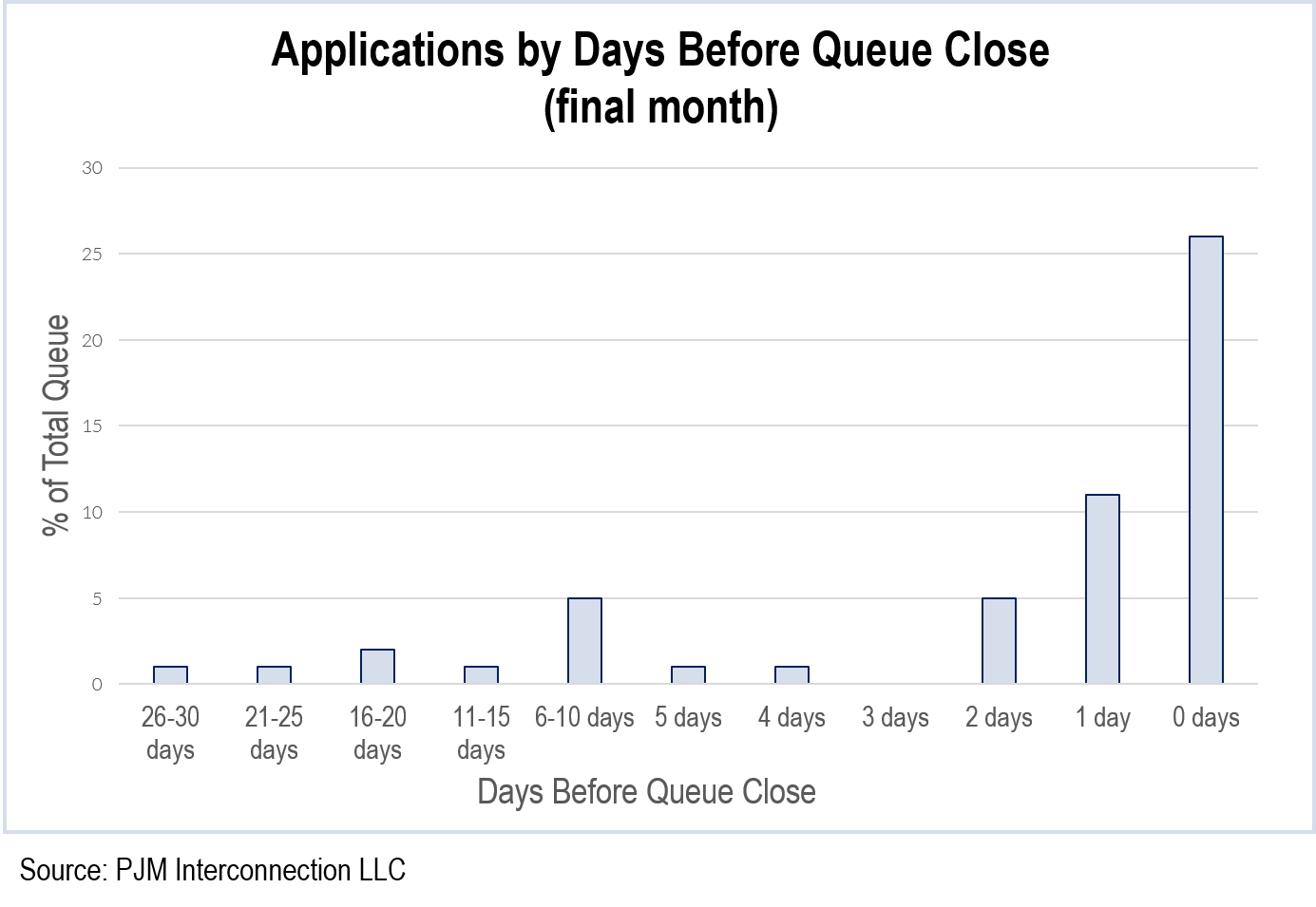

About 54% of the project applications in the queue that closed Oct. 31 (AA1) came in the final month, and 43% of those came in the final week — 26% on the final day — said David Egan, manager of interconnection projects. In the previous queue, before the fee structure was changed, 47% of applications came in the final month.

“This is not workable,” said Steve Herling, vice president of planning. “It hasn’t really improved with the changes we’ve made.”

Under the new structure, the deposit for applications filed in the first four months was set at $10,000; for the fifth month, $20,000; and for the last month, $30,000.

“I’m noodling on a method to fix this. That is going to be a proposal that we bring to better allow my group to handle it,” Egan said, inviting suggestions to incent early participation. “This is creating big chunks of work, and invariably things get dropped or missed.”

Projects totaling about 30,000 MW are currently under study, with another 19,000 MW under construction. Natural gas accounts for 80% of the total. PJM received 2,376 project applications in the queue. Of that, 23% are in-service and 172 agreements were terminated.

TO/TOP Matrix

Members approved Version 8 of the TO/TOP (Transmission Owner/Transmission Operator) Matrix, the result of an annual review. The document serves as an index between PJM manuals and North American Electric Reliability Corp. standards and creates no new obligations for PJM or its members.