By Amanda Durish Cook

Shareholders voted overwhelmingly Monday to approve Great Plains Energy’s $12.2 billion acquisition of Westar Energy.

Shareholders cast their votes in separate meetings at Great Plains’ headquarters in Kansas City, Mo., and Topeka, Kan., where Westar is based. Company spokesmen said stakeholders approved all proposals necessary with at least 95% percent support.

Great Plains CEO Terry Bassham called the move “a great transaction” for stakeholders of both companies. Great Plains’ $12.2 billion offer includes $3.6 billion of Westar’s outstanding debt.

Westar CEO Mark Ruelle said the transaction would be completed next spring. Both CEOs said the acquisition will create a stronger company, with Ruelle adding that shareholder support “clearly demonstrates the value of combining Westar and Great Plains Energy.”

“The combined generation portfolio of the new utility will be more diverse and sustainable,” Bassham said. “Once this transaction is complete, more than 45% of our combined retail customer demand will be met with emission-free energy, and we will have one of the largest wind generation portfolios in the United States. This helps us maintain reliable, low-cost energy for all of the residential and business customers we serve.”

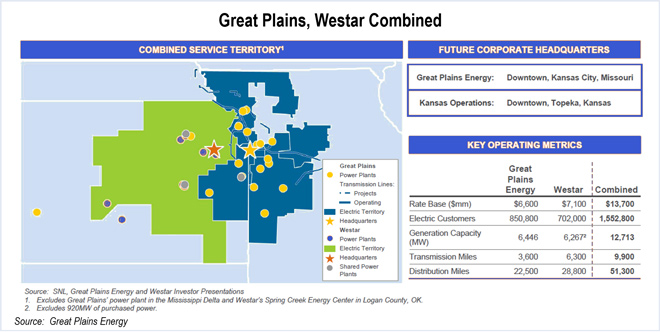

Westar’s 6,267 MW of generation is mostly coal-fired. Great Plains will walk away from the deal with 1.5 million customers in Kansas and Missouri, nearly 13,000 MW of generation and 10,000 miles of transmission lines.

Currently Great Plains and Westar jointly own the Wolf Creek Nuclear Generating Station and the La Cygne and Jeffrey power plants.

Westar’s shareholders will receive $60/share, paid in $51 cash and $9 in Great Plains common stock. Immediately after the vote, Westar stock was trending upward at $56.73/share.

Great Plains, parent of Kansas City Power and Light, announced plans to buy Westar in May. (See KCP&L’s Parent Great Plains Energy to Buy Westar for $12.2 Billion.)

Westar and Great Plains settled three lawsuits challenging the proposed merger, according to a U.S. Securities and Exchange Commission filing last week.

According to The Topeka Capital-Journal, a lawyer for one of the plaintiffs said the agreement will allow eight unsuccessful bidders to submit new bids. Attorney Derrick Farrell said the settlement required Westar and Great Plains to waive confidentiality provisions.

Andy Pusateri, a utilities analyst for Edward Jones, told the newspaper the settlement is unlikely to start a bidding war for Westar, saying Great Plains offered “a pretty significant premium.”

Westar also thinks the scenario is unlikely. Among other complaints, the lawsuits also alleged that the deal unfairly favored Great Plains Energy’s proposal while discouraging other and potentially better third-party bids.

“It is common to have someone file a lawsuit when mergers are announced. We were able to settle those lawsuits by simply modifying some of the language in the bidding documents. With that, the litigants agreed to stand down,” Westar wrote of the settlements.

The purchase still requires approval from the Kansas Corporation Commission, FERC, the Federal Trade Commission and the Nuclear Regulatory Commission.

The Missouri Public Service Commission wants in on the approval process, but Great Plains has said that Missouri regulators have no jurisdiction over the sale.

Westar would be the second acquisition in eight years for Great Plains, which acquired Missouri utility Aquila in 2008.