ERCOT stakeholders have endorsed a 1,109-mile, single-circuit 765-kV backbone transmission project that is expected to cost nearly $9.4 billion in capital, making it the largest initiative for the grid operator in decades.

The Texas 765-kV Strategic Transmission Expansion Plan (STEP) Eastern Backbone project is so large that some stakeholders referred to it with an uncapitalized term not found in the protocols.

“This project falls into the category of just a really big ass project,” the R Street Institute’s Beth Garza, who represents the Consumer segment, said during the Technical Advisory Committee’s Nov. 19 meeting. “It’s really big. It has the potential to be very impactful.”

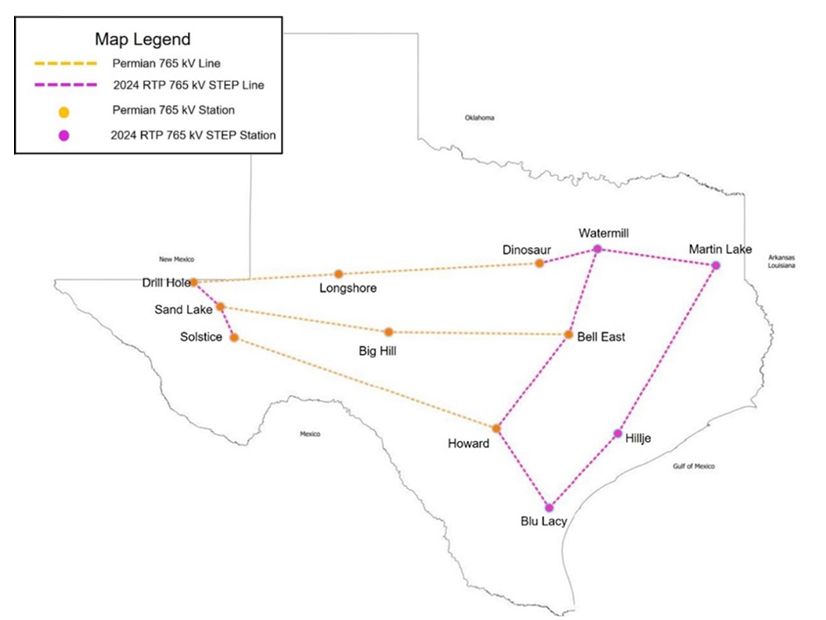

The project involves four transmission service providers (American Electric Power, CenterPoint Energy, CPS Energy and Oncor) who will build seven segments of the extra-high-voltage transmission lines, four 765-kV substations, 11 765/345-kV transformers, and 69 765- or 345-kV circuit breakers. The result will be a rectangular network from Northeast Texas down to the Coastal Bend.

The backbone project dwarfs ERCOT’s Competitive Renewable Energy Zone program, which was completed in 2014 at a cost of $6.9 billion. The project came in $2 billion over projections, but the 3,600 miles of 345-kV CREZ lines freed up more than 23 GW of wind capacity in West Texas.

The 765-kV STEP was developed in 2024 along with ERCOT’s Regional Transmission Plan to address load projections of 150 GW — 65 GW above its current demand peak — in 2030 on an already congested system. ERCOT staff said the 765-kV backbone would enable power to flow more efficiently through long-distance transmission from resource-rich regions to urban load centers. (See 765-kV Lines in West Texas Inch Closer to Reality.)

Prabhu Gnanam, ERCOT’s director of grid planning, said the Eastern Backbone, a subset of the 765-kV STEP Core Plan, addresses the statewide EHV reliability needs identified in the RTP. He said the RTP’s sensitivity analysis indicated major portions of the Core Plan would still be needed, even with 20 GW less load.

TAC endorsed the project in a 23-2 vote, with two abstentions. South Texas Electric Cooperative and Brazos Electric Power Cooperative both voted against the measure.

STEC’s John Packard questioned the “unprecedented” speed of the project, which was submitted to ERCOT’s Regional Planning Group (RPG) in July before being recommended by staff. He said the proposal also lacks an accompanying legislative or regulatory mandate.

“I think a lot of this load that’s forecast … doesn’t hit ERCOT until 2030 to 2032, so there’s other projects that are going to be carrying some of this large load in the meantime,” he said. “I think it only makes sense to take maybe a more measured approach and incorporate some of these policy initiatives.”

“Generally, I’m in favor of transmission. In order to have a truly competitive market, we need robust and reliable transmission,” said Nick Fehrenbach, manager of regulatory affairs and utility franchising for the city of Dallas. “My real concern, though, is 1,100 miles of new right of way. We can get [construction permits] and get it built in five to seven years … but this price is going to creep as we start acquiring that right of way.”

The project’s price tag easily met the $100 million threshold to be classified as a Tier 1 project, requiring approval by the ERCOT Board of Directors.

TAC endorsed two other RPG-recommended Tier 1 projects, adding them to the combination ballot that is the committee’s answer to a consent agenda:

-

- Oncor and AEP’s proposed 104-mile, single-circuit 765-kV project in West Texas that closes the western end of ERCOT’s EHV backbone. The Drill Hole-Solstice project has a projected capital price tag of $742.2 million.

- Oncor upgrades to a 345/138-kV switch and 9 miles of 138-kV line, and 13 new miles of 345-kV lines in far West Texas. The project has an estimated capital cost of $110.6 million and completion date in December 2026.

All three projects will require construction permits from the Texas Public Utility Commission.

ERCOT Looks Past RTC Go-live

With the Real-time Co-optimization plus Batteries (RTC+B) project barreling toward its Dec. 5 go-live date, attention has begun to turn to the stabilization period after the market mechanism begins procuring energy and ancillary services every five minutes.

The committee and ERCOT’s Matt Mereness, chair of the RTC+B Task Force, discussed who would be responsible for monitoring and tracking the market’s data and issues, and for how long. Mereness said the task force could be sunset or incorporated in another stakeholder group.

TAC Chair Caitlin Smith, with Jupiter Power, pointed out ERCOT has been setting aside several other market designs to observe RTC’s effects on the market.

“I feel like as soon as RTC goes live, you’re going to have maybe even more on your plate, more varied things,” she told Mereness. “All the things you’ve said, ‘We’ll get back to it after RTC.’ All the things you’ve said, ‘We can revise as we go along with RTC and have data.’”

Harika Basaran, the Texas PUC’s director of market analysis, noted RTC is one of ERCOT’s performance measures. She pointed out that ERCOT will have initial RTC settlements but could have an old system using data from the new system. She suggested a “stabilization piece and the writing out of issues and getting those assigned to a safe landing spot or dealing with them there.”

“We could do that,” Mereness said.

Smith agreed that the proposal makes sense. Protocol revision requests would go through the normal process, but the task force or its successor would handle the “plan and timeline for what pieces need to be done next, and maybe some issue-spotting is brought there too.”

Mereness said staff have filed a notice with the PUC alerting it to “likely” protocol violations in three of the RTC’s 150 or so reports. One of the reports prints $9,000 prices at the cap, even though the cap was reduced to $5,000 after February 2021’s Winter Storm Uri. Staff are working on an urgent Nodal Protocol revision request to remedy the problem.

“In the meantime, we’re going to fix our systems to not print $9,000 prices as soon as we can after go-live,” he said. “In a way, we’re going live with something that may or may not show up because it only shows up in a load-shed type event.

“See you on the other side,” Mereness said in closing his presentation.

Large Loads ‘Consuming’ ERCOT

ERCOT has added 142.2 GW of interconnection requests by large loads during 2025, staff told TAC, pushing the total queue to 225.8 GW as of mid-November.

Over 193 GW of those requests are by standalone facilities, with co-located loads accounting for the rest.

“We thought [83 GW] was a lot,” ERCOT’s Julie Snitman said.

Nearly a quarter of the requests (91 of 366) are from loads larger than 1,000 MW apiece; the other 275 are at least 75 MW each. Developers submitted 78 requests during the second quarter and have already filed half of that midway through the fourth quarter. At the same time, staff said a little more than 5,000 MW of large loads have been “observed” as being energized.

“ERCOT is having a problem getting started with cluster studies because everybody keeps submitting new large loads to them,” Longhorn Power’s Bob Wittmeyer, who chairs TAC’s Large Load Working Group, told stakeholders. “Large loads are effectively consuming all of their resources by adding more large loads.”

“That’s really heating up our bandwidth,” ERCOT’s Agee Springer, senior manager of grid interconnections, said in agreement.

Several stakeholders questioned how staff can be sure the large loads will eventually show up. Kristi Hobbs, vice president of system planning and weatherization, said she has been “very active” in the PUC’s large load rulemaking process.

“It’s very important that we work with the commission to get this rule right because that will indicate what we will include in our forecast going forward,” she said.

ERCOT is partnering with Texas A&M’s Engineering Experiment Station to develop detailed generic dynamic models of large loads and how they can change their power output during and after grid disturbances. Wittmeyer said he recently attended a conference on interconnecting large loads in ERCOT, held by the university’s College of Engineering, that was “pretty well attended by a bunch of data center folks.”

Ross’ Last Meeting

The meeting marked the last for AEP’s Richard Ross, the longest-serving TAC member. Ross has represented AEP on the Investor-Owned Utility segment for about 23 years, he said.

“He’s not going anywhere. He’s not retiring,” Smith assured members.

Ross said he will continue to supply a word or theme of the day — a staple at both TAC and SPP Markets and Operations Policy Committee meetings — in the future.

His final word of the month? “Ventilate.”

“Gratitude” had been suggested before Ross joined the meeting. But “no, that’s not the theme at all,” he said. “If you want to go with it, that’s fine, but the word of the month is ‘ventilate’ … you know, we’ve ventilated on ERCOT’s opinion.

“Use ‘ventilate,’ ‘gratitude,’ whatever it takes to get us to 2 o’clock,” Ross said, referring to the meeting’s scheduled close.

“Unless anybody else has gratitude or ventilating or is retiring from TAC, I think we can adjourn,” Smith said in ending the meeting.

NPRR Comments Rule

The committee endorsed a protocol change (NPRR1298) that would require comments on proposed rule changes to be delivered to ERCOT within 14 days of the revision request’s posting. Comments posted after the 14-day comment period can be considered at the Protocol Revision Subcommittee’s discretion.

The measure passed 21-1, with six abstentions. Ross was the only member voting against it.

“I don’t think it was necessary,” Ross, who said he doesn’t like abstaining, observed in explaining his vote to Basaran. “We’ve worked well without this for many years … I don’t know if we had this rule in place for the last 20 years if it would have adversely impacted anything.”

TAC approved a request by BHER Power Resources for a permanent site-specific exemption from complying with metering protocols by placing it on the combination ballot. The company said its Falcon Seaboard facility in Big Spring was built in such a way that it can’t meet a 500-kW maximum load limit requirement for auxiliary distribution factors. The facility has been operating for 35 years.

The combo ballot also included five other NPRRs and single revisions to the Nodal Operating Guide and Planning Guide that, if approved by the board, will:

-

- NPRR1274: update the estimated capital cost for the tier-classification rules used in the RPG process.

- NPRR1287: replace the defined term “Maximum Daily Resource Planned Outage Capacity” with “Resource Planned Outage Limit” (RPOL) to align with the actual calculated RPOL; add the maximum duration of a proposed transmission outage with a described lead time to align with current outage-coordination practices; define conditions under which ERCOT can accept an outage request if it could exceed the planned outage limit; and clarify that energy storage resources submit outages.

- NPRR1294: incorporate the Other Binding Document “Demand Response Data Definitions and Technical Specifications” into the protocols to standardize the approval process.

- NPRR1300: implement Senate Bill 1877 by including the Texas Office of Public Utility Counsel as an entity permitted to receive protected information or ERCOT critical energy infrastructure information without violating the protocols.

- NPRR1303: revise language to change the method for submitting and receiving declaration of natural gas pipeline coordination from a physical form to an electronic format.

- NOGRR280: remove language governing communication path requirements for CREZ circuits and stations.

- PGRR131: implement mandatory reporting requirements for transmission service providers’ and ERCOT’s interconnection-cost reporting and delete gray-box language superseded by the requirements.