By Robert Mullin

Increased transfer capacity is keeping a lid on congestion in the Western Energy Imbalance Market (EIM) and limiting participants’ ability to wield market power within their balancing authority areas, according to CAISO’s internal Market Monitor.

Gabe Murtaugh, a senior economist with the ISO’s Department of Market Monitoring, told a Dec. 7 Market Performance and Planning Forum that the increased capacity could help Arizona Public Service, NV Energy and PacifiCorp in reapplying to FERC for market-based rate authority. Citing market power concerns, FERC has limited the three companies to cost-based offers. (See CAISO Monitor Proposes Fixes for EIM Market Power Concerns.)

Puget Sound Energy — the only EIM member currently permitted to make market-based offers — has committed to the market 300 MW of bidirectional transfer capacity with the PacifiCorp-West balancing area. Those transmission links were congested during just 1% of intervals in the May-October period, Murtaugh said.

APS’ average outbound/inbound EIM transfer capability of 1,874 MW/924 MW with CAISO saw almost no congestion during the period, while the utility’s 321-MW/216-MW link with PacifiCorp-East showed congestion during 1% and 7% of intervals, respectively. Despite the proximity of their balancing areas, there is no EIM transfer capability between APS and NV Energy because of the limited availability of capacity to commit to the market.

Average transfer capacity among CAISO, NV Energy and PacifiCorp-East remained steady from May to October, and links between the areas were subject to relatively light congestion over the period. PacifiCorp-East’s outbound link into NV Energy was most congested during spring, when inland power prices are cheap.

The one exception to low congestion: transfers from PacifiCorp-West into CAISO via limited capacity available on the California-Oregon Intertie. The intertie is congested 20% of the time, in part because of the variability of transfer capacity made available to the EIM during given intervals.

“Generation in PacifiCorp-West is generally cheaper than generation that we see in the ISO and the rest of the EIM,” Murtaugh said. “And when prices are high in the ISO, [PacifiCorp-West] generation increases its output until it reaches its limit for export.”

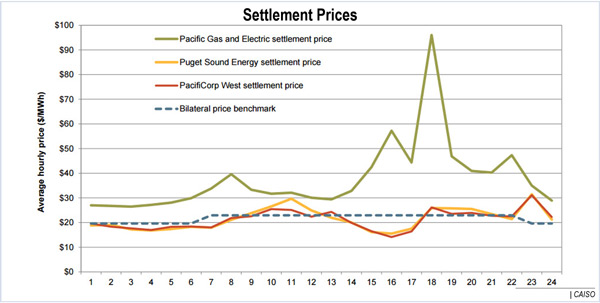

That constraint has historically led to price separation between PacifiCorp-West and the rest of the EIM.

PacifiCorp’s new EIM link with Puget Sound Energy is alleviating that isolation in most hours. Now, when there is congestion between PacifiCorp and CAISO, the ample transfer capability between PacifiCorp-West and Puget Sound means that PacifiCorp prices are set by the marginal generation in both areas, rather than just PacifiCorp-West, Murtaugh said.

But Pacific Northwest prices will still tend to diverge from the rest of the market.

“When prices are higher in the rest of the system, we see generation about as high as it can get in PacifiCorp-West,” Murtaugh said.

That pushes on the constraint out of PacifiCorp-West, causing price discrepancies between that area — and, now, Puget Sound as well — and the remainder of the EIM.

While price divergences stemming from congestion drive concerns about market power in the EIM, the Monitor finds that congestion is occurring in “a very low percentage of intervals” — even in the five-minute market, when congestion tends to be most elevated.

“The underlying message here is there isn’t a whole lot of opportunity to exercise market power during [most] intervals,” Murtaugh said.