As entities explore alternatives to the Western Resource Adequacy Program (WRAP), a new Brattle Group study examines the impact on planning reserve margins of an RA program encompassing expected participants in CAISO’s Extended Day-Ahead Market.

Brattle prepared the report for the Balancing Authority of Northern California, Idaho Power, the Los Angeles Department of Water and Power, NV Energy, PacifiCorp, Portland General Electric (PGE), Public Service Company of New Mexico (PNM), the Sacramento Municipal Utility District and Seattle City Light.

Those nine entities form a “non-CAISO EDAM” footprint that is the focus of the study. Some of the entities have signed agreements to join EDAM, while others are awaiting regulatory approval to do so or have said they are leaning toward EDAM.

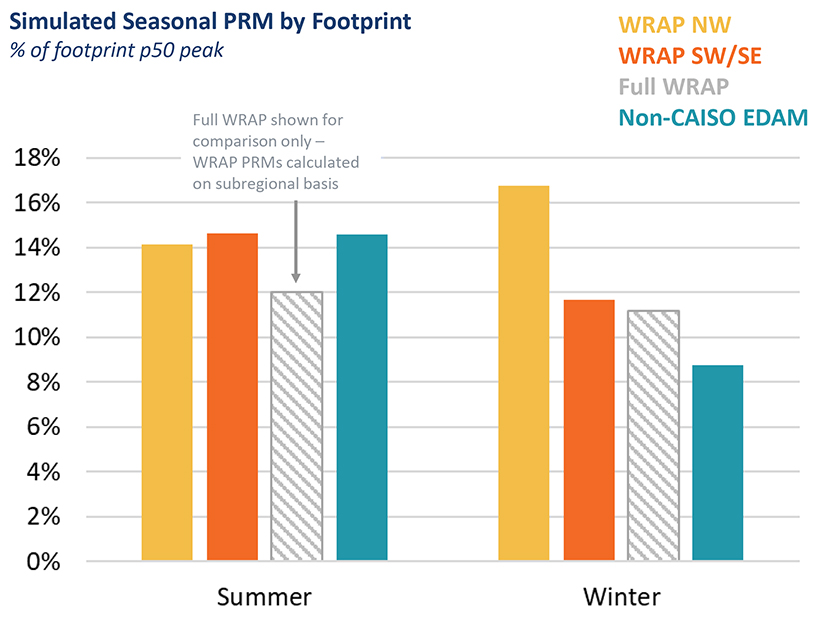

The study simulated winter 2027/28 and summer 2028 planning reserve margins for an RA program covering the non-CAISO EDAM footprint, compared with footprints for WRAP’s Northwest and Southwest subregions.

For summer, Brattle found the PRM was similar among the three footprints, with each falling between 14 and 15%. The authors said summer reliability risks are comparable for the three footprints.

More variability was seen in winter PRMs: from almost 17% for WRAP’s Northwest region to nearly 12% for WRAP’s Southwest region and about 9% for the non-CAISO EDAM region. The authors attributed the non-CAISO EDAM footprint’s lower PRM to higher regional resource diversity.

“The non-CAISO EDAM footprint offers significant resource adequacy benefits, on par with and possibly exceeding the resource adequacy benefit of the current WRAP footprint,” the report authors said.

Planning reserve margin volatility was one concern utilities cited in deciding whether to commit to Western Power Pool’s WRAP or to withdraw from the program.

With an Oct. 31 deadline to commit to the program’s first binding phase in winter 2027/28, WRAP won commitments from 16 entities, while five entities withdrew. (See WRAP Wins Commitments from 16 Entities and 4 Entities Join NV Energy in Exiting WRAP, While Idaho Power Commits.)

Many of those that committed to WRAP plan to join SPP’s Markets+, which requires WRAP participation. But there were exceptions: Idaho Power has committed to WRAP despite saying it is leaning toward EDAM.

NV Energy, PGE and PNM are expected to join EDAM; each announced their withdrawal from WRAP. And in October, NV Energy representatives revealed that talks are underway regarding an alternative resource adequacy program. (See EDAM Participants Exploring Potential New Western RA Program.)

Western Power Pool (WPP) wasn’t involved in the study and hasn’t fully reviewed the results, according to WPP Chief Strategy Officer Rebecca Sexton.

“In our initial review, the study seems to support WRAP’s foundational premise that there is significant benefit to customers from participation in a broad, WRAP-wide footprint,” Sexton said in an email.

Sexton noted that participants representing more than 58 GW of Northwest and Southwest load and a broad mix of resource types have committed to WRAP. She said WPP would welcome proposals based on the study’s findings that would enable study sponsors to participate in WRAP.

Brattle modeled loads and resources for the different footprints for winter 2027/28 and summer 2028.

Looking at planning reserve margins on a monthly basis, Brattle found that PRMs for the WRAP footprints were lower than that of the non-CAISO EDAM footprint in June, and were similar or lower in July. But PRM for non-CAISO EDAM was the lowest among the three footprints in August, which along with July is considered a high-risk month.

For the winter months, the non-CAISO EDAM footprint had the lowest PRM among the three footprints in November, December, January, February and March.

The Brattle study used WRAP’s methodology to look at zonal resource adequacy needs and resource capacity accreditations. Brattle also recommended fine-tuning the WRAP methodology by including transmission limits within the footprints, temperature-dependent thermal outage rates, and improved hydro and weather modeling.

Adding these enhancements to the WRAP methodology “would likely reveal additional risks and yield a more complete assessment of regional RA needs,” the report said.