VALLEY FORGE, Pa. — A senior PJM official acknowledged last week that a proposal to allow load-serving entities such as the Illinois Municipal Energy Agency to use external resources to meet their capacity requirements could be construed as “somewhat preferential.”

Stu Bresler, vice president of market operations, outlined a proposal to allocate capacity transfer rights (CTRs) to resources external to the PJM region that historically have been used to serve the needs of the PJM load.

“We think this is a relatively small population and we can do this … very narrowly,” Bresler told the Market Implementation Committee.

PJM estimates 1,037 MW of historic external resources would qualify under its proposal: 122 MW in the DOM zone, 533 in COMED, 261 in AEP and 121 in DAY.

GT Power Group’s Dave Pratzon, who represents generation owners, took issue with the plan. “What you’re proposing seems like a real sweetheart deal, and any rules I’d want to see would be very strict in terms of identification and not be able to be expanded in the future,” he said.

“I’ll be the first to admit the treatment here could be seen as somewhat preferential,” Bresler responded. The question for stakeholders, he said, is “does the historic nature of the commitments justify that solution?”

Independent Market Monitor Joe Bowring asked whether IMEA could sell its rights to a third party under the proposal.

Bresler said “that level of detail is not decided yet.” He said PJM will expand the detail of the proposal and return it to the committee in March.

(See Illinois Regulators, IMM Line Up Against IMEA Capacity Waiver Request.)

PJM-MISO Scheduling Product Approved

Members on Wednesday approved an optional scheduling product intended to reduce uneconomic power flows between PJM and MISO, similar to the Coordinated Transaction Scheduling product launched Nov. 4 with NYISO. (See NYISO Scheduling Product Wins FERC OK.)

The product would allow traders to submit bids that would clear only when the price difference between the two regions exceeds a threshold set by the bidder.

The vote came with a condition that the two RTOs detail their pricing methodologies in their joint operating agreement. (See PJM, MISO Reach Agreement on New Interchange Product.)

The product would operate on a joint clearing mechanism in which each party would evaluate the prices individually, and the common set would be the transactions that flow.

PJM stakeholders will have to vote on the accuracy of the product’s prices before the offering goes live.

The RTOs are expected to agree upon a common method of interface pricing by November 2016.

PJM, MISO near Agreement on M2M Language

PJM and MISO expect to file a revised Joint Operating Agreement this spring on three market-to-market rules.

PJM’s Asanga Perera told the MIC that the two RTOs have agreed in concept on all three issues and drafted language for one, a change to the threshold for naming flowgates. Perera said RTO officials were still “wordsmithing” provisions regarding conflicting constraint control and hold-harmless settlements for planned outages submitted after the day ahead market deadline.

The threshold for flowgates will be amended for transmission lines at 138 kV or less. The change means that 138-kV and lower elements will not be named as flowgates unless flows from the neighboring RTO amount to 35% or more of the line’s rating, up from the current 25%. The 20% threshold will remain for lines more than 138 kV.

Perera said language on the other two rule changes should be complete by the March MIC meeting. A filing with the Federal Energy Regulatory Commission is targeted for early in the second quarter.

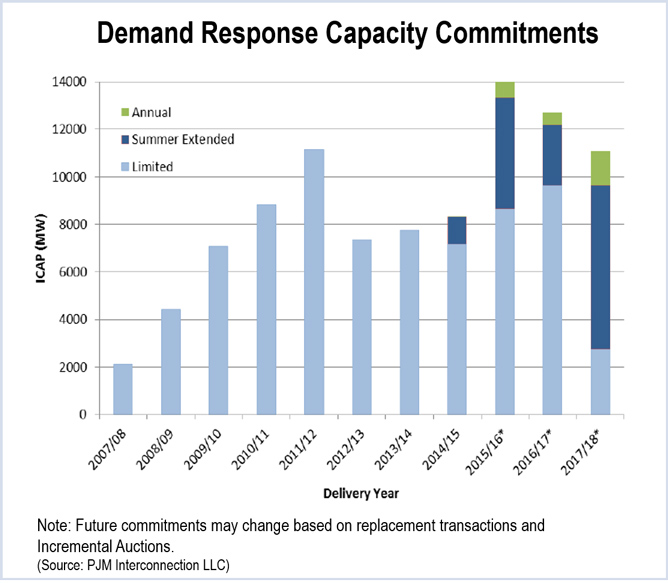

Test Shows Highest Promised Load Reductions

Summer limited demand response produced 135% of promised load reductions in tests this year, the highest ever.

The test showed 9,668 MW of limited DR responding, 2,510 more than the commitment. However, some providers failed the test, resulting in penalties of $2.7 million, at an average penalty rate of $140/MW-day.

PJM has not actually called on DR during delivery year 2014/15.

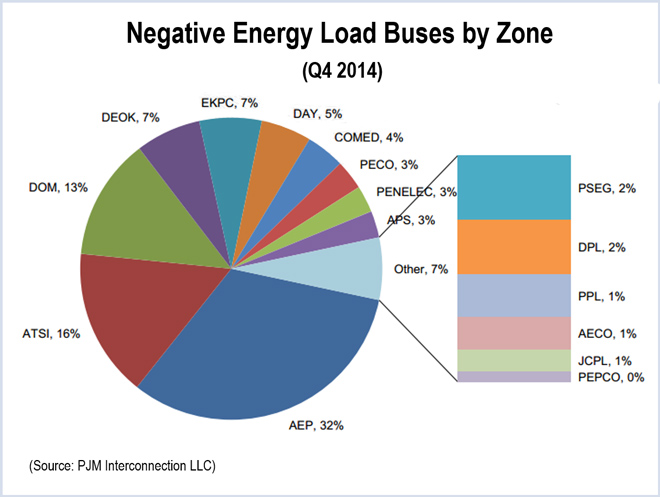

Faulty Models Hamper Net Energy Metering Study

PJM’s attempt to track the growth of distributed solar generation is being hampered by modeling issues. In a briefing on its net energy metering quarterly review, PJM told members that the locations identified as sources of “negative energy” — net energy injections at load buses — are not where most solar PV is located.

“Usually the largest ‘injections’ are because of modeling issues on the distribution system,” PJM’s Ken Schuyler said. “We haven’t really seen a trend of negative injections because of net energy metering.”

Suzanne Herel and Rich Heidorn Jr.