In a call with analysts Thursday, CEO Mauricio Gutierrez touted the company’s strong position despite the social disruptions stemming from the coronavirus pandemic.

“First, we initiated a comprehensive response to COVID-19 focusing on maintaining safe and reliable operations,” Gutierrez said. “Second, given the changes that we have made to our integrated business, we were able to deliver strong results during the first quarter and reaffirm our full-year financial guidance.”

Gutierrez also highlighted enhanced disclosures on the business, including the introduction of new integrated regional segments, with the company working to integrate its Eastern markets in the same manner it has in ERCOT, where it “moved from having two distinct businesses, Retail and Generation, to one integrated business with a regional focus.”

The company’s West segment will only have generation revenue and cost set, as there is no ability to replicate the integrated model because of a lack of competitive retail markets, he said.

“Because the East and West segments are not fully integrated, the sensitivity to changes in power prices is not as optimized as it is in Texas,” Gutierrez said.

Texas Rides High

CFO Kirkland Andrews noted that NRG as a whole saw $349 million in earnings during the first quarter. The company’s Texas segment accounted for $195 million, up $19 million largely because of the increased load from the acquisition of Stream Energy last year.

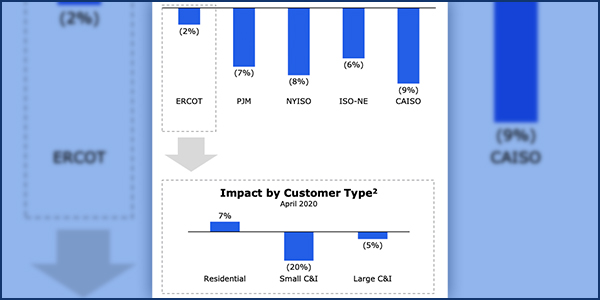

But the company reported power demand declines across all regions, except for that of ERCOT residential, which saw a 7% rise last month.

“To put the mild weather into context, ERCOT and the Northeast saw temperatures that were 20% and 17% warmer than the 10-year normal for the first quarter,” he said.

In these “unprecedented times,” Gutierrez said to “expect most of the adverse impact from COVID-19 to come from customer payment-related items, like bad debt. At this point, we estimate that to be around $50 million. We will look at and be studying this impact through prudent cost management and ERCOT’s relief fund.”

While the small business, commercial and industrial sectors have been negatively impacted, the impact on specific utilities will depend on the customer mix in their portfolios, Gutierrez said.

“In our case, we are heavily weighted towards the Texas residential customer,” he said.

Looking ahead to summer, Gutierrez noted that “Texas already began a partial reopening of the economy. This suggests that the severe impact to small businesses we have seen in April may ease as the economy reopens. … The impact to summer load is difficult to assess at this point, but I can tell you that summer prices will be dependent on wind production and weather.”

Call transcript courtesy of Seeking Alpha.