By Rich Heidorn Jr.

WASHINGTON — The Sierra Club, which has spent eight years battling utilities with its Beyond Coal campaign, would seem an unlikely participant in a program by the utilities’ trade group. But Sierra Club attorney Joe Halso was on stage at the Newseum on Friday, taking part in the Edison Electric Institute’s program celebrating the U.S. reaching its 1 millionth electric vehicle.

The Electric Power Research Institute predicted earlier this year that EVs and other electrification efforts could result in load growth of 24 to 52% by 2050. So, on this issue, environmentalists and utilities have common interests.

“There’s a role for utilities to play obviously in the electric [vehicle] future,” Halso said. “I think also in a world … with either flat or declining load growth, a strategic opportunity to electrify 250 million vehicles must look pretty good to utilities.”

Indeed it does. EEI CEO Tom Kuhn said the alignment of the morning’s speakers — representing consumers, automakers, policymakers, utilities and charging companies — is “incredibly exciting.”

“And so I think we’re here not just to celebrate this milestone of 1 million vehicles, but also to celebrate the collaboration that got us here,” Kuhn said. “I’ve always said the things that change a market … are technologies, public policies and customers. And we’ve got all three of them, finally.”

Amid the celebration — yes, there was a cake — there were also sobering reminders of both the importance of EVs to addressing climate change and the obstacles that could prevent the technology from meeting its potential. Here’s the highlights of what we heard.

Signs of Progress

Participants in Friday’s celebration cited numerous signs of progress in addition to the 1 million milestone:

- General Motors is developing its autonomous vehicles on an “all-EV platform,” said Dan Turton, GM’s vice president for North American policy.

- ChargePoint, which last week announced a $240 million equity infusion, has pledged to install 2.5 million charging spots by 2025, up from more than 57,000 today. The company has raised a total of more than $500 million from investors including American Electric Power, Chevron, Daimler, BMW and Siemens.

- Charger network EVgo, which recently completed installing nine fast-charging stations in the I-95 corridor from D.C. to Boston in a partnership with Nissan, also won a contract in August to operate a network of hundreds of stations across Virginia. Julie Blunden, executive vice president of business development, said the company also will increase its charging network in California, its largest market, by 50% by mid-2019 over mid-2018. It currently has more than 1,000 fast chargers at 700 stations. (A DC fast charger can add 60 to 80 miles in 20 minutes.) Virginia will use $14 million from its portion of the Justice Department’s settlement with Volkswagen, which agreed to spend $2 billion on zero-emission vehicle infrastructure in the U.S. after admitting to cheating on diesel emissions tests.

- Arshad Mansoor, EPRI’s senior vice president for research and development, predicted there will be 130 EV models available in five years, up from about two dozen today. BMW will be adding an all-electric Mini and sport utility vehicle, with plans for 25 EV models by 2025, said Bryan Jacobs, vice president of government and external affairs.

- Regulators have approved $1 billion in utility investments in EV charging infrastructure. Halso said the amount is “a drop in the bucket” compared to what’s needed “but leaps and bounds from where we were five years ago.”

- More than 130 companies and organizations have signed the transportation electrification accord negotiated by environmentalists and others. The agreement outlines ways transportation electrification can benefit “all utility customers and users of all forms of transportation, while supporting the evolution of a cleaner grid and stimulating innovation and competition for U.S. companies.”

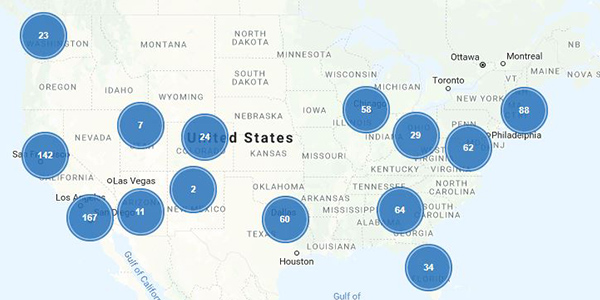

- Walmart installed chargers at 250 stores in 2018, nearly double the goal it had set, as part of its partnership with Electrify America, the unit VW set up to manage its settlement. It is now possible to drive an EV from Houston to Chicago using chargers at Walmart and Sam’s Club stores, said Sara Decker, the company’s director of federal government affairs.

-

Kathy Kinsey, NESCAUM | © RTO Insider - The 1 million milestone would not have been reached without state ZEV programs, said Kathy Kinsey, senior policy adviser for Northeast States for Coordinated Air Use Management (NESCAUM), a group representing the air directors of New Jersey, New York and the six New England states. Until now, she said, states have made “ad hoc” investments in EVs and their infrastructure. But with the money from the VW settlement and utilities proposing infrastructure investments, “our states now have recognized the importance of thinking strategically and regionally,” she said.

The Stakes

Friday’s celebratory mood was tempered by the release a week earlier of the federal government’s Fourth National Climate Assessment, which declared that “the impacts of climate change are already being felt in communities across the country.” (See US Climate Report Spells out Coming Challenges.)

“We cannot continue to pretend that we can solve our climate crisis by only asking the power sector to do more,” said Rep. Paul Tonko (D-N.Y.), who noted that transportation has surpassed electric generation as the largest source of greenhouse gas emissions in the U.S.

Alan Oshima, CEO of Hawaiian Electric Co., said EVs are crucial to the state’s goal of 100% clean energy by 2045. He said the state needs to triple its rooftop solar capacity to meet the goal and that daytime EV charging is needed to absorb excess supply. While the state is fifth in per capita EV ownership, he said, it has only 8,000 EVs today.

Tonko acknowledged the limits of EV-boosting legislation possible in the new Congress, where Democrats will hold the majority in the House of Representatives while Republicans will increase their majority in the Senate.

“We need to focus on potential policy wins that might be considered singles and doubles,” said Tonko, who pledged to push the deployment of EV charging facilities in any infrastructure bill and to seek an extension of the federal EV tax credit.

President Trump threatened to eliminate tax credits for GM’s EVs after the company announced Nov. 26 it would close assembly plants in Ohio, Michigan, Maryland and Ontario. Although Trump lacks the power to take such action, “we pay a lot of attention to what any president says,” Turton told the EEI gathering. “But this EV movement is going forward regardless.”

Established in 2008, the tax credit provides $2,500 to $7,500 per new EV, depending on the size of the vehicle and its battery capacity. The full credit is available for the first 200,000 EVs per manufacturer, after which it begins to be phased out. Tesla has already hit the threshold, and GM is expected to reach it near the end of this year. In September, a group of Congressional Democrats introduced a proposal to eliminate the per-manufacturer cap and extend the credit for 10 years.

“I think that the evidence has shown that the biggest driver to future EV adoption will be the extension of the federal tax credit,” Tonko said. “We may disagree on what that tax credit may look like or how long we allow it to be in play, but I hope this is an area where the new House Democratic majority can focus next year.”

Fleet Electrification

EV proponents see big opportunities to electrify not only personal transportation but also shipping and buses.

Although Walmart’s Project Gigaton aims to reduce GHG emissions throughout the company’s supply chain, Decker acknowledged that electrifying its truck fleet is “probably just a white board exercise at this point.”

Electrification of school and transit bus fleets is on the way, however, said Eric McCarthy, senior vice president of government relations, public policy and legal affairs for electric bus maker Proterra. McCarthy said incentives to make the switch are being provided by the VW settlement, the Federal Transit Administration, and voucher programs in states including Maryland and New York.

McCarthy said his company no longer has to convince transit agencies to “experiment” with EVs, which he said are well suited to fleet use because of buses’ combination of high mileage, low fuel economy and predictable travel routes. Now, he said, the company is focusing on its relations with utilities and educating state regulators.

Because transit agencies have limited capital budgets, Proterra has begun leasing its batteries, with the original equipment manufacturers taking the operating risk, McCarthy said. “It was authorized by the [2015 Fixing America’s Surface Transportation Act] and many of our customers are taking advantage of that,” he said.

Proterra has buses operating or planned in locations including Georgia, Edmonton, D.C. and Baltimore (in partnership with Exelon unit Baltimore Gas and Electric). On Oct. 30, the company unveiled an electric school bus it is producing with Thomas Built Buses, a subsidiary of Daimler Trucks North America, which has also invested in Proterra.

The California Air Resources Board is expected to rule in January on a proposal requiring all transit agencies in the state to transition to ZEV fleets. “If that happens, and then we see other states adopt that as a model, I think you’re going to see this really take off in five years,” McCarthy said.

EVgo’s Blunden also sees fleets making a swift change.

“If there is one thing that has shocked me this year, it is how fast corporate fleet owners and operators are thinking about moving to electrification. It is going to make your head spin,” she said. “This reminds me very much of 2008 in the solar industry, where we had the very first … utility-scale solar plants. Four years later, utility [solar] was larger than residential.”

R&D

For GM, EVs represented only 1.5% of total sales in 2017, and none of them was a pickup truck or SUV, which have gained market share at the expense of sedans. GM’s Turton said electrifying those heavier vehicles is part of the company’s “all-electric future.”

“It’s going to take the next generation of batteries, the generation after that, to be able to advance the R&D … to be able to have better, more cost-efficient batteries that can do this with the longer range that’s necessary,” he said.

Alex Fitzsimmons, chief of staff for the Department of Energy’s Office of Energy Efficiency and Renewable Energy, said his agency has three R&D goals for EVs: reducing battery costs (currently more than $200/kWh) to less than $100/kWh; expanding their range to 300 miles (the second generation Nissan Leaf has a range of 151 miles); and completing a full charge within 15 minutes.

Consumer Ignorance

Speakers said the biggest obstacle to wider EV penetration, however, is not technology but consumer ignorance.

“It’s troublesome how little progress we’ve made in the last five years in consumer education,” NESCAUM’s Kinsey said.

“A lot of consumers still think that EVs drive like a golf cart,” lamented Michael Arbuckle, senior manager of EV sales and marketing strategy for Nissan, which has sold 365,000 electric Leafs worldwide. “They also think that they’re not affordable — they’re wrong. We know that EVs also have acceleration that’s exciting. They’re fun to drive. They’re great vehicles to drive.”

Southern California Edison’s service territory claims 200,000 EV owners — one-fifth of the U.S. total. Yet less than half of Californians know what an EV is, said Phil Jones, executive director of the Alliance for Transportation Electrification. Jones also noted that the U.S. remains far behind China, which has accounted for about 37% of passenger EV sales since 2011 and about 99% of e-buses. The city of Shenzhen last year converted all of its 16,359 buses to electric.

Joel Levin, executive director of Plug In America, which represents EV drivers, said few auto salespeople are familiar enough with EVs to answer prospective buyers’ questions. “With a gas car, the dealer never has to answer questions like, ‘So, where do I get gasoline?’” he said.

Levin said consumers’ cost comparisons need to switch from sticker prices — at which EVs are a disadvantage — to total cost of ownership, which includes their lower fuel and repair costs.

Auto dealers generally earn more money from repairs than vehicle sales, a potential disincentive to promoting EVs, which have far fewer moving parts than vehicles with internal combustion engines. But Levin insisted that hurdle can be overcome. “There’s other pieces of the value chain that they can capture,” he said, citing rooftop solar sales and installing home chargers.

Multifamily Housing Challenge

Another obstacle to wider penetration is how those lacking individual garages can charge at home.

Multifamily housing remains a hurdle even in SCE’s territory, said Jill Anderson, vice president of customer programs and services.

Anderson said the utility intended to include multifamily housing in its first big launch of light-duty chargers, in part to address concerns that low- and moderate-income residents could be shut out of the transition.

“And that’s the area where we had the most difficulty,” she said. “I think only three or four sites were successful in multifamily charging. So it’s an area we have to think about differently. We might have to think about the utility doing more soup-to-nuts solutions for multifamily. It’s an area that’s going to be important.”

New York state is attempting to increase multifamily penetration by offering rebates on Level 2 chargers (240-V AC units that add up to 20 mph of charging) to apartment buildings in addition to office buildings and public and commercial locations, Rep. Tonko said. The state also is offering grants for DC fast chargers for cities, transportation corridors and hubs such as airports.

“It is my belief that the federal government can encourage similar investments, and we should ensure that charging is open to public access, interoperable and that the recipients of this funding are required to maintain the equipment,” Tonko said. “Without this type of concerted push, we are going to have many of the same problems and split incentives that we see on consumer-side energy efficiency, where building owners might not see the benefit of making efficiency investments on their tenants’ behalf. We can’t shut these potential consumers out of the EV market.”

Dave Packard, vice president of utility solutions for ChargePoint, said his company is working with competing charging networks to create a “seamless driving experience” that ensures drivers know where to charge and how much it will cost. “I think we have to take a lesson from the cellphone industry,” he said. “Those of you that remember in the early days when you roamed you had to call [through a different provider]. It was just a nightmare.”

Projections

EEI ended the event Friday with the release of a report projecting the U.S. will hit the 2 million EV mark by early 2021 and total 18.7 million by 2030. By then, annual sales would exceed 3.5 million, 20% of total car and light truck sales, EEI said. The report says the U.S. will need an additional 9.6 million charge ports to meet the 2030 projections. There are currently about 45,000 public Level 2 charging ports and 9,000 DC fast-charging ports, the report said.