The annual status report from the Business Council for Sustainable Energy (BCSE) finds sustainable energy met rising U.S. power demands in 2025 despite the far-reaching policy shifts roiling the sector.

The report also flags this policy uncertainty — along with the slow pace of permitting and interconnection — as a potential barrier to meeting the sharply higher power demand expected in coming years.

The “2026 Sustainable Energy in America Factbook,” prepared by BloombergNEF and published Feb. 18 by BCSE, is the 14th of its kind. It comes at a tumultuous time for the U.S. electricity sector: The Trump administration is executing a sharp shift in strategy while power demand has begun significant growth after more than a decade of minimal increases.

BCSE and BloombergNEF frame this as a time to recommit to sustainable energy.

“These fast-moving dynamics provide an opportunity to accelerate investment into a broad portfolio of sustainable energy technologies,” BCSE President Lisa Jacobson said in a news release. “This diverse set of resources will allow the U.S. economy to prosper, boost national security and economic competitiveness, and deliver reliable and affordable energy for all Americans.”

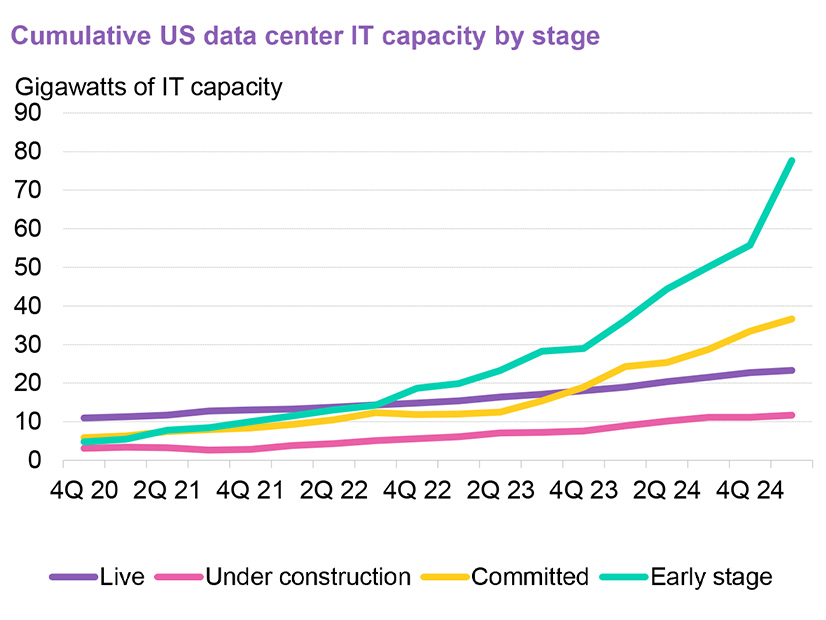

Ethan Zindler, BloombergNEF’s head of country and policy research, said: “As demand from energy-hungry data centers continues to grow, we’ll likely continue to see upward pressure on power prices. The need to expand supply from sustainable energy sources has never been clearer.”

This emphasis on sustainable energy would be at direct odds with Trump administration policies under many definitions of “sustainable.” But BCSE defines natural gas as sustainable, aligning it with one of President Donald Trump’s priorities: boosting the U.S. natural gas sector. The industry trade group American Gas Association is a BCSE member and helped sponsor the factbook, as did other notable members of the natural gas sector.

The factbook is the latest in a sea of analyses, opinions and invectives that have attributed demand growth to data centers. The authors stop short of blaming data centers for rising electricity prices, a primary line of criticism.

Instead, they acknowledge that data centers — particularly for AI applications — have become central to power planning and are poised to be the dominant force behind rising power demand.

Their power consumption was 18% higher in 2025 than in 2024 and has risen more than 150% over the past five years, the authors write. Data center load reached 23 GW installed and 48 GW under construction or committed to construction with land, power and permits secured. Early-stage announcements — a less certain prospect — combined for 165 GW of potential additional load.

Meanwhile, a record 1.6 million electric vehicles were sold in the U.S. in 2025 as consumers rushed to qualify for federal tax credits about to expire. This also drove grid investment.

“The need for electricity infrastructure is growing rapidly with rising EV sales and the AI data center buildout,” said Trina White, BloombergNEF’s senior associate for North American energy transition. “This is creating some supply chain bottlenecks while raising the costs for key grid equipment.”

But the same federal policy changes and regulatory obstacles influencing the power sector also crimp the ability or willingness of some private-sector businesses to respond, BCSE said.

Eighty-seven new tariff and trade policies were announced in 2025, the authors said, eroding the stability and confidence needed to attract investment in the clean-tech sector.

“Businesses are ready to deploy solutions to meet energy demand, but they need certainty that policies and permits will not change once commitments to long-term energy sector investments have been made,” Jacobson said.

Key Takeaways

Some details about the U.S. energy landscape in 2025, as excerpted from the new BCSE factbook:

-

- A total of 54 GW of new utility-scale generation and storage capacity was commissioned in 2025, the most in more than two decades; 90% of it was wind, solar and storage.

- New gas generation more than doubled from record-low 2024 additions but still totaled only 5 GW.

- New corporate zero-carbon energy procurements totaled a record 29.5 GW.

- The One Big Beautiful Bill Act accelerated the phaseout of key tax credits for clean energy development and cut federal subsidies for clean-tech manufacturing.

- Permitting setbacks and outright interference were dealt to solar, onshore wind and particularly offshore wind.

- As it was hampering other forms of clean energy, the Trump administration boosted support for nuclear generation, geothermal and hydropower technologies.

- Overall energy transition investment grew 3.5% to $378 billion.

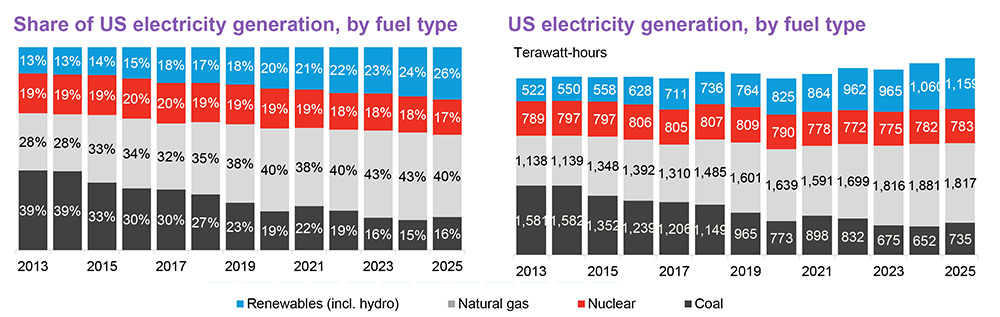

- Greenhouse gas emissions from the power sector rose 3.6% as coal-fired generation increased.

- Overall energy costs for consumers, a metric that is taking a prominent role in policymaking and political rhetoric, actually fell 0.2 percentage points to 3.66% of personal expenditures, due to lower gasoline prices; however, natural gas and electricity rose from 1.6% to 1.62%, a reversal from recent years.

- Energy consumed to produce electricity rose 2% to 33.4 quadrillion BTU but still was well below the peak of 38.5 quadrillion in 2007, reflecting improvements in energy efficiency and productivity.

- Interconnection requests to the seven ISOs and RTOs reached a combined 377 GW, the largest component being storage and the largest number of requests being submitted to ERCOT, followed by MISO and PJM.

The factbook was commissioned by BCSE and supported by contributions from a diverse group of sponsors including Amazon, American Clean Power, JPMorganChase, Schneider Electric, the Polyisocyanurate Insulation Manufacturers Association and Sempra.