By Robert Mullin

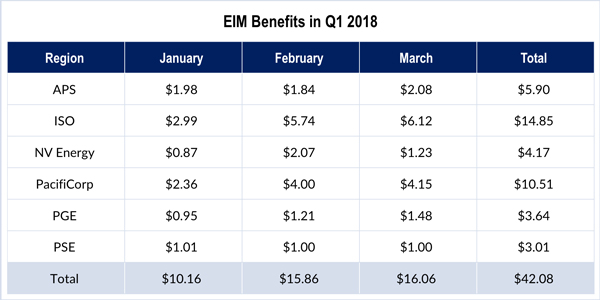

CAISO and PacifiCorp reaped the majority of the Western Energy Imbalance Market’s (EIM) $42.1 million in gross benefits during the first quarter, according to a report released by market operator CAISO.

The ISO earned $14.85 million in EIM benefits over the quarter, followed by PacifiCorp at $10.5 million. Trailing those two market players were Arizona Public Service ($5.9 million), NV Energy ($4.2 million), Portland General Electric ($3.6 million) and Puget Sound Energy ($3 million).

Total quarterly benefits were up nearly 26% from the fourth quarter of 2017 and 31% from the same period a year ago — before Portland General Electric began transacting in the EIM last October. The market has yielded $330.5 million in benefits since it was launched with PacifiCorp in November 2014, the ISO estimates.

The report again illustrated an established pattern with the arrival of spring: that CAISO becomes a net exporter of energy as increasing output from solar resources coincides with modest electricity demand during mild weather in California. (See CAISO EIM Exports Rise with Spring, Report Shows.)

The ISO’s EIM exports surged from 94,769 MWh in January to 325,664 MWh in March, with imports falling from 299,586 MWh to 185,008 MWh, the report showed. First-quarter exports totaled 608,416 MWh, compared with 362,774 MWh the previous quarter.

CAISO said the energy transfers facilitated by the EIM allowed it to avoid curtailment of 65,680 MWh of renewable output during the quarter, up 24% from the same period last year. That was still down sharply from the nearly 113,000 MWh of avoided curtailments in the second quarter of 2016, which the ISO attributed to improved hydroelectric conditions and advancements in how EIM participants are deploying their resources.

The avoided renewable curtailments translated into the displacement of 28,188 metric tons of carbon dioxide, based on an assumed default emissions rate of 0.428 metric tons CO2/MWh from other sources of generation. By avoiding curtailments, the EIM has helped to displace 250,845 metrics tons of CO2 since 2014, the ISO said.

The report also showed that APS and NV Energy functioned heavily as “wheel through” areas during the first quarter, meaning their transmission networks facilitated many transactions for which the utilities received no financial benefits because they were neither source nor sink. (See graph). During February and March, energy volumes wheeled through APS’ territory exceeded the utility’s combined EIM net imports and exports, as significant amounts of energy flowed between the CAISO and PacifiCorp-East balancing authority areas during what is typically a period of low demand in Arizona.

The ISO has “committed to monitoring the wheel-through volumes to assess whether, after the addition of new EIM entities, there is a potential future need to pursue a market solution to address the equitable sharing of wheeling benefits,” the report said.

A CAISO proposal to provide transmission revenue to EIM participants that wheel energy through their BAAs last summer drew stiff opposition from current and future stakeholders concerned about the impact of new charges on the economic dispatch of generating resources. (See EIM Member Wary of Need for Wheeling Charge.)