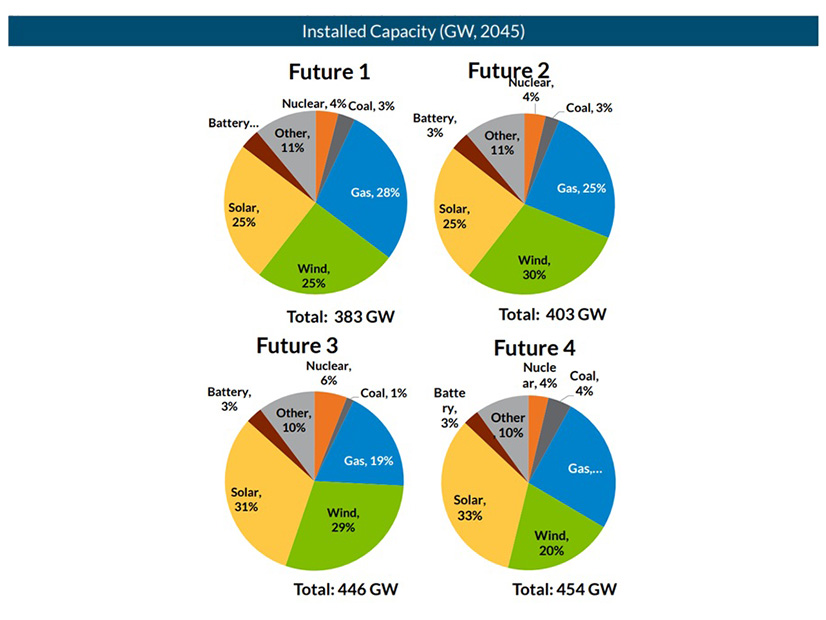

MISO predicts it will have anywhere from 383 GW to 454 GW of installed capacity in its footprint by 2045, according to a preliminary version of its 20-year planning futures.

MISO charted resource totals at 383 GW, 403 GW, 446 GW and 454 GW for its Futures 1-4, respectively. The grid operator makes capacity expansion predictions under its 20-year planning scenarios, which help decide which long-range transmission projects are useful. This time around, MISO’s predictions contain more natural gas generation and fewer renewable energy resources.

At a Nov. 18 stakeholder teleconference to debate the futures, Director of Economic and Policy Planning Christina Drake said they “limit all-in costs to members” while respecting states’ and utilities’ decarbonization goals and still being able to serve peak demand and meet planning reserve margin targets.

MISO has been constructing its planning futures for more than a year. It paused in mid-2025 to recalibrate the generation expansion assumptions in its futures after the Trump administration revoked tax credits for renewable generation. (See MISO Seeking Realistic Gen Buildout for Tx Planning Futures.)

Drake said MISO will perform more sensitivity analyses to test whether the four futures are “broad enough.” MISO plans to use sensitivities to test other assumptions, like more load hyperscalers than MISO anticipates in its updated load forecast, a drop in cost for small modular reactors or long-duration storage, the reinstatement of renewable tax credits or natural gas prices that rise faster than expected.

Drake said MISO would not adjust members’ stated resource plans to test assumptions, considering those plans set in stone. She has said “MISO will not be putting its finger on the scale” by changing planned units.

MISO Independent Market Monitor David Patton has suggested MISO introduce a sensitivity that contemplates cost caps on members’ decarbonization goals. Patton reasoned that utilities would not spend infinite amounts of money to meet their clean energy goals when they have shareholders to answer to.

Drake said MISO will share its chosen sensitivities in December.

MISO said it will incorporate its growing load into the futures and plans to include data from its long-term load forecasting pilot program. (See MISO Rationalizes Load Forecasting Pilot Program.) According to early results, MISO could have an additional 64 GW to serve within 20 years.

Sustainable FERC Project’s Natalie McIntire asked how MISO would capture the “uncertainty” behind the rise in large loads, where some may not materialize.

Clayton Mayfield, manager of MISO’s economic planning team, said MISO would evaluate its stakeholder sources of data to figure out which large-scale load projects plan to minimize their needs. He also said MISO would use a project certainty ranking for loads, with a “high” classification for publicly known load projects in development with known locations, a “medium” ranking for loads under study and included in MISO’s long-term forecast and “low” for loads still in talks and unreported in the long-term forecast.

MISO’s first, most conservative future would include only high-certainty loads, while the second, middle-of-the-road future would include high- and medium-certainty projects. MISO’s most aggressive fleet change scenario would include all potential load growth.

Mayfield said MISO is using a siting process for load additions similar to its capacity expansion process to depict load locations.

Bryn Baker, senior director at the Clean Energy Buyers Association, requested MISO consider that some large loads bring their own co-located or behind-the-meter generation to the table to aid their needs.

WPPI Energy’s Steve Leovy similarly asked MISO to consider that some loads might be interruptible or construct on-site generation.

Finally, MISO won’t include Louisiana’s previous goal to reach net-zero greenhouse gas emissions by 2050 in its futures. At a late October workshop, Drake said MISO had “active discussions” with Louisiana officials and was told the Louisiana goals have been discontinued.

“Probably for the entire expansion, it’s not going to move the needle much,” Drake said.

MISO will hold more futures stakeholder workshops Dec. 17, Jan. 29 and Feb. 26.