ERCOT’s Technical Advisory Committee passed three nodal protocol revision requests to improve the ISO’s reliability-must-run procedures.

AUSTIN, Texas — ERCOT’s Technical Advisory Committee passed three nodal protocol revision requests (NPRRs) Thursday to improve the ISO’s reliability-must-run procedures following its decision earlier this summer to extend an RMR contract for an aging natural-gas unit in the Houston area.

The three revisions, previously endorsed by the Protocol Revision Subcommittee, would modify the Texas grid operator’s RMR planning studies, create a clawback mechanism for ERCOT-funded capital expenditures and clarify the reliability unit commitment process. The Board of Directors is scheduled to consider all three revision requests at its Oct. 11 meeting. The NPRRs were classified as urgent requests following this summer’s extension of an RMR contract through 2018 for NRG Texas’ Greens Bayou Unit 5. (See ERCOT Finds No Alternatives to Greens Bayou; RMR Rule Changes Advance.)

The TAC approved NPRR788, which modifies the system’s RMR planning studies, after accepting revisions from the Independent Market Monitor. The revision request will require that future studies include forecasted peak loads, and it says a potential RMR unit must have “a meaningful impact on the expected transmission overload” to be considered for an agreement.

“ERCOT filed comments [after the subcommittee vote] that I feel effectively rebutted the comments made by [stakeholders] that they were concerned ERCOT was not being compliant with NERC standards,” said Beth Garza, the IMM’s director.

The Monitor’s revisions would allow ERCOT, “in its sole discretion,” to deviate from the planning criteria “in order to maintain … reliability. However, ERCOT shall present its reasons for deviating from the above criteria at the next regularly scheduled [TAC] and [board] meetings.”

Transmission Providers Opposed

The measure was opposed by transmission providers American Electric Power, CenterPoint Energy, Sharyland Utilities and Luminant, Texas’ largest generating company.

Valentine Emesih, CenterPoint’s vice president of grid and market operations, said the ISO’s approach could create problems in a year or two. “If you force me to operate the line at 110% of [rated capacity], you’re essentially using a policy that forces you to use load shed to upgrade the system,” he said. “The real solution to mitigate the issue is to build appropriate infrastructure to inoculate yourself from that situation, and that’s where the planning comes in.”

ERCOT staff assured stakeholders there were no plans to shed load and there were no reliability issues.

“It’s more about what is the risk this market is comfortable with when deciding whether or not to get an RMR unit,” said Jeff Billo, senior transmission planning manager. “We are going to plan transmission projects to address those issues.”

The transmission providers also lost a bid to revise the planning criteria’s threshold for overloaded transmission facilities to 100% of the emergency rating under normal system conditions following a contingency loss of a generating unit, transmission unit or other facilities. The threshold will instead remain at 110%.

Stakeholders unanimously approved NPRR795, which creates a mechanism to refund capital expenditures funded by ERCOT under an RMR agreement, but not before adding amended language from Texas Industrial Energy Consumers and the ISO.

Coleman © RTO Insider

Attorney Katie Coleman, representing industrial customers, said she wanted to “tighten the parameters around the depreciation assumptions” and compensate customers for the value of accelerated tax depreciation, “which can provide a significant tax write-off for a resource owner.”

Coleman proposed requiring 10% of this value to be repaid along with the capital expenditure before a resource re-enters the market.

“This approach compensates loads for funding a tax write-off for the resource entity in excess of what straight-line depreciation would provide during the RMR contract period,” Coleman said, “but then transfers the value of any accelerated depreciation back to the asset owner after the asset is returned to service.”

ERCOT added language that would only require a signed attestation from a company’s officer or executive, rather than having the ISO audit tax forms.

The TAC also quickly passed the final revision request, NPRR793, by a unanimous vote. It adds several responsibilities for RMR unit owners, revises RMR formulas and makes other clarifications to ensure RMR units are not accidentally committed as a reliability unit before other resources.

Two Transmission Projects Sent to Board

ERCOT stakeholders endorsed staff recommendations for a pair of West Texas reliability projects that address the region’s Permian Basin oilfield load growth without opposition. Reliant Energy Retail Services abstained from both votes.

The first project, estimated at $50.6 million and belonging to Texas-New Mexico Power, will rebuild 39 miles of 69-kV line and three substations to 138-kV standards, and add a new 138-kV ring substation and 6 miles of 138-kV line.

According to ERCOT’s analysis, that portion of the TNMP system will see coincident peak loads of 254 MW by 2022, resulting in reliability violations. The project, expected to go into service in the fall of 2019, would reduce loading on other transmission lines in the utility’s system.

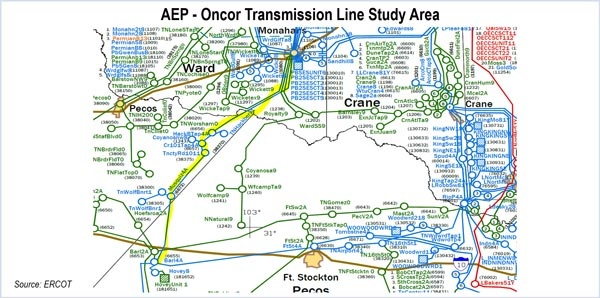

AEP and Oncor proposed the second project, a 138-kV line between Barrilla Junction and the Permian Basin. The 54-mile line’s load is expected to grow from 95 MW to 150 MW by 2020.

Staff recommended a rebuild of the existing line and installing a new 100/-50-MVAR static VAR compensator at an estimated cost of $77 million. The project will not require new rights of way, which will help keep the costs down. It is expected to go into service in June 2019.

Committee Deactivates 4 Groups

The TAC’s annual structural review resulted in the deactivation of four stakeholder groups, agreements to improve the revision-request process and the incorporation of additional binding documents into ERCOT’s protocols and guides.

The committee’s leadership agreed to move the Competitive Renewable Energy Zone Task Force, the Future Ancillary Services Team, the Scenario Development Working Group and the Long-Term Study Task Force to ERCOT’s inactive groups list.

Stakeholders agreed NPRRs and any accompanying guide revisions will now both require board approval, eliminating the discrepancy in the timing of the approval process. NPRRs have normally been approved at the board level, but guide changes are only endorsed by the TAC.

The committee also agreed to incorporate some of ERCOT’s 49 other binding documents — 24 of which have not required frequent changes — into the appropriate guides or protocols, either as new language within existing sections or as appendices.

Additional TAC Endorsements

TAC unanimously approved five NPRRs and one revision to the nodal operating guide (NOGRR) after first agreeing on several refinements to ERCOT’s approval process following the committee’s annual structural review.

- NPRR755: Allows an entity to register as a data-agent-only qualified scheduling entity (QSE) to connect to ERCOT’s wide area network (WAN) as an agent for another QSE without meeting applicable collateral and capitalization requirements.

- NPRR769: Clarifies the alternative-dispute resolution process to note the proceeding is the next level of appeal following ERCOT’s denial of verifiable costs. Also clarifies the confidentiality of data submitted in connection with a verifiable-cost appeal.

- NPRR775: Strengthens the limits on fast responding regulation service (FRRS) to address future operational issues. A previous revision (NPRR581) added limits of 65 MW to FRRS up and 35 MW to FRRS down, but it lacked implementation details regarding self-arrangements in the day-ahead market and restrictions on providing the service in real time without a day-ahead award.

- NPRR781: Addresses the market’s growing use of advanced metering systems (AMS) by updating protocol language to clarify purpose and definitions, update processes and methodologies and remove outdated ones.

- NPRR789: Requires ERCOT to publish all of its mid-term load forecasts for market participants and note which one is currently being used by operations. The ISO currently publishes several forecasts per weather zone, but it only makes one at a time available to the market.

- NOGRR154: Clarifies the WAN’s installation requirements, allows a QSE to designate an agent in order to connect to the WAN and requires ERCOT and its market participants to use the network to exchange resource-specific XML data.

– Tom Kleckner