Eversource Energy has increased its five-year capital investment plan by $2.3 billion, an increase largely driven by investments in its gas and electric distribution systems.

The company now plans to spend about $26.5 billion over the next five years; $1.5 billion of the spending is incremental to the period overlapping the company’s previous five-year plan for 2025-2029. These totals include only projects with a “clear line of sight from a regulatory approval perspective,” CEO Joe Nolan said during the company’s fourth-quarter earnings call Feb. 13.

Most of the spending is intended “to address aging infrastructure needs under our multiyear projects such as the Electric Sector Modernization Plan and the Underground Cable Modernization Program, as well as complying with applicable state safety regulations,” Nolan said.

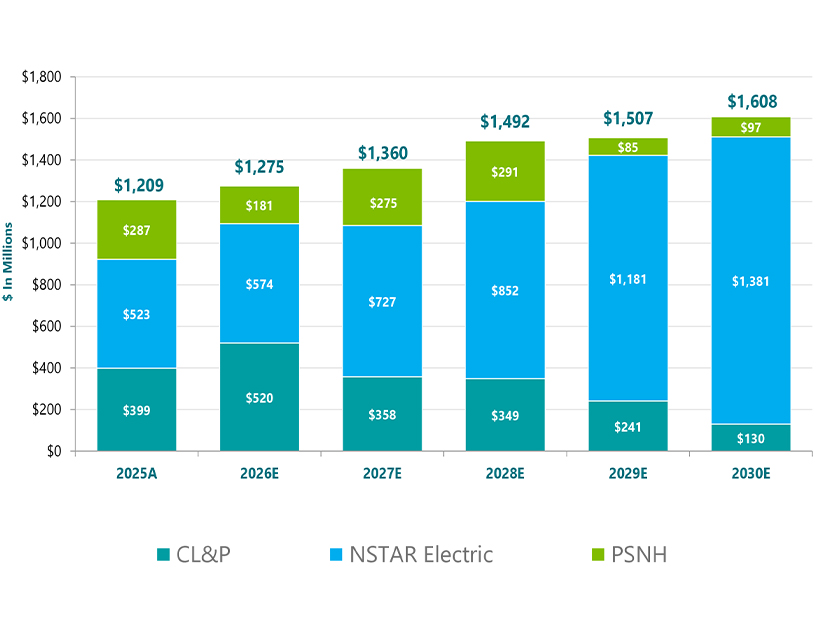

Of the $1.5 billion, Eversource plans to spend $696 million on electric distribution, $523 million on gas distribution and $233 million on transmission. For 2026 to 2030, electric distribution accounts for 43% of investment, followed by transmission at 27% and natural gas distribution at 26%.

Eversource forecasts annual transmission capital investments to increase by about 33% by 2030, though this number will likely grow as the company adds projects to its investment plan.

Increased spending on infrastructure has played a large role in driving up consumer energy costs in recent years, a trend that appears likely to continue into the foreseeable future. In Massachusetts, grid upgrades to prepare for the clean energy transition are a major cost driver, while upgrades to replace aging and deteriorating infrastructure on both the gas and electric systems also are a major contributor to costs. (See Conflict Brewing over Gas Transition in Massachusetts.)

Nolan said Eversource has ramped up its rollout of advanced metering infrastructure (AMI) in Massachusetts, installing more than 100,000 smart meters over the past year. He said the company plans to upgrade more than 1.5 million meters in the state. Once in place, regulators hope AMI help will enable incentives for demand flexibility.

Eversource, however, continues to hold off on investments in AMI in Connecticut. The company has clashed with regulators in the state in recent years and has expressed concern about the AMI cost recovery mechanism.

“We’re optimistic that we can at least get additional clarity around … the rules of the road down there to make it fair for us to make that investment.” Nolan said. “But we’re not going to make the investment until we feel comfortable with the recovery mechanism. … We’ve got a lot of money on the line down there right now.”

Regarding the Revolution Wind project, he said Eversource finished work on the onshore substation for the project in late 2025.

While Eversource sold its 50% share of Revolution to Global Infrastructure Partners in 2024, the company remains on the hook for construction cost increases. Eversource’s liability will end once the project achieves commercial operations, which project developer Ørsted forecasts to occur in the second half of the year.

In Ørsted’s earnings call on Feb. 6, the company said construction on Revolution is about 87% complete, with electricity beginning to be delivered in the coming weeks. (See Revolution Wind Weeks Away from Generating Power — Maybe.)