Black Hills Colorado Electric (BHCOE) has filed an application with the Colorado Public Utilities Commission to join SPP’s Markets+, saying it has no choice because it is embedded in a balancing authority that will be a Markets+ participant.

BHCOE, a Black Hills Energy subsidiary, receives balancing services from Public Service Company of Colorado (PSCo), which was granted PUC approval in October to join Markets+. (See Split Colo. PUC Approves Xcel Energy’s Markets+ Application.)

If BHCOE doesn’t sign up with Markets+, PSCo would be required to register BHCOE’s load and generation on its behalf. PSCo would settle directly with SPP and pass along any resulting charges to BHCOE, the utility said in an application filed with the PUC on Dec. 30. Yet BHCOE wouldn’t receive the potential benefits of market participation.

“Direct registration [with Markets+] ensures that unavoidable costs deliver value to BHCOE’s customers and positions BHCOE to access market benefits rather than bearing costs without corresponding advantages,” Kerri Schlachter, Black Hills’ program manager of Western markets and policy, said in written testimony filed with the application.

BHCOE is asking the PUC for approval to participate in Markets+ and to recover the costs of its participation through the energy cost adjustment on customer bills.

Under Colorado PUC rules, the commission will consider the application through an abbreviated proceeding in which a written decision is issued within 150 days. On Jan. 7, the commission set a Jan. 23 deadline for interventions in the case.

Markets+ or RTO Expansion?

Although BHCOE has filed an application to join Markets+, it has not yet decided whether to participate in SPP’s day-ahead market or instead join SPP’s RTO Expansion (RTOE).

The utility has commissioned a study to evaluate the two options, with results expected in June or July.

“Even with approval of this application, BHCOE may pivot to the RTO path if the analysis demonstrates that it is the superior option for our customers.” Schlachter said.

Schlachter raised some concerns in her testimony about Markets+, noting PSCo’s acknowledgement of its limited transmission connectivity to other Markets+ balancing authorities.

“This restricted interconnectivity raises questions for BHCOE about whether Markets+ can deliver the full range of real-time dispatch efficiencies with neighboring systems,” she said. “It may also lead to less effective economic dispatch compared to a more interconnected day-ahead market with a broader footprint.”

Schlachter said CAISO’s Extended Day Ahead Market (EDAM) might provide greater connectivity potential for PSCo, with its ties to EDAM participants Public Service Company of New Mexico to the south and PacifiCorp to the north.

Another issue is SPP’s Western Energy Imbalance Service (WEIS), a real-time market that BHCOE joined in April 2023.

WEIS will end when SPP’s RTOE goes live, which is expected April 1. From then until PSCo starts its Markets+ participation, expected in October 2027, PSCo and BHCOE will rely “only on bilateral arrangements and limited tools such as Real-time Dispatchable Transactions,” Schlachter said.

Two other Black Hills Energy subsidiaries — serving parts of Montana, Wyoming and South Dakota — announced in August 2024 that they would move from SPP’s WEIS to CAISO’s Western Energy Imbalance Market (WEIM). Some viewed the move as a symbolic victory in the ISO’s competition with SPP. (See CAISO’s WEIM Plucks Black Hills Utilities from SPP’s WEIS.)

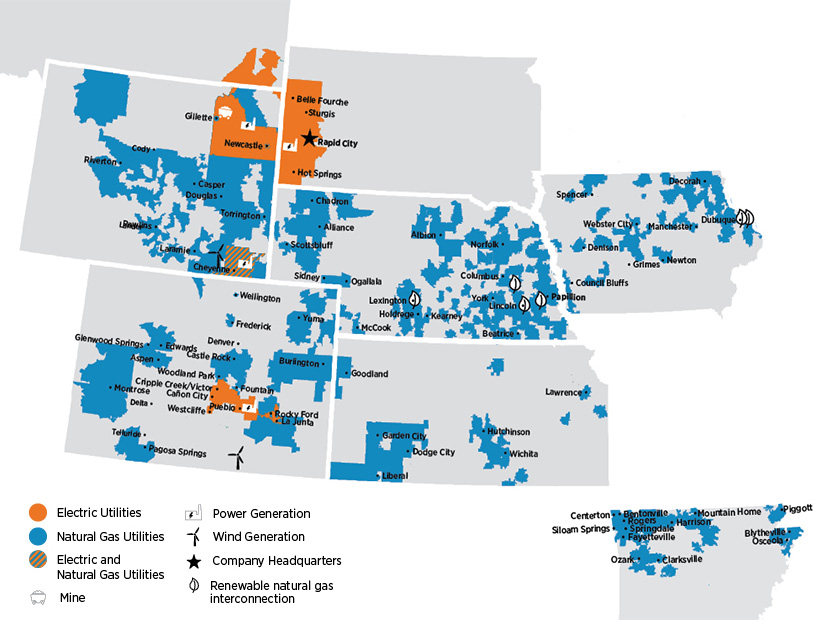

Black Hills Energy operates natural gas and electric utilities in eight states: Arkansas, Iowa, Kansas, Montana, Nebraska, South Dakota and Wyoming, in addition to Colorado.

Cost Recovery

BHCOE’s application outlines the expected cost of Markets+ participation that would be recovered through the energy cost adjustment. The costs were estimated by applying a load ratio to PSCo’s costs.

Costs include about $117,016 in fees from Phase 1 of market development. Phase 1, which BHCOE participated in, ended with approval of the Markets+ tariff.

Administrative fees for Phase 2 are expected to be $700,000/year for the first five years and $500,000/year thereafter.

Collateral obligations will include a $100,000 one-time share of PSCo’s Phase 2 funding obligations and roughly $12,000/year.

SPP will require Markets+ members to participate in the Western Power Pool’s Western Resource Adequacy Program (WRAP). BHCOE expects about $32,000 in WRAP entry fees and $135,000/year in participation fees.

Another $5 million to $10 million is expected in one-time costs for software and information technology upgrades, followed by $500,000 to $700,000 in annual costs.

Tri-State’s RTOE Participation Approved

BHCOE’s application comes just weeks after the Colorado PUC granted approval to Tri-State Generation and Transmission Association to participate in RTOE.

Tri-State CEO Duane Highley said previously that expansion of the SPP RTO would be “the most cost-effective pathway to organized market benefit for Tri-State’s members.”

Tri-State and six other Western utilities are preparing for full market integration in April. The SPP RTOE will include WEIS participants Basin Electric Power Cooperative, Colorado Springs Utilities, Deseret Power Electric Cooperative, the Municipal Energy Agency of Nebraska, Platte River Power Authority and the Western Area Power Administration.