By Rich Heidorn Jr.

PJM backed off plans to seek a vote next month on short-term changes to its five-minute dispatch and pricing procedures after pushback from the Independent Market Monitor and stakeholders.

PJM’s Tim Horger told the Market Implementation Committee on Wednesday that the RTO was prepared to make manual changes detailing short-term changes but needs more time to evaluate the operational benefits and impacts of long-term changes it has been discussing with the Monitor.

Horger said the short-term changes comply with FERC Stalls PJM Fast-start Compliance Filing.)

The commission ordered PJM and NYISO a year ago to revise their tariffs to allow fast-start resources to set clearing prices. (See FERC Orders Fast-start Rules for NYISO, PJM.)

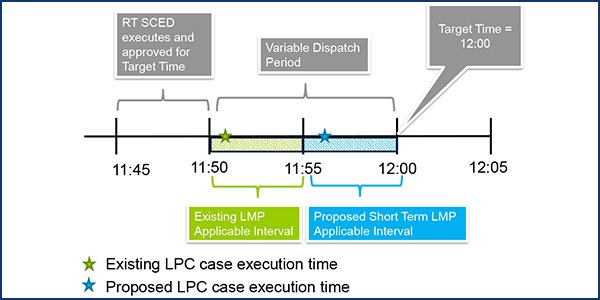

PJM’s proposed short-term fixes would align the locational price calculator (LPC) to use the reference real-time security-constrained economic dispatch (RT SCED) case for the same target time. LPC would calculate prices for the interval from 11:55 a.m. to 12 using the RT SCED solution for a 12 p.m. target time.

The RTO would execute LPC cases every five minutes after the start of a dispatch interval, using as inputs resource offers, parameters and ancillary service assignments for the interval ending at the target dispatch time. Offers for 11 to 12 would be effective up to and including the 12 p.m. target; offers for 12 to 1 p.m. would be applied to a dispatch target of 12:05.

Horger said PJM also has committed to conduct operator training and make software changes to limit automatic execution of RT SCED cases to once for every five-minute target time. Additional cases may be manually executed and approved as needed by dispatchers under what PJM calls this “intermediate” change.

The long-term changes would include auto-execution of RT SCED cases every five minutes with a target time of 10 minutes into the future.

If dispatchers do not manually approve an RT SCED case for a target time, a case would be automatically approved before the start of the dispatch interval. It would also add transparency when cases are not approved for a target time because of data errors or software failures.

Horger said PJM wants to prioritize and consider parallel or incremental implementation of the long-term changes. “It might look good on paper, but until we get a comfort level on an operational level, we can’t commit to it.”

IMM Joe Bowring said the Monitor thought it had reached an agreement with PJM following “months of productive discussions” on a compromise that would give dispatchers better information closer to the dispatch time and help ensure consistency between dispatch and pricing.

But he said the RTO posted a presentation and a proposal matrix the night before the meeting that indicated the RTO no longer supported the agreement. The RTO’s current long-term proposal “is vague at best and probably years away,” he said.

In addition to aligning pricing and dispatch, Bowring said in an email later, it also is essential to reduce “the RT SCED dispatch interval from 10 minutes to five minutes, running RT SCED on a regular five-minute interval to match the pricing interval to minimize running multiple RT SCED cases and changing dispatch instructions for the same target time, and using the prior RT SCED case as inputs to the current RT SCED case.”

“Our goal continues to be a single comprehensive package,” he said at the meeting. “We believe the entire package is needed to make SCED and LPC work consistent with the FERC order … and it’s really required for fast-start pricing to work correctly.”

“This is something were going to need to test. It requires operator training,” responded Horger. “It won’t be years away. It will be a lot closer than that.”

PJM says the long-term changes may require a revised approach to ancillary service products.

“If we slow down the dispatch, [our concern is] what other compensating measures we [might] need to take,” explained Adam Keech, PJM vice president of market services. “Do we need more regulation if we slow down the dispatch? Sitting here today, I don’t know that we know the answer to that.”

Bowring noted that PJM recently changed the automated case execution for SCED from three to four minutes without operator training. “I don’t know why training is needed to go from four to five minutes,” he said.

Keech said the RTO believes the intermediate and long-term changes aren’t required by the FERC order because they are not used “uniformly” in other RTOs/ISOs. He acknowledged that the recent change in the automated SCED case execution from three to four minutes has not caused any operational issues.

But he said that shift still allowed dispatchers to manually order additional cases in response to changing conditions. Preventing dispatchers from such manual intervention “is much different than where we are today,” he said. “TBD on an exact timeline, but I will say there is motivation to make the change quickly, but I will add, judiciously.”

Keech also said PJM’s long-term goal is to greatly reduce dispatchers’ interventions while retaining operators’ ability to approve SCED cases if, for example, they unexpectedly lose a large generating unit. “The desire is not to [intervene] unless it’s absolutely necessary.”

He said about one-third of approved RT SCED cases do not set prices currently because they are supplanted by new cases.

One stakeholder representing a trading firm who said he was not permitted by his company to be quoted by name said PJM’s current practices are preventing proper transient shortage pricing even when the system is in a “critical state.”

He cited a spinning reserve event in February that resulted from an under-forecast for load, an incident in October in which load rose faster than forecast and a July 2018 time error correction at noon and subsequent unit trips that resulted in a drop in system frequency on the Eastern Interconnection.

MIC Chair Lisa Morelli concluded the discussion by saying the committee will hold a second first read of the proposal in May. “I think it’s pretty apparent we’re not ready to move this to a vote at the next meeting,” she said.

In the interim, the MIC will hold a special meeting on the issue May 1.

Horger said that because the short-term changes only affect the manual and do not require FERC approval, the delay should not prevent the RTO from making the changes by July as planned.