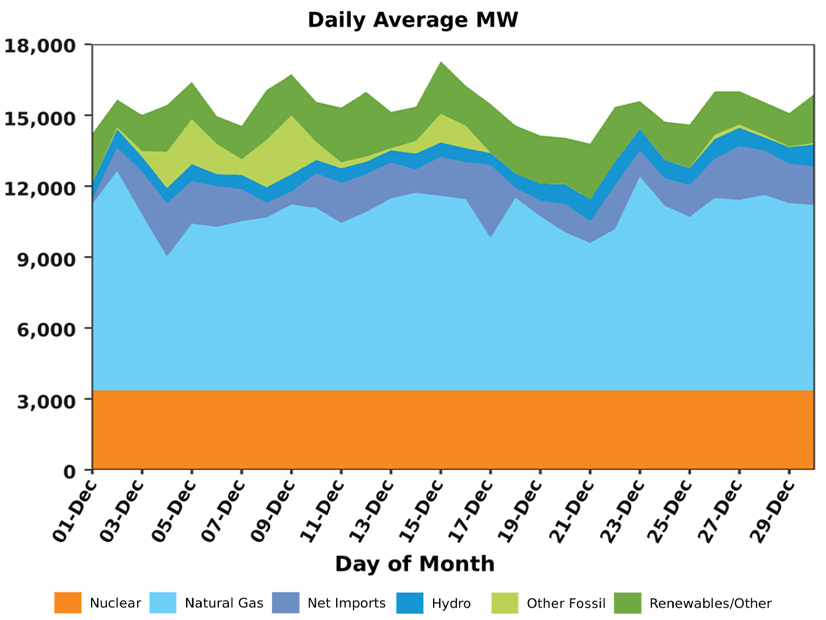

Consistently cold weather drove record-high December energy market costs for ISO-NE and caused the region to rely heavily on stored oil and LNG injections.

“It was the coldest December, by our measurements, since December 2017,” averaging about 4.5 degrees below normal, Stephen George of ISO-NE told the NEPOOL Participants Committee on Jan. 8.

He said the region experienced its second-highest monthly energy market costs — and the highest recorded December energy costs — since ISO-NE Standard Market Design was implemented in 2003.

Based on data through Dec. 30, ISO-NE energy market value totaled about $1.8 billion in December, compared to about $1 billion in December 2024 and $718 million in November 2025.

December peak demand reached 19,477 MW, shy of last winter’s 19,631-MW peak and ISO-NE’s forecast 20,059-MW peak for the current winter, George said.

ISO-NE expects the region’s winter peak to grow by about 6 GW by 2034, driven by heating and transportation electrification. (See ISO-NE’s Final 10-year Demand Forecast Tapers Expectations.)

While the low temperatures caused the region to dip into stored fuels, there has been strong LNG and oil replenishment, George said.

Day-ahead ancillary service costs also spiked, with prices associated with day-ahead reserves and the Forecast Energy Requirement reaching their highest per-megawatt level since ISO-NE launched its new day-ahead market in March 2025. Consumer advocates in the region have said high costs associated with the RTO’s new day-ahead ancillary service products are a key area of concern in 2026. (See Costs of ISO-NE Day-ahead Ancillary Services Higher than Expected.)

Regarding the New England Clean Energy Connect (NECEC) transmission line, George said testing may continue over the next week as the project proceeds through its final review steps, with the line scheduled to come online officially by Jan. 16. (See NECEC Transmission Line Ready to Begin Commercial Operations.)

“There’s been a bit of export testing,” he said. “Even though the line itself isn’t permitted as an export facility … exporting is an important part of that testing process.”

ISO-NE data indicate New England exported about 1,200 MW over the line for about eight hours Jan. 7.

While the line’s export capabilities “could be, at some future time, utilized,” George said, “once it’s in service and fully operational, we don’t anticipate exporting at any point.”

The NECEC project includes 20-year supply contracts with Massachusetts electric distribution companies for baseload power from Québec, and it appears unlikely the line will be operated bidirectionally for the duration of these contracts. However, Hydro-Québec has expressed a long-term interest in increased bidirectional power exchanges with New England.

George also noted Vineyard Wind’s operational offshore wind turbines have continued to run following the Trump administration’s suspension of leases for all under-construction offshore wind facilities in the U.S. Vineyard Wind has reached operation capabilities up to 572 MW, while the Revolution Wind project was scheduled to start sending power in January. (See Offshore Wind Developers Fight to get Back in the Water.)

“We’ve observed continued operation of the offshore wind facilities that are fully built out and have frequently observed several hundred megawatts of offshore wind flowing into the New England system, and we anticipate that that will continue,” George said.