By Michael Kuser

Eversource Energy said Wednesday that it will seek to support earnings growth through offshore wind contracts from its Bay State Wind partnership and a new rate plan in Connecticut that increases the average customer’s electricity bill by 3.8%.

The company reported first-quarter earnings of $269.5 million, compared with $259.5 million in the same period a year ago.

Eversource’s transmission unit earned $107.4 million in the quarter, up 11.4% from a year earlier because of additional investment in its electric transmission system.

The company’s electric distribution and generation business earned $104.2 million in the first quarter, down 6.5% from last year primarily because of the sale of generation assets, as well as higher depreciation, property tax, and operations and maintenance expenses, which were partially offset by higher electric distribution margins. Exceptional storm-related costs drove O&M expenses higher.

CFO Phil Lembo said in an analyst call May 3 that “we had significant storm activity in March this year, very significant, particularly in eastern Massachusetts, as a result of a series of nor’easters that hit us over an 11-day span.”

“The vast majority of the restoration costs, about $150 million, was deferred under regulatory mechanisms for future recovery,” Lembo said.

Regulatory Updates

Lembo noted the “good news” of a FERC administrative law judge’s March 27 ruling that municipal utilities and commission staff failed to prove that the New England Transmission Owners’ (NETOs) base return on equity of 10.57% (11.74% with incentives) is unjust and unreasonable. (See ALJ Rules New England Tx Owners’ ROEs not Unjust.)

FERC last October rejected a bid by NETOs, including Eversource, to increase their ROE to the levels in place before being reduced by a 2014 commission order that was vacated by an appellate court early last year. The commission said it would address the actual rate in a later remand order but has yet to do so (ER15-414, EL11-66).

Executives also discussed the New Hampshire Site Evaluation Committee’s (SEC) March 30 decision to formalize its rejection of Northern Pass, a joint venture between Eversource and Hydro-Quebec for a 1,090-MW transmission line to bring up to 9.4 TWh of Canadian hydropower to New England each year. Massachusetts had chosen Northern Pass, but in light of the rejection selected as an alternative a transmission project proposed by Avangrid subsidiary Central Maine Power. (See Mass. Picks Avangrid Project as Northern Pass Backup.)

Lee Olivier, Eversource executive vice president for business development, said the SEC has scheduled a May 24 meeting to hear Eversource’s request to reconsider the rejection. If rejected again, “the next step would be to appeal to the New Hampshire Supreme Court,” Olivier said.

Offshore Wind Hopes

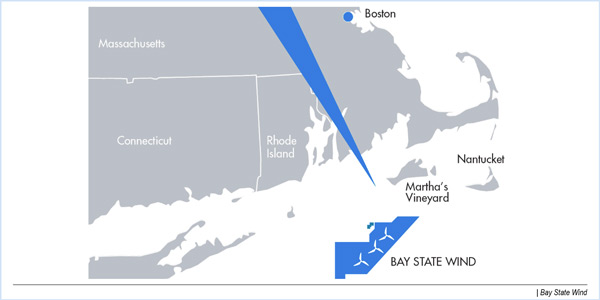

Eversource partnered with Orsted to form Bay State Wind for a offshore wind solicitation in Massachusetts, and in December the company proposed a 400- or 800-MW wind farm 25 miles off New Bedford to be paired with a 55-MW battery storage facility.

Olivier said Massachusetts officials delayed by a month the date to select projects for negotiation, to May 23, 2018, now to be followed by submission of contracts to the Department of Public Utilities by July 31.

Connecticut is also conducting a request for proposals for offshore wind, and the company bid approximately 200 MW last month, Olivier said. A winning bidder is expected by midyear, he said.

Olivier said Bay State Wind can produce up to 2,500 MW of wind energy from its 300-square-mile lease area south of Martha’s Vineyard and interconnect it to surrounding states and Long Island, even extending over land to New York City with relatively minor upgrades to existing infrastructure.

“We’ll also have returns on these assets, transmission-like returns,” Olivier said. “Clearly once you get in, if you’re one of the first selected, you’ll have a first-mover advantage in every other solicitation.”