By Jason Fordney

CAISO’s fourth quarter was beset by 15-minute market energy shortages and a significant shortfall in congestion revenue rights auction revenues, the ISO’s Market Monitor said Wednesday.

During a conference call to discuss its fourth-quarter market performance report, the Department of Market Monitoring said energy shortages or power balance constraints last quarter consistently pushed 15-minute market prices above day-ahead levels.

“That is not something that we typically see,” DMM Senior Analyst Gabe Murtaugh said. “These are really some interesting results.”

Average 15-minute system prices increased to almost $47/MWh in October — exceeding $750/MWh in almost 1% of intervals — but then fell in November and December. October’s 15-minute price averages were higher than day-ahead and five-minute market prices by about $4/MWh and $9/MWh, respectively.

Day-ahead and real-time prices in the fourth quarter closely tracked the “net load curve,” which represents load minus wind and solar output. High 15-minute prices during October occurred most often between hours ending 18 and 20, when net load was highest.

“Many of these high prices occurred in intervals when the supply of ramping capability bid into the market was fully utilized and the power balance constraint was relaxed,” CAISO said in the report. “Even when the load bias limiter was triggered, prices were often set by bids greater than $900/MWh.”

Load bias describes the last-minute adjustments an operator makes to the load forecast ahead of a market run to account for potential inaccuracies and inconsistencies in the forecast. Constraints in the 15-minute market drove up the ISO’s usage of the practice, a topic of continuing interest for market participants. During the call, the DMM declined to answer a question about whether the load bias usage was appropriate, saying it has raised the issue before and that the ISO is looking into it. (See ‘Load Bias,’ Prices Rise in CAISO Q3.)

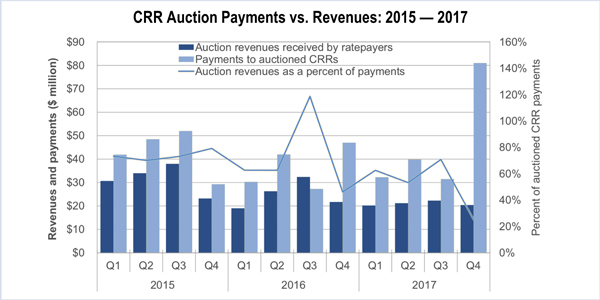

The department also said the ISO experienced $61 million in CRR auction “payment deficiencies” in the fourth quarter and $101 million for 2017. But not all market participants agree with the DMM’s take on the CRR auction, which is the topic of a highly scrutinized reform program by CAISO. (See CAISO Overhauling CRR Auctions.)

In the fourth-quarter report, the department said there was heavy north-to-south congestion in the day-ahead market, primarily because of planned outages in Southern California. The congestion pushed up day-ahead prices in Southern California by about $2/MWh and decreased prices in Northern California by about the same amount, the Monitor said.