By Chris O’Malley and Michael Brooks

WASHINGTON — MISO’s Independent Market Monitor urged the Federal Energy Regulatory Commission last week to resolve a standoff between MISO and PJM over interface pricing that he said is costing consumers millions.

“We’re seeing tens of millions of dollars in uplift. We see transactions being scheduled that are not efficient. And the only way to really solve this is to get prices right,” MISO Market Monitor David Patton told commissioners during a panel discussion with RTO representatives and state regulators at FERC’s Jan. 22 meeting.

But PJM Market Monitor Joe Bowring and Stu Bresler, PJM vice president of market operations, said pressure for an immediate resolution could be short-sighted. “We have to be careful an arbitrary deadline does not force a bad answer rather than getting to the right answer,” Bowring said.

“I think a deadline that required a solution in a very near timeframe would be very difficult and potentially damaging if it resulted in an inferior approach,” agreed Bresler.

Whether the commissioners will set a deadline to help spur a resolution is unclear.

“I think we want to distill what we have heard today and get the sense of where the commissioners are,” Chairman Cheryl LaFleur said at a press conference following the meeting.

Two Years

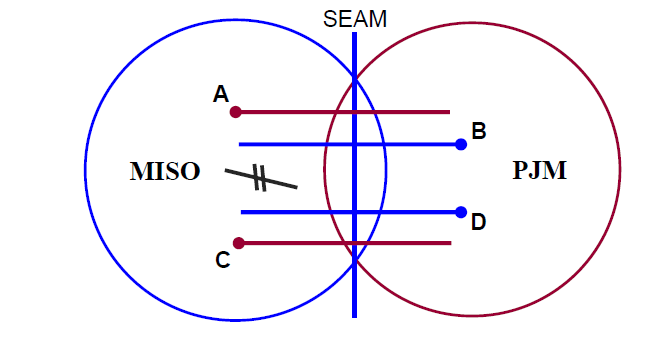

MISO and PJM have been working for two years to resolve differences in the way they price transactions at interface buses.

The RTOs agree that the current methods undermine efficient scheduling of power because they cause both RTOs to model the same constraint, resulting in double-counting.

Patton says transactions are overcompensated when they are expected to relieve a constraint, and overcharged when they are expected to contribute to congestion. Interface pricing flaws “cost MISO some money. It costs PJM a huge amount,” he said.

Patton contends that PJM’s method exaggerates the effects of imports and exports on transmission constraints near the seam. As a result, he said, scheduling incentives have been inflated by as much as 600% at the Cook-Palisades interface in Michigan, the most active M2M constraint last winter.

“We massively overpriced congestion last winter and it resulted in an average of something like 3 GW being exported from PJM to MISO. This was during the timeframe when we were just coming out of the polar vortex and PJM had just incurred half a billion dollars in uplift, committing tons of generation under conservative operations, and they’re exporting gigawatts to MISO, where it’s demonstrably less valuable,” Patton added.

Bresler said he didn’t see the correlation. “PJM has made changes to its interface definitions in direct response to concern from MISO. Given the change we made, I’m not sure I understand the reference … to the polar vortex and the uplift,” he said.

Patton recommends removing the congestion component of the LMP for the non-monitoring RTO.

PJM offered an alternative in which each RTO would set its interface bus price relative to a common set of interfaces.

FERC to Set Deadline?

Patton said FERC should set a deadline for an agreement because there have only been two solutions under consideration for more than a year.

“We’ve had an incredible amount of analysis on those two solutions. Obviously, I think there’s one clearly correct answer, but not everyone agrees with me,” he said to laughter. “I think if we did have a deadline to file, it would be useful just to file and say ‘We’re agreeing to disagree, and here are the pros and cons of these two solutions that we have an enormous amount of research on, and then allow the commission to maybe weigh in and give some guidance and push the needle in one direction or the other.”

“We really need FERC’s involvement in this issue. We need a deadline to file a solution to this,” Patton told commissioners.

Bowring said he didn’t think a hard deadline made sense, although he suggested the RTOs could report back to the commission in June. “If we knew the answer, we would have told you already. We don’t.”

Bresler said Patton’s proposed solution to interface pricing could have negative impacts elsewhere.

“PJM has always defined our interface prices so that we reflect the impact of interchange transactions on the transmission system and more specifically on the transmission constraints which we are actually operating,” Bresler said. “And part of the solution that Dr. Patton has proposed is essentially eliminating the impact of some transmission constraints in the interface price.

“That may end up being the right solution,” Bresler added. “But I think the difficulty … is making sure that doing so doesn’t have detrimental effects elsewhere.”

LaFleur expressed frustration with the inability of the two RTOs to resolve the impasse.

“I am at least actively contemplating, should we do something more active than ask for another schedule, which is what we decided to do [in 2013] after a lot of tough talk,” she said. She acknowledged work done by the RTOs to address seams issues but added, “I’ve been a little disappointed with the level of progress on some of the thorniest issues, many of which have come before us today.”

Commissioner Philip Moeller said the problems are “partly our fault.”

“We kind of took our foot off the gas and stopped requiring the quarterly reports and basically lost focus on the fact that these issues were not going away,” he said.

Michigan Public Service Commissioner Greg White, another panelist, agreed a deadline could increase the parties’ “sense of urgency” but said he didn’t want to “end up with a product that is inferior because of a lack of time.”

Joint and Common Market Progress

The bus interface pricing issue has proven to be perhaps the most intractable issue facing PJM and MISO’s Joint and Common Market initiative, a joint stakeholder process to address seams issues.

Patton said the JCM process has borne fruit. He said MISO’s ability to export capacity into PJM has increased, although the two parties haven’t solved the underlying problems. “So while I don’t think we structurally have solved the problem and I don’t see a filing coming any time soon that will structurally solve this, I think the priority has diminished.”

Bowring was unapologetic. “There will continue to be issues as long as there are very substantial differences between the design for procuring capacity in MISO and the design for procuring capacity in PJM,” he said. “The … notion that there should be transfers no matter what I think is excessively simple-minded.”

Elizabeth Jacobs, chair of the Iowa Utilities Board, who represented the Organization of MISO States on the panel, said she was encouraged by MISO and PJM’s plans to introduce Coordinated Transaction Scheduling to improve interchange optimization. (See “PJM Posts MISO Price Predictions Before CTS Vote” in Market Implementation Committee Briefs, Jan. 12, 2015.) Jacobs noted that while the panel discussion focused on the PJM-MISO seam, many MISO members are facing new seams issues with an expanded SPP.