NYISO on Wednesday released its annual Power Trends report, this year focusing on how the grid is being shaped by public policy – amid a global pandemic in which New York was the epicenter for COVID-19 cases in the United States.

“Obviously, the COVID-19 pandemic has altered significantly the way that people work and live their lives, and as a result the challenges and changes to the electric sector,” CEO Rich Dewey said in a press conference.

The economic shutdown has reduced load levels statewide by an average of 8%, and a return to pre-pandemic demand will depend on how quickly the economy rebounds, he said.

The ISO will continue “to keep our eyes on some of those demand patterns and how they might influence the way markets work,” Dewey said.

Though the study found that increasing electrification will likely flip the peak from summer to winter by 2050, the ISO still plans for reliability based on the current summer peak, when air-conditioning use spikes demand, he said.

“The electrification of transportation and building heating systems will certainly change the demand patterns that we need to manage,” said Executive Vice President Emilie Nelson.

Studying these trends “will allow us to develop the market design and further the planning processes necessary to support this transition,” Nelson said. “The ISO hopes to integrate renewable resources like wind and solar not only operationally but also in terms of planning.”

The ISO in December published a 122-page “Grid in Transition” report and in January decided to devote at least one day a month in 2020 to discussing how to meet the clean energy goals set by last year’s Climate Leadership and Community Protection Act (A8429). The law mandates that the state get 70% of electricity from renewable energy resources by 2030 and reach 100% carbon-free electricity by 2040. (See NYISO Focus Turns to Grid ‘Transition’.)

Transmission Buildout

“New technologies are impacting the industry at large, so it’s a very exciting time in the utility industry, whether it’s new renewable projects, whether it’s wind or solar, distributed energy resources, it’s really changing the way energy is produced and how it’s moved and used,” Dewey said.

The state’s Siting Board earlier in June approved a 340-MW wind project south of Buffalo, to date the largest wind farm to pass Article 10 review in New York (17-F-0282). (See NY Regulators Approve 340-MW Alle-Catt Wind Farm.)

In addition to the increasing influence of public policy decisions on the ISO, infrastructure is becoming more important, he said.

“Specific to the infrastructure of transmission, we remain very, very bullish on the need to build out the infrastructure, and transmission is going to be a very important part,” Dewey said. “We continue to study and promote the notion that we need additional infrastructure.”

The state’s recently enacted Accelerated Renewable Energy Growth and Community Protection Act addresses transmission constraints directly by providing for expedited transmission upgrades. (See NY Renewable Supporters Push for New Siting Agency.)

The ISO is mindful of the economic impact from the pandemic and as always is “committed to looking at the most cost-effective way of being able to both hit the goals and to deliver power to consumers,” Dewey said.

The study also considers the transmission implications of developing 9 GW of offshore wind in New York by 2035. The New York Public Service Commission in April granted a state agency permission to solicit up to 2,500 MW of offshore wind energy this year. (See NYPSC Greenlights 2,500-MW Offshore Wind RFP.)

Dewey was asked why the ISO includes the controversial 1,000-MW Champlain Hudson Power Express (CHPE) project in its trend forecasts. FEFERC OKs Negotiated Rates for Champlain Hudson Project.)

Dewey said that the project is in the interconnection queue and that the ISO’s use of it in planning does not signify endorsement of it.

Nonetheless, he added, “the project that can deliver low-carbon power down to New York City, that’s something that’s probably got to be seriously considered from a policy standpoint.”

Carbon Pricing Still Tops

“First and foremost of the ISO’s initiatives is our proposal to implement carbon pricing,” Dewey said. “We look at this as the most effective, viable means to attract the right kind of investment for renewables that is going to be so important for New York State to achieve its clean energy goals.”

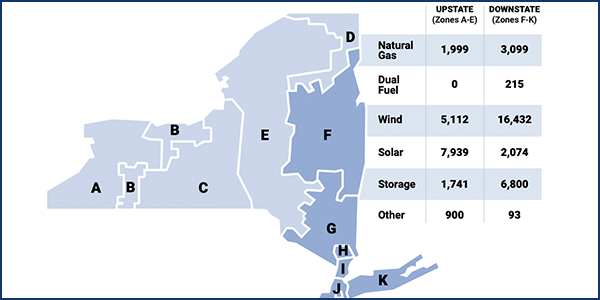

Speaking at an industry forum in March, NYISO Principal Economist Nicole Bouchez said the ISO determined its carbon price should be incorporated into the energy rather than capacity market because of transmission constraints that prevent upstate New York, which has 87% zero-emission generation, from delivering it to downstate, where only 27% of the mix is renewable. (See Carbon Pricing Gains Popularity — and Doubts.)

“We remain committed to promoting carbon pricing,” Dewey said. “We think using a social cost of carbon embedded in the markets is going to be the most effective and cost-efficient means to be able to hit those goals.”