NYISO’s annual report on the grid and wholesale electricity markets this year focuses on how public policy, climate change and new technologies are driving unprecedented and rapid change in the state’s energy resource mix.

In a press briefing Wednesday, CEO Rich Dewey said the ISO’s 2021 Power Trends report examines “the core of our mission of maintaining reliability and markets, [while] recognizing that significant change is underway, both in terms of technology of the grid as well as the policies that are driving some of the change, specifically within New York.”

“In addition to that, we’re seeing across the country the effects of more frequent extreme weather events and the need to think about what sort of systems and procedures we need to have in place to make sure we’re prepared and ready for those types of events,” he said.

Data in this year’s report were skewed by the economic slowdown stemming from the COVID-19 pandemic, which cut 2020 energy usage by more than 4,100 GWh — or about 2.6% below forecasted levels. Statewide peak demand at times fell 10% below forecasts and as much as 16% below forecast in New York City, the most heavily affected area.

NYISO also observed an increase in residential usage, especially during midday, which reflects lower economic activity and a shift in usage from New York City to the suburban areas of Long Island and the lower Hudson Valley during the pandemic, the report said.

Peak Transition

As New York moves toward becoming a winter peaking area by about 2040, solar will not contribute output when the peak load occurs after sunset, Dewey said. “So when we start thinking about planning the system, and increasingly as we get to be a winter-peaking system, we’ve got to have good forecasting capabilities and good understanding of how solar resources need to be managed.”

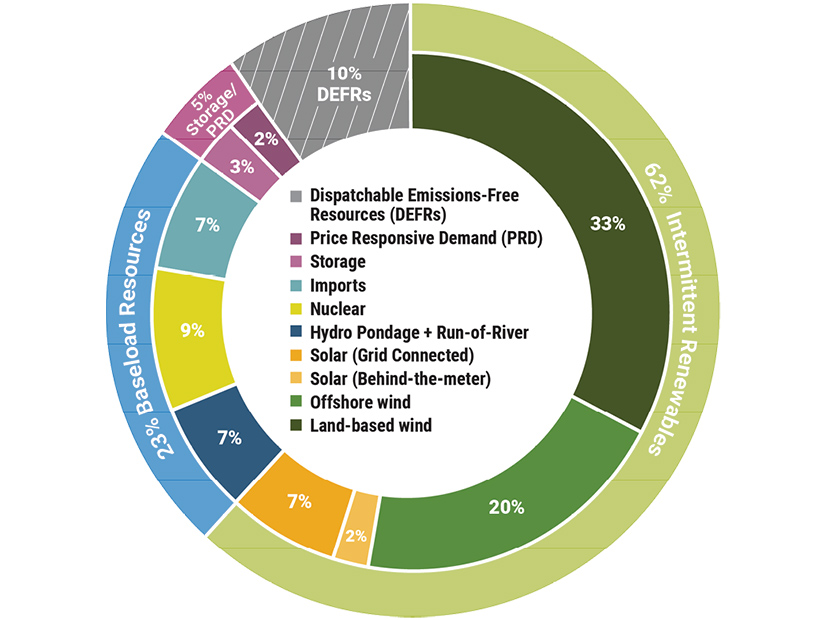

New York’s Climate Leadership and Community Protection Act (CLCPA) requires that 70% of the state’s electric load be served by renewable resources by 2030; it also requires procurement of 6 GW of solar by 2025, 3 GW of storage by 2030, and 9 GW of offshore wind by 2035. New nitrogen oxide emission limits in the state are affecting about 3,300 MW of peaker generation, mostly located in the lower Hudson Valley, New York City and Long Island.

Newly instituted market participation rules for storage “we think will lead to consistent and steady increases in the amount of storage on the system,” Dewey said. “That’s very beneficial to be able to backstop the wind, firm up the wind and solar, so when those intermittent resources go off the grid or have their output reduced by weather impacts, storage is going to be an increasingly valuable asset and to reduce the need for fossil fuel-based resources to come online.”

Policy Signals

Dewey said the new FERC commission seems more receptive “to trying to resolve the conflict between states’ energy policies and what was the federal energy policy. It seems like we’ve got some daylight that we can come up with an acceptable solution that I believe the renewable projects and the existing generators will all be pretty happy as long as they’re getting a fair signal.”

FERC in March accepted NYISO rules allowing energy storage to participate in the wholesale markets with wind or solar as a co-located storage resource (CSR). In a separate statement concurring with that ruling, Chair Richard Glick urged the ISO “to replace those rules with a model that moves beyond minimum offer price rules as a means for mediating the interaction between state policies and wholesale markets.” (See FERC Approves NYISO Co-located Storage Model.)

NYISO last month laid out a plan to revise its capacity market rules by this fall — especially those regarding buyer-side mitigation (BSM) — to address regulators’ views that they hinder the deployment of state-subsidized resources such as solar and wind, which have environmental attributes not normally accounted for in market valuations. (See NYISO Outlines Goals for Capacity Market.)

“Acceptable resolution of these buyer-side mitigation rules … would naturally influence New York state’s decision on what the right resource adequacy mechanism is,” Dewey said.

Regarding the increased frequency of extreme weather events, Dewey said the rolling blackouts in California highlighted the importance of having an accurate reserve margin in place. (See ERCOT: Grid was ‘Seconds and Minutes’ from Total Collapse.)

Regarding fuel availability, Dewey said, “We deal with gas shortages in New York, but many of our critical facilities are dual fuel units and have back-up oil supplies.”