By Jason Fordney

Power industry participants got their first “peak” at a potential organized market that could rival CAISO’s efforts to expand its own operations into the rest of the West.

During a conference call Tuesday, Peak Reliability and PJM Connext sketched out details on their proposed new Western electricity market, possibly setting up a battle with CAISO over who will oversee markets and reliability across the broad region.

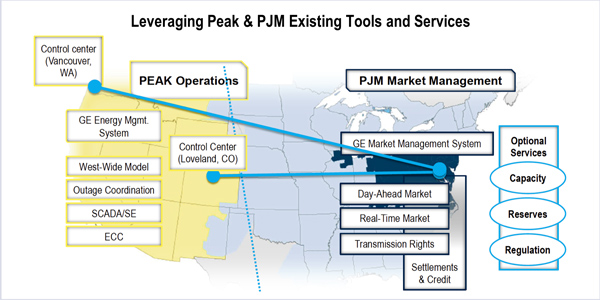

Vancouver, Wash.-based Peak has for months been developing a proposal to expand its Reliability Coordinator (RC) services into a new West-wide energy market. It has partnered with PJM, which brings extensive experience and sophisticated knowledge from its Eastern market covering 13 states and the District of Columbia. (See PJM Unit to Help Develop Western Markets.)

Peak and PJM officials said the market would be nodal, with locational marginal pricing, real-time and day-ahead energy transactions, financial transmission rights, consolidated credit and market settlement, and optional services if desired by participants. These could include ancillary services such as regulation and reserve markets, demand response, a capacity market, and other features.

“Together we have climbed quite a mountain if you will, and this is the next logical step,” said Brett Wangen, Peak’s chief engineering and technology officer. He added that members would have a direct say in the market design and governance with the goal of reducing operating costs and improving reliability. “We definitely have been hearing the message that the industry is in need of these tools.”

Wangen also addressed CAISO’s own plans to withdraw from Peak and offer its own reliability services to Western participants. (See Horse is Out of the Barn for CAISO RC Effort.) The ISO recently said it plans to allow Peak participants enough time to review its new RC proposal and switch from Peak to CAISO for services by spring 2019.

“This urgency that is being created is a red herring,” Wangen said. “People believe they have to make a decision in the next few weeks … clearly that is not the case.”

Peak said it is fully funded to provide its current reliability services through August 2019 and it could explore full RTO status after it deploys a new market structure. The organization will continue to be funded at current levels through June 2020, assuming no other members withdraw before September 2019.

Peak pointed out that participants could keep Peak as their RC whether they join the Peak/PJM market, participate in other markets such as SPP or CAISO, or continue with self-scheduling and bilateral contracts. They can also use Peak’s balancing authority services or continue with separate balancing authorities regardless of market participation.

Peak said it is developing a straw design for its proposed market and will complete a business case by the end of March or beginning of April. It will then lock in a final design and develop a memorandum of understanding for participation.

CAISO cited increased costs when it announced its plans to depart Peak and provide RC services across the West at much lower costs than are currently charged by Peak. During a conference call earlier this month, ISO officials said they plan to quickly transition current Peak members to CAISO services.

CAISO last month also said it will enhance and expand its day-ahead market across the footprint of its Western Energy Imbalance Market. (See CAISO Plan Extends Day-Ahead Market to EIM.) Peak Reliability member Mountain West Transmission Group is also in discussions to join SPP, and has asked SPP to become its reliability coordinator if it links up with that market.

Peak in 2014 split off from the Western Electricity Coordinating Council, a North American Electric Reliability Corp. Regional Entity based in Salt Lake City, Utah.

Peak on Tuesday said that the partnership’s existing capabilities will allow a relatively quicker development of a market and that a multiple state/province market “offers public policy balance.”