IESO has reduced its 2026 demand growth projection slightly, citing “international trade tensions.”

The revised projection came in its January 2026–June 2027 Reliability Outlook, which concludes Ontario is “well prepared” to meet its reliability requirements over the 18-month period.

IESO said firm energy demand rose about 2.3% in 2025 — “stronger than anticipated” — and will grow another 1.6% in 2026 and 1.1 % in 2027, with both peak and total energy demand to “moderate … as international trade tensions impact economic activity.”

In its previous forecast on Oct. 7, IESO projected 2026 growth would be 2.23%.

The ISO says 2026 growth will be driven by numerous “large step loads” — electric arc furnaces, electric vehicle battery manufacturers and data centers — in addition to the electrification of transportation and industry.

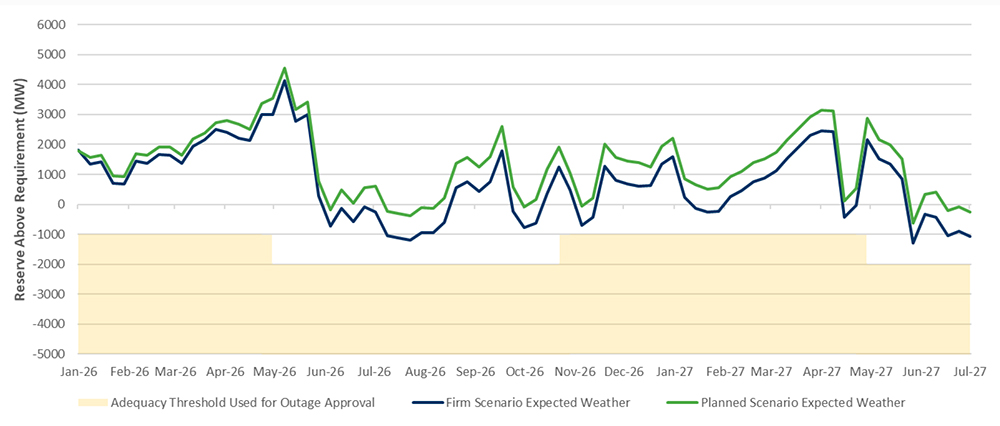

Reserve Above Requirement levels — the margin between available and required resources — are above summer and winter thresholds and expected to range as high as 4,500 MW.

The latest demand forecast, released Dec. 18, is “broadly consistent with, though lower than, the previous forecast,” IESO said. “In the longer term, the IESO continues to expect strong electricity demand growth.”

The demand models use actual demand, weather and economic data through September, with data on large step loads incorporated in mid-October. Planned generator and transmission outages reflect plans reported as of November.

Reduced Supply

IESO will lose more than 2 GW of generation when the Pickering B Nuclear Generating Station goes out of service in October 2026 for a $26.8 billion refurbishment that will extend the lives of Units 5 to 8 for up to 38 years. Work is set to begin in early 2027, with completion expected by the mid-2030s.

IESO hopes to add 185 MW in gas upgrades and 1,073 MW in battery storage and other resources from its Long-Term 1 procurements, which would leave the grid operator with a net reduction of 800 MW during the 18-month reliability horizon.

It also is counting on up to 260 MW of re-contracted capacity resources and more than 200 MW of re-contracted energy resources under its Second Medium-Term procurement.

The outlook does not include the results from the December 2025 capacity auction, which saw a record $645/MW-day (CAD) clearing price for summer 2026. “Forecast assumptions were based on capacity targets from the IESO’s 2025 Annual Planning Outlook, and incorporating the actual auction results would not materially change the outlook,” the ISO said. (See Big Jump in Ontario Capacity Prices Signals Tightening Supplies.)

The report said the refurbishment of the Bruce and Darlington nuclear plants remained on schedule, with work on Darlington Unit 4 expected to be completed in Q4 2026.

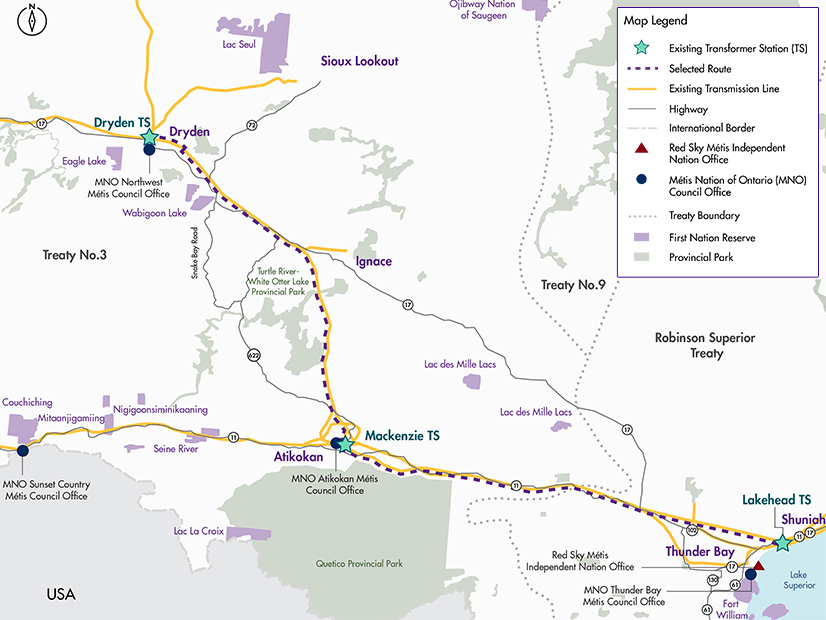

The ISO also is expecting completion of Phase 1 of Hydro One’s Waasigan Transmission Line Project — including a new double-circuit 230-kV line between Lakehead TS and Mackenzie TS — by Q4 2026.

New Format

The outlook identifies risks that can be addressed by coordinating maintenance plans for generation and transmission facilities. The Q4 outlook is the first using a “more focused and concise” format, IESO said. Details on assumptions, explanations and terminologies were moved to the Methodology to Perform the Reliability Outlook.