secures $216M Loan from TEF.)

“This is a positive trend,” he said.

Solar and ESRs continue to be the ISO’s workhorses during the critical afternoon hours. Solar set four records during the summer, the last on Sept. 9 (29.83 GW); the 29.34-GW solar peak July 29 broke the grid operator’s mark for wind generation (28.47 GW) for the first time. ESRs also set records this summer, with a high-water mark of 7.51 GW on Sept. 10.

“The additions of solar and batteries have helped us handle the growth in the summer months, where we’ve seen a lot more consumption,” Vegas said.

Board Approves Transmission Projects

The directors approved two regional transmission projects that could cost as much as $827 million to build and that have been recommended by ERCOT’s Regional Planning Group and passed the Technical Advisory Committee. (See “$827M in Tx Projects OK’d,” ERCOT Stakeholders Endorse 2026 AS Methodology.)

CenterPoint Energy’s Baytown Area Load Addition project in the petrochemical industrial region east of Houston is projected to cost $545.3 million for 45 miles of 138-kV lines and additional capacitors. CenterPoint submitted a $141.7 million estimate to address reliability issues caused by proposed new load; ERCOT staff said additional temporary work would be required for all structure replacements, accounting for about 45% of the capital costs, maintenance-outage issues and the expense of rebuilding 138-kV lines among industrial facilities.

Bryan Texas Utilities’ Texas A&M University System RELLIS Campus project has an estimated capital cost of $282.1 million. The project includes 40 miles of new 345-kV double-circuit lines to the RELLIS campus; constructing or rebuilding about 10 miles of 138-kV lines; and expanding the campus’ existing 138-kV substation.

Benjamin Barkley, CEO of the Texas Office of Public Utility Counsel, abstained from the vote on the Baytown project.

The board also approved a price correction for the day-ahead market on its June 27 operating day. ERCOT said a software malfunction related to a generic transmission constraint affected day-ahead prices and wasn’t discovered until after the two-business day deadline for corrections.

The correction resulted in a maximum absolute value effect of $26,525 to counterparties and $124,385 due to ERCOT.

Complete Board Seated

Independent Directors Christopher Krummel, Kathleen McAllister and Bill Mohl, fresh off recent selections to the board, participated in their first meetings Sept. 22-23. They have also been appointed to the board’s subcommittees, which are fully rostered for the first time in 2025. (See ERCOT Fills out Board with 2 Final Selections.)

Consent Agenda Passes

The board’s consent agenda included 10 nodal protocol revision requests (NPRRs), three changes each to the Planning (PGRRs) and Settlement Metering Operating (SMOGRRs) guides, two modifications to the Nodal Operating Guide (NOGRRs), single revisions to the Variable Cost Manual (VCMRR) and Retail Market Guide (RMGRRs), and a system change request (SCR) previously endorsed by TAC that will:

-

- NPRR1265: implement procedures for distributed generation reporting by clarifying DG’s definition and defining the new term, “unregistered distributed generators” (UDGs). The NPRR would establish procedures for UDG reporting to ERCOT and reporting requirements from the ISO.

- NPRR1266: specify that a transmission-voltage customer that is a securitization uplift charge opt-out entity may not transfer its status to other entities. The measure adds a requirement that a transmission service provider (TSP) associated with an electric service identifier originally granted opt-out status must compare at least monthly the names of transmission-voltage customers originally granted the status and inform ERCOT of any changes. The TSP requirement excludes those that are securitization uplift charge opt-out entities.

- NPRR1277: revise the minimum current exposure and estimate aggregate liability (EAL) formulas, improving the efficacy of existing credit formulas that measure credit exposures in the ERCOT market. The EAL formula revisions include applying the real-time forward adjustment factor against the respective days’ real-time liability estimated (RTLE) and then taking the max over the lookback period; and introducing seasonal variability in the lookback period as it is applied for RTLE.

- NPRR1279: enable generation resources to file exceptional fuel costs that include contractual and pipeline-mandated costs and strengthens the process for ERCOT and the Monitor to verify the costs.

- NPRR1281: strengthen the relationship between the settlement of firm fuel supply service (FFSS) and operations by clarifying its hourly rolling equivalent availability factor language to ensure the accurate calculation of the FFSS standby fee.

- NPRR1283: require that any necessary subsynchronous resonance studies be complete and mitigation be in place before the initial synchronization of an ESR, new generation resource or a settlement-only generator before the initial energization.

- NPRR1288: simplify the congestion revenue rights (CRR) auction by removing the ability to transact in multiple month strips that create optimization issues for ERCOT.

- NPRR1289: provide an option pricing report that would be posted following each CRR auction. The report will contain shadow prices for all biddable source-sink paths for each month within each time of use for the auction period and establish a minimum CRR bid of 1 MW.

- NPRR1290, NOGRR278: address several gaps and clarify protocol language to support the RTC+B initiative’s implementation.

- NPRR1291: incorporate the Texas PUC’s substantive rule setting a goal for average total residential load reduction into the protocols, specify data exchange methods and formats, and extend the deadline for posting the annual demand response report.

- NOGRR272, PGRR121: establish new advanced-grid support requirements — including model-quality tests and unit validation requirements — for inverter-based ESRs with a standard generation interconnection agreement executed on or after April 1, 2025.

- PGRR120: prevent generators from interconnecting to the ERCOT grid if they would be radial to a series capacitor under N-1 conditions.

- PGRR129: establish requirements for posting the Grid Reliability and Resiliency assessment and update a list illustrating data sets and classifications.

- RMGRR183: incorporate several updates that have been implemented as part of previous project improvements to transmission and/or distribution service providers’ Competitive Retailer Information Portal self-service tool. TDSPs will be able to assign weather moratoriums by county name instead of service territory.

- SCR832: discontinue and eventually retire a report not being used by market participants.

- SMOGRR032: incorporate the Other Binding Document “TDSP Access to EPS Metering Facility Notification Form” to standardize the approval process.

- SMOGRR033: incorporate the Other Binding Document “TDSP Cutover Form for EPS Metering Points” to standardize the approval process.

- SMOGRR034: remove obsolete gray-box language associated with NPRR1020 (Allow Some Integrated Energy Storage Designs to Calculate Internal Loads).

- VCMRR044: set the variable operations and maintenance cost in the mitigated offer cap for hydro generation resources to the real-time systemwide offer cap and the incremental heat rate value to zero.