By Christen Smith

Dominion Energy executives told investors Tuesday that PJM’s expanded minimum offer price rule (MOPR) poses no near-term threat to its 2,600-MW offshore wind farm planned for 2026.

CFO Jim Chapman said Dominion’s balanced portfolio in Virginia will shield the company from any financial impact, but that electing the fixed resource requirement (FRR) alternative in the future remains a possibility.

“We don’t expect that that MOPR as proposed will have really any financial impact on Dominion,” he said. “As you know, our capacity and load in Virginia is pretty well balanced, so no near-term impact. And if we foresaw that some change with MOPR and PJM rules that would mean that we would not be potentially receiving capacity payments on new build generation, we could very easily … just elect that FRR option, which we think is pretty straightforward.”

In December, FERC expanded PJM’s MOPR to all subsidized resources entering the capacity market. Critics hold that the ruling will limit renewable energy development because offer price floors will push them out of the capacity market, while others insist capacity revenue factors little into renewable investment decisions.

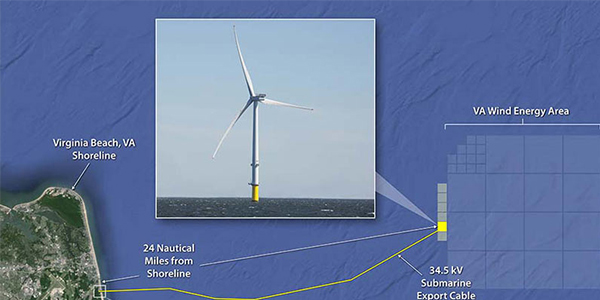

Dominion’s $8 billion offshore wind farm, the largest in the nation, will sit 27 miles off the coast of Virginia in federal waters. Dominion said ocean survey work will begin on the project in April, with construction slated for 2024. The company also confirmed Siemens Gamesa will provide the 210 turbines needed and that it contracted with three labor unions to perform the onshore interconnection work.

“We will continue to monitor that situation as it winds towards resolution,” Chapman said. “In the meantime, we do not see this as a material financial risk for our company given the even balance of supply and demand at Dominion Energy Virginia.”

Chapman’s comments came during a quarterly earnings conference call with investors where the company touted its progress on emissions reductions and improving its environmental, social and governance principles. The company reported a 33% increase in year-over-year earnings in its fourth quarter, totaling $4.48 billion.

Dominion CEO Tom Farrell said Tuesday that coal-fired generation produced just 12% of the company’s electricity last year, representing an 80% decline over the last 15 years. He said most current estimates suggest that “coal-fired generation today accounts for less than 8% of our total regulated investment.”

Farrell also expanded on Dominion’s plans to reach net-zero emissions by 2050, including extending licenses for its nuclear generation fleet; promoting customer energy efficiency programs, investing in wind and solar power; further reducing coal-fired generation; enhancing natural gas infrastructure leak detection; replacing legacy distribution lines; and repurposing agricultural methane emissions as renewable natural gas.

“We will never lose sight of our fundamental responsibility to customers, provision of safe, reliable and affordable energy,” he said. “Though certain approaches will undoubtedly evolve over the coming decades to reflect the most up-to-date assumptions, our commitment to net-zero emissions will not change.”