The 2020 MISO Transmission Expansion Plan (MTEP 20) is shaping up to become one of the RTO’s most expensive ever.

Being developed virtually with stakeholders because of COVID-19 measures, the plan so far contains 510 proposed projects at a combined $4.06 billion, the priciest since MISO’s 2011 multi-value project portfolio. If approved by the RTO’s Board of Directors in December, MTEP 20 will best last year’s plan, which rang in with 480 projects at $4 billion. (See MISO Board OKs $4 Billion MTEP 19.)

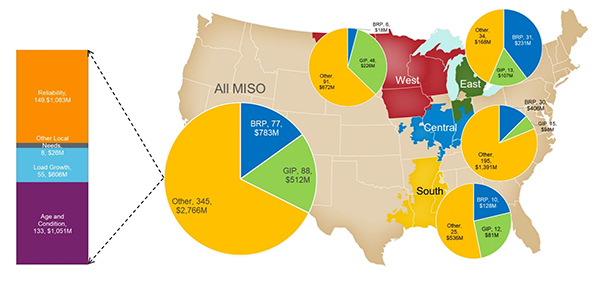

Broken down, the transmission investment contains:

- 149 reliability-related projects at nearly $1.1 billion;

- 133 age- and condition-related upgrades at $1.05 billion;

- 77 baseline reliability projects at $783 million;

- 88 generator interconnection projects at $512 million;

- 55 projects necessary to accommodate load growth at $606 million; and

- eight projects to be built for other local needs at $26 million.

Of those, MISO South accounts for 47 project proposals valued at $750 million.

Stakeholders at subregional planning meetings last week wondered whether some load-growth projects may be scaled back or withdrawn as the catastrophic economic impact of the COVID-19 pandemic continues to play out.

MISO Senior Manager of Expansion Planning Edin Habibovic said transmission owners might revise some projects based on COVID-19 effects, adding that the RTO will have more information on individual load-growth projects during a final round of subregional planning meetings in August. He said discussions over why some load-growth projects drop out likely won’t be disclosed publicly.

Ameren Illinois and Entergy Texas have so far submitted some of the costliest MTEP 20 projects, with the former planning four projects between $74 million and $91 million for reliability and age and condition needs, while the latter is tendering three projects between $65 million and $77 million in response to load growth in its territory.

MISO said it will test one of Ameren’s reliability project submissions — the 345-kV New Holland NW-Neoga South line rebuild in central Illinois — for economic benefits that might allow it to be cost-shared as a market efficiency project.

Altogether, Ameren proposed 152 new projects at an estimated $1.4 billion in its Illinois and Missouri service areas.

Some stakeholders asked why Ameren was suddenly making such big investments in transmission.

MISO expansion planning team member Scott Goodwin said Ameren is this year using a three- to five-year outlook on transmission projects instead of an annual planning horizon. Senior Manager of Expansion Planning Thompson Adu also said MISO has been coordinating with Ameren on issues that require transmission upgrades.

“We make sure we agree with the projects and justifications that they have given to us,” Adu said.

Stakeholders also asked if MISO performs any research to confirm the necessity of TOs’ age and condition projects.

Adu said TOs must justify those projects to MISO, but not all of them provide photos or engineering analyses.

No Midwest-South Tx Solution this Year

MTEP 20 will not contain a long-awaited transmission upgrade to secure more transfer capability on the Midwest-South subregional transmission constraint, stakeholders also learned.

David Severson, a MISO economic studies engineer, said that while there were a “couple promising project candidates,” the RTO will not recommend any Midwest-South transmission projects to the board this year.

Last year, MISO received and screened 35 project ideas to reduce dependence on its Midwest-South transfer constraint. Nine projects passed an initial screening, with three of those showing the required 1:1 or better cost-benefit ratio. (See MISO Floats New Option for Midwest-South Constraint.)

Missouri Public Service Commission economist Adam McKinnie asked why MISO planners don’t submit one of the three project finalists for consideration in the 2020 cycle of the RTO’s and coordinated system plan with SPP, developed to identify potential interregional economic transmission projects.

“I’m waiting for a good reason to hold off on a good solution for another year,” McKinnie said. The transfer limit study has been ongoing since the MTEP 19 cycle.

“We can use the project candidates for a really good starting point in the future,” Severson said. “Further study efforts under an expanded scope would be better served under MTEP 21 future assumptions and models.” MISO is currently redoing its 20-year futures assumptions to factor increased renewable generation and zero-carbon goals in time for the 2021 cycle of transmission planning.

Some stakeholders have criticized the study, saying that MISO focused too narrowly on only increasing the existing contract path capacity and not on a potentially more beneficial increase in physical transfer capability located somewhere else between the Midwest and South regions.

North Study Extends into 2021

Meanwhile, results are pending on MISO’s other special MTEP 20 study on the North Region economic transfer. The study evaluates transfer limitations caused by non-thermal constraints between the renewable-rich northwestern portions of the footprint and load centers in the Upper Midwest. MISO said it’s studying wind generation transfers from the Dakotas, Minnesota and Iowa to Wisconsin and Illinois.

That study will also extend into MTEP 21. MISO economic planner Ryan Hay said that while the study is largely academic, possible transmission projects could be identified and submitted in MTEP 21.

MISO has said the study is the first of its kind and will serve to develop a template for identifying and incorporating non-thermal transmission limits into its production cost analyses. Currently, MISO’s typical economic studies don’t consider non-thermal operational limits. (See MWEX Study Could Elicit New Tx Planning for MISO.)