By Michael Kuser

In a call with analysts, NRG CEO Mauricio Gutierrez highlighted the company’s signing of 1.6 GW of medium-term solar power purchase agreements in ERCOT, its $300 million acquisition of Stream Energy and the return of its 385-MW natural gas-fired Gregory plant in Corpus Christi, Texas, to service before the summer.

Gutierrez said the purchase of Stream, with 600,000 electricity and gas customers in Pennsylvania and Texas, adds “important capabilities to our retail portfolio,” aiding its move to balance generation and retail.

Adjusted EBITDA for generation rose 24% year-over-year to $1.1 billion on higher realized power prices. Retail EBITDA dropped 3% to $920 million primarily because of higher supply costs.

NRG generates electricity and provides electric power and natural gas to more than 3.7 million residential, small business, and commercial and industrial customers in the U.S. and Canada.

Texas Hold ’em

Electric demand in ERCOT continues to grow at the fastest pace in the nation, between 2 and 3% per year for the foreseeable future, the company reported. “This requires a tremendous amount of generation investments simply to maintain the current low reserve margin,” Gutierrez said.

The company expects ERCOT to remain tight and volatile for the foreseeable future. “Regulators in ERCOT continue to refine our scarcity pricing mechanism to incentivize new generation, which is predominantly renewable and intermittent, while adequately compensating existing resources that provide firm generation,” Gutierrez said.

He also praised PJM’s MOPR Quandary: Should States Stay or Should they Go?)

“This ruling is just the most recent in a series of market reforms that PJM and FERC have undertaken since 2004 to protect the integrity of competitive markets,” he said.

Low Carb Diet

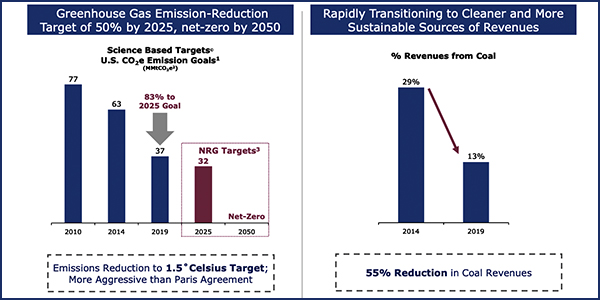

The company aims to reduce its carbon emissions by 50% by 2025 and to net zero by 2050.

“We are already 83% of the way to our 2025 goal, with clear line of sight to achieve it with our current portfolio,” Gutierrez said. “We have reduced our carbon emissions by 40 million metric tons in just the last 10 years. That is the equivalent of taking 9 million cars off the road every year.

“In just the last six years, coal as a percentage of our total revenues has decreased 55%, and that is inclusive of capacity revenues,” Gutierrez said. “This is an important distinction, as energy revenues have been the bulk of the decline, and our coal assets in the East now act primarily as insurance for grid reliability and not for electric generation.”

Call transcript courtesy of Seeking Alpha.