By Robert Mullin

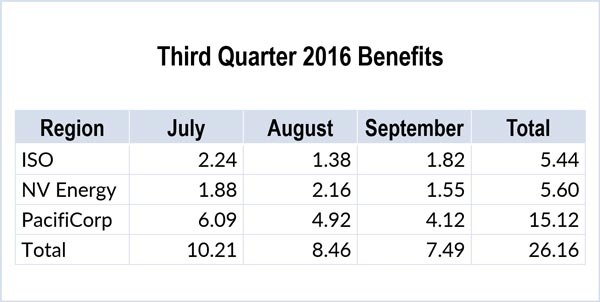

PacifiCorp reaped more than half the $26.16 million in gross benefits yielded by the Western Energy Imbalance Market (EIM) during the third quarter, market operator CAISO said in a report released Wednesday.

The Portland-based utility earned $15.1 million in benefits — versus $5.6 million for NV Energy and $5.4 million for the ISO. Last quarter, PacifiCorp took in a 45% share.

The EIM’s total benefit increased by $2.56 million over the second quarter.

The benefits represent either cost savings — for example, the reduced need for reserves and greenhouse gas credits — or increased profits from merchant operations. The market’s ability to reduce curtailments also enables participants to collect renewable energy credits that would not otherwise be issued.

The benefits calculation nets out inter-balancing authority area (BAA) transfers that were scheduled ahead of the EIM’s 15- and five-minute market runs to avoid attributing contracted flows to the market.

Transfers from the PacifiCorp East (PACE) BAA into NV Energy’s territory increased sharply during the period, as did transfers from NV Energy into CAISO — reversing a pattern seen during the previous quarter, when California was able to export a significant volume of surplus solar generation because of low springtime loads.

The ISO’s exports into NV Energy fell by more than half, following a 56% jump the previous quarter. (See EIM Report Shows Continued Growth in CAISO Exports.)

The drop-off in exports was largely a function of the change in seasons, Khaled Abdul-Rahman, the ISO’s director of power systems and smart grid development, told the Board of Governors during an Oct. 27 meeting. “This is because of increased [summer] load,” which absorbed more solar production, he said.

Even in their reduced state, those exports enabled the ISO to avoid curtailing 33,094 MWh of renewable generation.

CAISO also touted the EIM’s impact on the procurement of flexible ramping capacity — resources equipped to respond to the variability of intermittent generators.

Because variability can decrease in one BAA at the same time that it’s increasing in another, the EIM enables its participants to share flexible resources — allowing each BAA to procure fewer resources than would have been necessary on a standalone basis. These “flexible ramping procurement savings” were about 35% of total savings during the third quarter, the ISO reports showed.

The next quarterly report will include figures for Arizona Public Service and Puget Sound Energy, which began trading in the EIM at the beginning of October.

Abdul-Rahman gave the two utilities high marks for their market performance so far, noting that both have been coming into hourly intervals with balanced schedules more than 96% of the time.

“They are doing very well in managing their system,” he said.

He also pointed out that interconnected balancing areas within the EIM are seeing steady bidirectional transfers, indicating a true sharing of resources.

“We’re happy to see this kind of transfer — and that sometimes they’re importing or exporting,” Abdul-Rahman said. “That means the EIM is doing its job.”