Rising electricity demand has outpaced winter capacity growth over the past year, leaving many North American regions at elevated risk for outages if they face extreme weather this winter, NERC reported in its newly released Winter Reliability Assessment.

Demand in areas covered by the report has grown by 20 GW since last winter, but corresponding grids have added just 9.4 GW of new supplies to meet the higher consumption, the report said.

“The bulk power system is entering another winter with pockets of elevated risk, and the drivers are becoming more structural than seasonal,” NERC Director of Reliability Assessments John Moura said during a Nov. 18 webinar on the report. “We’re seeing steady demand growth faster than previous years, landing on a system that’s still racing to build new resources, navigating supply chain constraints, and integrating large amounts of variable and integrated inverter-based generation.

“We also added the continued threat of extreme cold weather, which has changed over the years, and the margin for error narrows quickly,” he said.

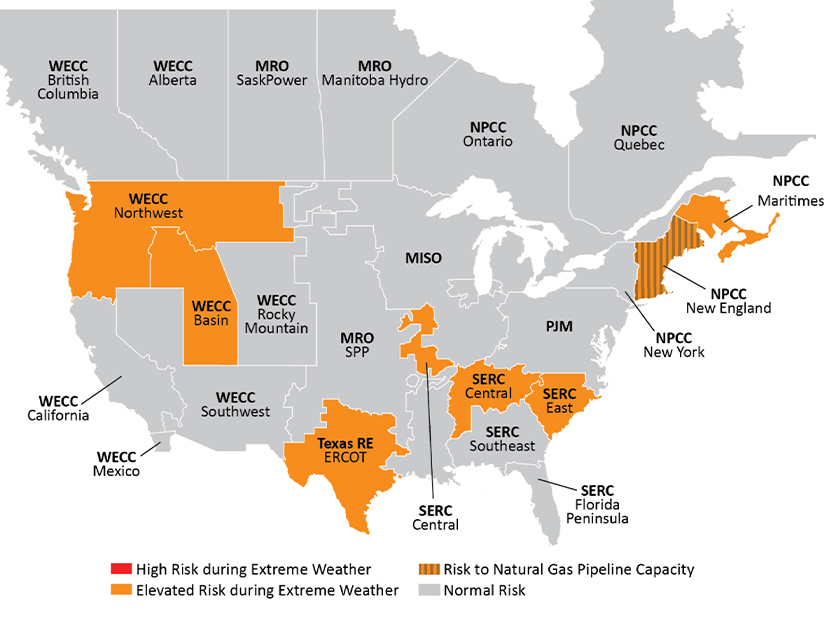

The assessment finds highest risk of outages during extreme weather in the WECC Northwest and Basin regions; ERCOT; SERC Reliability’s Central and East regions; and the Northeast Power Coordinating Council’s New England and Canada Maritime Provinces regions.

While the past two winters have seen noticeable improvements in the delivery of natural gas to bulk power system generators, gas availability remains precarious during extreme cold due to the uneven application of voluntary freeze protection mitigation, NERC found.

“Gas production and supplies going to generators really do strongly affect how well the bulk power system can perform during winter conditions,” NERC Manager of Reliability Assessments Mark Olson said during the webinar. “These two systems are inextricably linked.”

New England stands alone in the report as facing “risk to natural gas pipeline capacity.” The region’s demand forecast for this winter is 2.9% lower than the previous winter’s demand, and firm imports and demand response can make up for retired power plants, the study said.

“New England continues to closely monitor regional energy adequacy, particularly during extended cold snaps where constrained natural gas pipelines contribute to rapid depletion of stored fuel supplies,” the report said. “ISO-NE’s deterministic winter scenario analysis shows limited exposure to energy shortfalls this winter. In New England, winter energy concerns are highest in scenarios when stored fuels are rapidly depleted; during these periods, timely replenishment is critical to minimizing the potential for energy shortfalls.”

‘Pragmatic, Proven Tools’

New England has for decades faced the issue of energy shortfalls during winter, and the idea of building new natural gas pipelines there has gained traction. (See Pipeline Expansion Highlights Key Questions About Gas in New England.)

“Expanding the gas infrastructure into a constrained area like the Northeast would help as you get to these low-temperature periods where gas-fired generation is competing with other users of the gas system; the gas infrastructure would better postured to be able to support the uses,” Olson said. “So basically, for electric reliability, we would expect fewer generator curtailments due to fuel issues, if we can expand that capacity, which can provide reliability benefits.”

That would mean fewer generator outages and less reliance on backup fuels, allowing the region to be more resilient during extended cold snaps, he added.

NARUC recently released its Gas-Electric Alignment for Reliability report, which recommended construction of more pipelines to improve electric reliability. (See NARUC Report Seeks to Make Headway on Gas-electric Coordination.)

Moura said “the preponderance of material that’s being presented to decision-makers around gas-electric” points in the same direction: “That alignment between gas and electric are critical, these are interconnected systems, and there needs to be some changes in the future.”

The power industry continues to build new natural gas plants, but they are not always paired with new pipelines, or contracts with firm service able to ensure delivery during the coldest days of the year, he added.

“The findings around aligning the markets, being able to put in more resilience through more infrastructure, are all lining up with what we need to have a reliable and resilient system in the future,” Moura said.

The National Petroleum Council plans to publish another report on gas-electric coordination in early December that will include recommendations to shore up the reliability of both systems, Moura said.

Electric Power Supply Association CEO Todd Snitchler said his group’s members are investing in the resources needed to maintain reliability, including gas-fired plants and batteries. Evolving demand forecasts increase uncertainty, but competitive markets can shield customers from risk, he said.

“Policymakers should avoid extreme rhetoric or drastic interventions driven by outlier projections and instead focus on pragmatic, proven tools that support reliability and encourage cost discipline,” Snitchler said. “Competitive markets remain the most effective mechanism to deliver reliable, innovative and cost-effective energy. With targeted reforms — and continued private investment — we can better ensure the dependable, affordable power system Americans expect this winter and for years to come.”