IESO is reconsidering how it deploys hourly demand response (HDR) following complaints over partial activations and an increase in standby notices.

In a meeting Jan. 29, stakeholders expressed frustration over IESO’s issuance of standby notices and said partial DR activations were harming performance. The ISO also heard concern about its announcement that the capacity targets set in the Annual Planning Outlook will no longer be binding and may be adjusted upward or downward before the yearly auction.

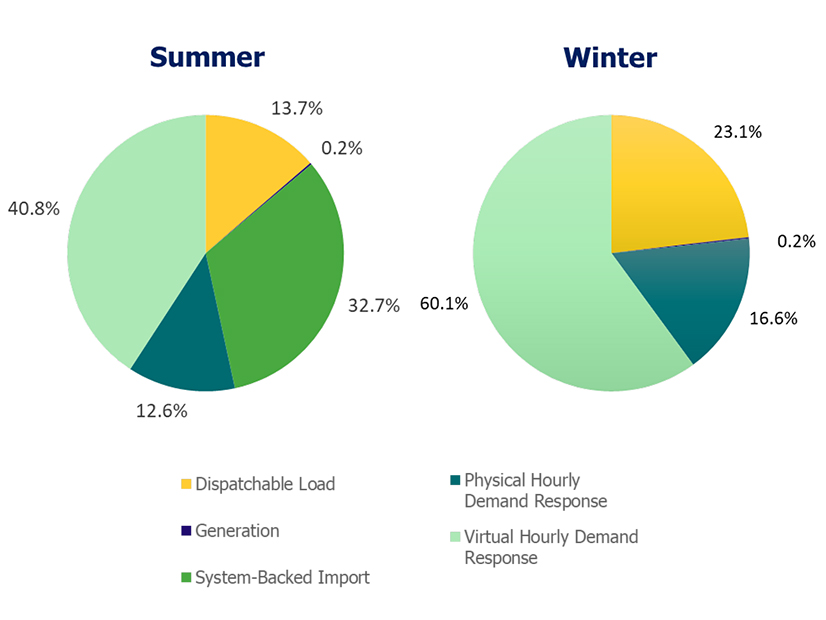

Hourly demand response accounted for more than half the capacity procured in the 2025 auction (53.4% of summer, 76.7% of winter). (See Big Jump in Ontario Capacity Prices Signals Tightening Supplies.)

IESO said HDR resources are “critical” to reliability during tight supply conditions but that they have historically underperformed, making it difficult for control room operators to maintain supply-demand balance during emergencies. In summer 2025, IESO activated 16,775 MW of HDR, but only 12,153 MW (72%) was delivered.

IESO previously triggered HDR activations manually during a Conservative Operating State or NERC Energy Emergency Alert 1. More recently, activations have been triggered by pre-dispatch scheduling run prices exceeding $2,000/MWh.

HDRs were activated 10 times in summer 2025 and seven times so far this winter, an increase from the historical rate of two to three activations in summer and none in winter.

The ISO acknowledged that more frequent HDR activations could lead to “resource fatigue” and participants dropping out. In addition, “all-or-nothing” HDRs lack the ability to follow dispatch instructions for partial activations.

As a result, IESO said it will hold an engagement over the next three capacity auctions on potential changes to HDR rules and improvements to non-HDR rules that have been identified in previous engagements.

The engagement, scheduled to begin in Q1 2026, will initially focus on “achievable ‘quick wins’” due to the limited time available before the 2026 auction, the ISO said.

Standby Notices

IESO issues standby notices to provide HDR resources time to prepare for potential activations.

Gilon Hershkowitz, of steelmaker ArcelorMittal, asked for guidance to help DR providers understand when standby notices will translate to activations.

“We want to be able to respond to the activations with our full capacity. [With] the short notice it’s very challenging for us to do so,” he said. “If we receive [fewer] standby notices and [have] a higher level of confidence that when we do receive a standby notice — maybe there’s some other data that [will indicate] this notice will actually translate to an activation — teams can be prepared.”

Laura Zubyck, IESO’s capacity auction supervisor, said the ISO will review its procedures to “make sure the standby is working in the way that that we want it to.”

Ted Leonard, of EnPowered, said the Market Renewal Program, which introduced LMPs and a financially binding day-ahead market in May 2025, has resulted in a “new normal” with unintended consequences.

“HDR [is] a reliability product; it wasn’t constructed to have partial activations,” said Leonard, IESO’s former chief financial officer. “It’s not meant to be there to help suppress prices during high demand events. It’s meant to keep the lights on.

“Maybe we need to look back and say, ‘Was this the intended consequence?’” he added. “Was this what HDR is all about, or HDR is meant to be? Because it feels like we’re losing our way a little bit.”

Zubyck said higher-than-normal temperatures during summer 2025 caused an increase in HDR activations and — for the first time — partial deployments.

“Now that we are seeing a partial activation of an HDR, we need to look at it, and we need to understand if there’s perhaps some changes we need to make,” she said.

Inefficient Decisions?

Roman Grod, of Rodan Energy, said his company has been challenged by partial activations that differ hour to hour. “Let’s call it 10 MW in the first hour, 15 in the second and 20 in the third. … That’s when I think it gets a little more challenging, because then you’re forced to do this kind of cascading effect where you’re activating folks for … three hours, then a different … side of your portfolio for two hours, and then another one for three hours,” he said.

Aaron Lampe, of Workbench Energy, said the ISO’s optimization engine is making inefficient decisions in picking HDR resources because “unlike for other resources, where the tools the ISO has built respect the operating characteristics of those resources — things like minimum loading point, ramp rates, minimum runtime, daily energy limits, etc. — none of those are reflected for the DR resource.

“And so, the optimization engine is picking the DR resource in situations to fill these short gaps, assuming this is an essentially infinitely flexible resource and then activating them. But it’s actually a very expensive resource [because of] market payments outside of that optimization that are occurring.”

Zubyck said the ISO is reviewing its rules “from a holistic level.”

“It’s not as simple as … we need to just fix partial activations, or we need to do this item. We do have to kind of look at everything that happened and consider … those bigger questions.

“This is the feedback we want to hear: that it’s a challenge to go up and down for some resources, and that we may need to consider … solutions to deal with that,” she added.

Other Priorities

Lampe said that stakeholders have been waiting for several years for action on items that were “shelved,” in part because the ISO was consumed by developing the Market Renewal Program.

In late 2023, Lampe said stakeholders had a meeting with the ISO to discuss issues regarding DR data submission and metering requirements. “It’s been two-and-a-half years or so [and] we haven’t heard anything following up,” he said. “I just want to ask: Are those still being tracked? … And how do those fit in the relative prioritization?”

Zubyck said the issues will be included in the new engagement. “We will bring those items back out and start to speak with stakeholders again about reprioritizing them and … allotting them into the next few auctions,” she said. “They have not been shelved.”

Changing Capacity Targets

Rodan Energy’s Grod also expressed concern about the ISO’s announcement that the capacity auction targets published in the Annual Planning Outlook (APO) each spring will now be preliminary, with the binding target published in the Pre-Auction Report in summer.

“This change provides additional flexibility for the IESO to adjust the target in response to issues/uncertainties that may emerge after the APO is published,” said the ISO, adding that the changes “will have limited impacts on stakeholders.”

“The ability to decrease the target concerns us significantly,” Grod said. “Customers often commit to this program based off historic clearing prices and where they … see the market going. [The] target in the APO really provides some level of confidence that … pricing is going to stay somewhat stable.

“If the ISO has the ability to lower the target — say, by 500 MW — that’s going to have a significant negative impact on pricing,” he added. “And I frankly think that that’s the wrong signal we want to be sending, especially as we’re seeing this resource be … activated more and more often.”

Bryan Timm, senior adviser on IESO’s capacity auction team, said the ISO would raise or lower the target only in response to an “unusual or significant event.”

“If [a] procurement delivered fewer megawatts than we anticipated, that might cause us to consider raising the target to meet system needs,” he said. “So, these would be significant events, not … one-off, minor changes.”

Feedback

Feedback on the Jan. 29 engagement is due Feb. 12 via the feedback form on the Capacity Auction Enhancements webpage.