A common theme across the deluge of comments on the Department of Energy’s Advance Notice of Proposed Rulemaking to FERC on large load interconnections was that parties welcomed the process as a vehicle for the commission to improve its rules to help with speed-to-market concerns (RM26-4).

But many of the comments warned FERC and DOE from going too far into jurisdictional issues that could wind up working at cross purposes with the ANOPR’s goal of speeding up interconnections. The first round of comments on the proposal was due Nov. 21. (See Energy Secretary Asks FERC to Assert Jurisdiction over Large Load Interconnections.)

“Any commission action must recognize that large load customers are end-use retail customers, meaning the delivery service they receive necessarily includes an element of local distribution service,” the Edison Electric Institute told FERC. “Even in states that have elected to restructure their electric industry and implement retail choice, the states require that local utilities secure wholesale transmission service on behalf of all retail customers so that they can procure this competitive generation supply.”

The fair and rapid interconnection of large loads can be achieved without calling into question the way states and FERC traditionally have regulated bundled service, the organization said.

“States have successfully regulated retail interconnections for decades, including interconnections of large retail loads, and upsetting that paradigm here may have unintended consequences that could undermine the goals of both EEI members and the commission regarding developing methods to ensure rapid and reliable connection of large loads,” EEI said.

The ANOPR cites EPSA v. FERC as part of the justification for FERC to claim jurisdiction over large loads. In that case, the Supreme Court found that the commission could regulate areas that impact wholesale markets it oversees. But EEI said that decision left intact the Federal Power Act’s savings clause in Section 201, which reserves authorities for the states.

“A court may find an argument that retail customers affect wholesale prices simply because they interconnect to the grid as a clear overreach by the commission,” EEI said.

The National Rural Electric Cooperative Association filed similar comments, saying the ANOPR can help by focusing on issues firmly under FERC’s jurisdiction, but any rule changes should avoid a jurisdictional fight.

If FERC does decide to go forward with asserting jurisdiction, it needs to foreswear jurisdiction over retail sales — even for large loads that connect directly to the transmission system, NRECA argued. The proceeding cannot be a backdoor to impose retail competition on states that are vertically integrated, it said.

“In considering whether to act upon load interconnection processes, the commission should keep core federalism principles at the forefront of its decision-making,” the American Clean Power Association said in its comments. “Load interconnection has historically been a state-jurisdictional issue, and any federal action should be measured and carefully considered.”

FERC could set clear requirements for consistent, timely and transparent load and hybrid interconnections, and then trigger federal action only if and when states and transmission owners cannot keep up with the minimum standards, ACP said.

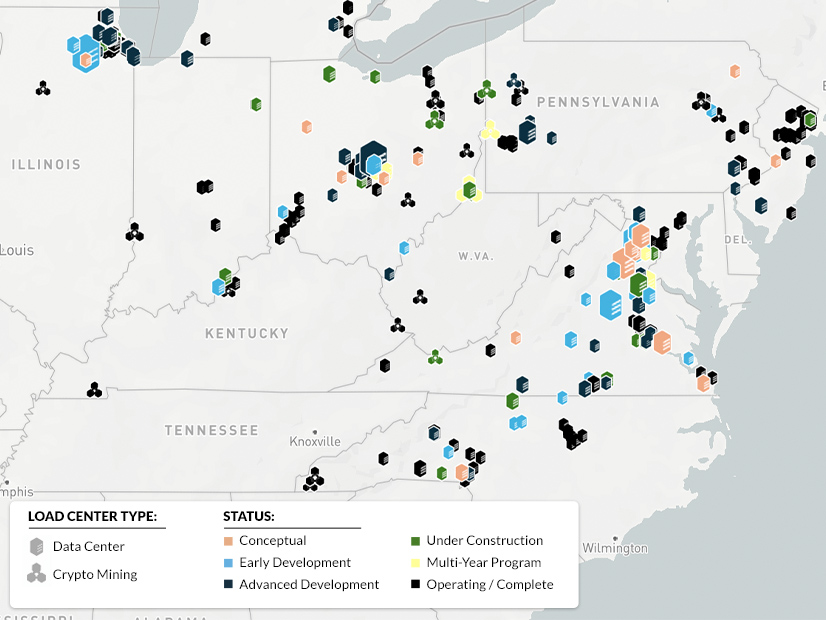

The Virginia State Corporation Commission, which regulates the largest data center market in the world, made similar comments.

“Under this paradigm, the transmission owners would file with the commission verification that a large load interconnection tariff meeting such requirements has been filed with their state regulatory authority,” the SCC said.

The SCC noted that the ANOPR’s claims about “connecting directly” to the transmission is questionable because almost all such loads have one or more substations on site to step down the voltage before the electricity can be used.

“The legal durability of any final rule in this proceeding will thus depend on the merit of these assertions,” the Virginia commission said. “The VSCC does not believe it is necessary for the commission to even reach these questions, however, as the best approach to these issues is a cooperative one, where the commission sets minimum standards for interconnecting utilities to meet, while leaving it to state commissions to regulate these retail tariffs as they have done for many years.”

The National Association of Regulatory Utility Commissioners argued that nothing in the ANOPR is intended to assert jurisdiction over distribution interconnections, generation facilities and retail sales, and the commission should state that explicitly in any final rule.

“As acknowledged in the ANOPR, FERC has never attempted to assert jurisdiction over end-user load interconnections,” NARUC said. “The reason for this fact is that FERC asserting jurisdiction over load interconnection is outside the boundaries imposed by the FPA.”

If FERC were to assert jurisdiction over the interconnection of a subset of retail customers, it would interfere with the balancing performed by state regulators in retail rate cases and would have significant impacts on all classes of customers.

“NARUC pledges to engage with regulated entities and other stakeholders to explore consensus solutions for FERC’s consideration that will help meet national goals for large load interconnection, while avoiding disputes over jurisdiction that would impede achieving our shared goals,” it told FERC. “Working together, under the concept of cooperative federalism, will lead to optimal solutions.”

FERC can and should regulate large loads’ interstate transmission and wholesale market aspects, the Pennsylvania Office of Consumer Advocate and the Delaware Division of the Public Advocate said in joint comments.

“Due to the resource adequacy and affordability crises that residential consumers face within PJM, the joint consumer advocates support all jurisdictional efforts to effectuate the FPA’s plain text and core purposes as well as cost-causation principles,” they said. “Primarily, the joint consumer advocates support the creation of an expedited large load interconnection queue that includes the large load through its interconnecting utility or electric distribution company, with a workable study time frame, that seriously accounts for participants’ costs to all other affected grid users within the wholesale market.”

The consumer advocates argued that the ANOPR ignores the fact that even very large customers often are connected through distribution facilities that are firmly under the states’ authority.

“FERC should avoid pre-empting existing state authority because courts no longer reflexively defer to agencies’ interpretations of ambiguous statutes, and Skidmore deference will not suffice here,” the advocates said. “A FERC final rule that includes federal pre-emption of any existing, traditional state authority will face an uphill battle under the U.S. Supreme Court’s new standard of review for agency statutory interpretation.”

The ANOPR compares large load interconnections to the process FERC has long overseen for generators, but the Maryland Public Service Commission argued that the two are far different in reality.

“FERC issued Orders 888 and 2003 to correct inefficiencies and discrimination by vertically integrated utilities favoring their own generation resources,” the PSC said. “However, utilities have no comparable incentive to discriminate against large load, as these customers represent valuable opportunities for new retail sales and investment. And unlike generators, end-use customers are retail customers — they do not participate in the wholesale markets.”

Still, like many commenters, the PSC said that FERC can help speed up data center interactions through a policy of cooperative federalism.

The R Street Institute generally supports the expansion of wholesale and retail competition, but it said the fast-paced ANOPR process was not the right venue.

“FERC should narrowly address large load interconnections in ways that hew to the commission’s well supported implementation of generation interconnection planning and that limit regulatory creep,” R Street said. “FERC should further leverage the commission’s competencies and expertise and prioritize litigation risk and implementation concerns.”

What should FERC do in response to the ANOPR?

PJM said a federally regulated large load interconnection process warrants more study, but it urged FERC to move forward on areas where it has firmer jurisdictional footing, such as resource adequacy, ancillary services, interconnection and transmission planning, and NERC reliability requirements.

“Such a construct would have potential benefits including centralization and the promotion of uniform policies and practices,” PJM said. “But, as with the existing generator interconnection process, there will undoubtedly also be costs, claimed delays (many of which will be outside the control of the RTO/ISO), and other complexities that will have to be addressed and that are likely to frustrate the ANOPR’s ‘speed to market’ objective — especially given potential impacts to the existing generator interconnection process.”

The RTO asked FERC to move forward on the pending co-location proceeding that has held up large load issues in its footprint, as did other commenters who do business in its territory (EL25-49).

MISO supports rule changes to help speed up interconnections, but it argued that FERC should respect regional differences.

“MISO’s existing processes effectively reflect unique facts and circumstances of MISO’s system, its states and members,” the RTO said. “Importantly, states and load-serving entities are primarily vertically integrated and responsible for resource adequacy within the MISO footprint. As a result, many states and utilities within MISO have processes which enable them to review and pare through speculative load requests to determine projects with more certainty, allowing MISO processes to enable speed to power for more certain large load interconnections, including determining the associated transmission required to facilitate the required generation interconnections.”

Making large load use the same or a similar process to the generation queue, which has had its own well documented issues with delays, is questionable, the RTO said.

“MISO questions whether standardized large load interconnection procedures will result in the ‘speed to power’ that is necessary to allow the United States to effectively compete in the global competition for economic development, such as in artificial intelligence and creating manufacturing and industrial jobs,” it told FERC.

Meta, the parent company of Facebook and a major player in building data centers, cautioned FERC against a one-size-fits-all approach, even though large load interconnections could benefit from some standardization.

“Some regions of the country are just beginning to bring data centers online, while others have already interconnected substantial large data center loads and are working quickly to add more,” Meta said. “Keeping this momentum going is imperative. Issuing a detailed, standard rule that fails to account for the diversity in the economic landscape could slow down successful interconnection processes and undermine the commission’s goal of bringing more data centers online faster and in a more orderly manner.”

Amazon Energy — Amazon’s energy trading subsidiary — supports FERC action, but whatever the commission does should not upset the planning around data centers that is underway.

“Amazon Energy respectfully urges the commission to apply any new rules or policy changes adopted in this proceeding prospectively, and not to large load interconnection requests currently in progress under existing interconnection procedures,” it said. “Specifically, Amazon Energy proposes any new rules apply only to large load interconnection requests that, as of the effective date of the new rules, have not executed agreements that include a significant financial commitment to the interconnecting utility.”

Google filed comments arguing FERC should work to build out the grid so the growing demand from data centers can be met in a timely and reliable way.

“Now is the moment to right the ship and build out the transmission grid needed to support our nation’s ambitious AI goals,” Google said. “And we must do this with a commitment to affordability: The goal is not to spend more, but to plan better in order to develop a transmission grid that can support the nation’s digital infrastructure needs. Ultimately, a modern, robust transmission grid is the essential platform for delivering affordable, reliable energy to all customers, unlocking transformative dividends across the American economy — from AI leadership to a revitalized domestic manufacturing base.”

The grid needs a holistic planning process, and grid planners need an accurate sense of how much new demand from large loads they will have to meet. Google endorsed SPP’s Consolidated Planning Process, in which generator interconnection and long-term transmission planning are combined.

“The commission should also focus its near-term efforts on identifying pathways to expediting other transmission-level load interconnections that benefit the grid, such as loads that voluntarily offer flexibility via demand reduction or agree to take curtailable transmission service,” Google said. “As with co-located or electrically proximate pairs of load and generation, Google believes that the commission should consider prioritizing reforms to expedite the study of loads that can themselves minimize or help manage the strain on the transmission system.”

Flexibility’s Role

Emerald AI, which works with data centers to make their operations more flexible, endorsed the ANOPR’s idea to create a “Flexible Load Fast Track” for projects that can curtail demand when needed.

“The greatest opportunity in this rulemaking is not merely streamlining the administrative study process but enabling large loads to actively avoid or defer massive grid and energy infrastructure upgrades,” the company said.

The traditional model in which new customers’ load is measured at its maximum and coincident with system peaks requires major investment in new wires and generation and is fundamentally incompatible with the exponential growth and unique physical characteristics of data center demand, Emerald said.

“Delays in interconnection, driven by study processes that do not allow for flexibility — including software-defined flexibility — threaten to stall this economic engine,” Emerald said. “By adopting a technology-neutral, performance-based definition of flexibility and curtailable load, the commission can unlock tens of gigawatts of capacity, ensuring that the U.S. maintains its competitive edge in AI while protecting ratepayers from the costs of unnecessary transmission buildout.”

Non-firm Interconnection Service

American Electric Power commended DOE for launching the rulemaking and said FERC needed to ensure that generation can come online in a timely fashion to serve new large loads. It endorsed the connect-and-manage approach used in ERCOT.

“Under this approach, all generators pay an entry fee and can rapidly connect to the grid, subject to curtailment until supporting network transmission is planned and constructed,” AEP said. “Generators may start as energy resources for some portion of their capacity but are on a pathway to full recognition as capacity resources until supporting network transmission is built.”

The Data Center Coalition also endorsed a change to interconnection service, arguing FERC should regulate energy resource interconnection service more like ERCOT does with connect and manage. Too often, the organization argued, the commission has stringent requirements that are more in line with network resource interconnection service, which is meant to ensure resources can deliver power even during peak hours.

“The stakes are clear: If the United States is to maintain resource adequacy, economic competitiveness and technological leadership, the grid must be capable of interconnecting both load and supply at the pace required by today’s economy,” the coalition said.

NRG Energy urged an even bigger change: using open seasons to help large loads connect to the grid much more quickly.

“A more efficient, market-based approach employing open seasons would provide much needed certainty around the amount and location of large loads, which would benefit regional transmission system operators/independent system operators, transmission owners, generators and consumers alike by facilitating more orderly planning and capital investment,” it told FERC.

Such processes have been used by natural gas pipelines to help raise capital and get customers, NRG said. The Alberta Electric System Operator recently used the concept to allocate open headroom on its system to data center customers.

“AESO began by establishing an interim, reliability-based megawatt limit (1,200 MW) on large load interconnections with its grid and then assigning that capacity to large loads ready to advance in the interconnection process in ‘a fair, efficient and openly competitive manner’ based, in part, on each large load’s ‘willingness to commit’ through the posting of financial security,” NRG said.

Open seasons will require a more proactive role from grid planners, but that should benefit the interconnection and transmission planning processes, NRG said.

“Such an approach is geared toward speed-to-market, getting the most megawatts online at the lowest overall cost, and ensuring a direct allocation of incremental costs to new large users of the grid,” the company added.

What to do about reliability rules?

NERC intervened in the case to ask whether it should consider new rules to deal with issues caused by new large loads and whether the large load customers should have to follow them.

So far customers have not had to follow NERC’s mandatory standards, but the FPA does say they can apply to “users” of the bulk power system and that could cover large customers.

“NERC plans to coordinate with stakeholders over the following year to explore potential revisions to the registry criteria and reliability standards that would incorporate large loads impacting the reliable operation of the BPS,” the ERO told FERC.

The Large Loads Task Force is working on those issues now. NERC laid out a timeline that runs through 2028 to address any needed changes to its mandatory reliability standards in response to the proliferation of large customers.

“Depending on the outcome of these activities, next steps may include NERC registry criteria updates that help mitigate risk associated with emerging large loads,” it said. “As discussed at the commission-led 2025 Reliability Technical Conference, any updates to registry criteria would be dependent upon whether relevant users, owners and operators of the BPS could materially impact, either individually or in aggregate, the reliability of the BPS.”