By Rich Heidorn Jr. and Amanda Durish Cook

Shares of Westar Energy fell 8% Thursday after Kansas regulators rejected as too risky and too expensive the company’s planned sale to Great Plains Energy.

The Kansas Corporation Commission voted 3-0 to reject the $12.2 billion deal, announcing it at the end of the day Wednesday.

Westar shares, which had ended Wednesday at $55.11, dropped $4.24 to $50.87 Thursday. Shares of Great Plains, the parent company of Kansas City Power and Light, were virtually unchanged, rising 4 cents to $29.55.

Price Too High

“The commission is not opposed to mergers as evidenced by its approval of two acquisitions within the past six months,” the commission’s order said. “As one of the intervenors notes, in many ways a merger between GPE and Westar makes sense, but for one insurmountable obstacle — the purchase price is simply too high.”

The commission said that based on their complementary service territories, a merger of the two companies could make sense. But it said the price was excessive and would force Great Plains to take on too much debt, noting the $4.9 billion acquisition premium exceeds Great Plains’ market capitalization by $100 million.

The commission also said that Great Plains’ winning bid of $60/share was $4 higher than that of the next highest offer. “Evidence suggests the $60/share purchase price exceeded the expectations of both Goldman Sachs and Guggenheim,” who validated the purchase price for Great Plains and Westar, respectively. Great Plains’ own analysis showed a “mid-fifties price point as the high end of a reasonable purchase price,” the commission said.

“Unfortunately, the transaction was presented to the commission as a take-it-or-leave-it proposal. Repeatedly, the joint applicants advised the commission that any significant safeguards that would protect consumers, such as maintaining a separate, independent Westar board of directors, would halt the transaction. Therefore, the proposed transaction could not be salvaged and the commission is left with no choice but to reject” it, the commission said.

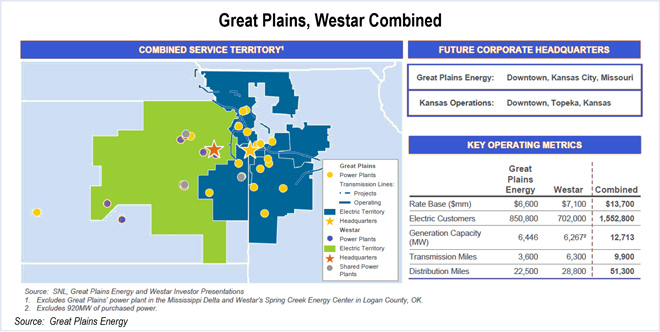

The deal, announced last May, would have given Great Plains 1.5 million customers in a service territory covering the eastern one-third of Kansas, much of the Kansas City metropolitan area and a large portion of northwest Missouri. Great Plains said the merger would have increased its operating scale, resulting in efficiencies that would benefit ratepayers. (See Great Plains Asks Missouri PSC’s OK on Westar Deal.)

Debt Burden

Great Plains would have assumed $3.6 billion of Westar’s debt. It planned to finance the $8.6 billion purchase of outstanding Westar common stock with a package of 50% equity and 50% debt, including $4.4 billion in new debt. The company issued $4.3 billion in debt financing in March, the order noted.

“Since GPE has already completed both the equity and debt portions of the financing, it argues its ability to accomplish the financial steps necessary to close and support the transaction is no longer a concern. But the issue facing the commission in evaluating the transaction … is not whether GPE could obtain financing, but whether post-transaction, the resulting entity would be financially stronger than the stand-alone entities would be absent the transaction.”

The commission noted that Great Plains acknowledged that it expected Moody’s to downgrade its senior unsecured debt rating from Baa2 to Baa3, the lowest investment grade credit rating.

The commission cited the testimony of Great Plains CFO Kevin Bryant, who said that the company hopes to pay off $300 million to $500 million of debt within three to five years, but that it has no written plan to do so.

“Since GPE has failed to formulate any written plan to pay down the debt, the commission has nothing to review and cannot assume GPE will be able to rapidly deleverage. Therefore, the commission must review the joint application under the assumption that a post-transaction GPE will have substantial debt that will likely result in downgrades to its credit rating.

“The commission shares the concerns voiced by [the Kansas Board of Public Utilities] and [the Citizens’ Utility Ratepayer Board] that if the transaction is approved, GPE has little financial flexibility and very little margin of error to keep its investment grade rating. … The evidence is overwhelming that the rating agencies believe … GPE will be a riskier investment if the transaction goes through.”

The commission also noted Great Plains and Westar’s claims that applying a consolidated capital structure that included Great Plains’ transaction-related debt would halt the merger, saying such assertions were “a tacit admission that the joint applicants’ ability to complete the deal is entirely dependent on its ability to use the operating utilities’ higher rates of return to finance the transaction.”

Savings in Question

The commission also cast doubt on Great Plains and Westar’s estimated savings from the early retirement of five KCP&L generating units and five Westar units, calling them “too speculative to be reliable.”

Great Plains and Westar “support their application with little more than preliminary estimates, developed in only three weeks and without full access to Westar’s books or personnel,” the commission said of Great Plains’ savings analysis.

The commission also said Great Plains and Westar’s commitment to not seek recovery of the acquisition premium from ratepayers was flimsy at best. It pointed out that an exception to acquisition financing can be triggered if a “single intervenor simply proposes to use a different capital structure, regardless of whether the commission adopts the intervenor’s proposal.”

With 22 parties intervening in Westar’s last rate case and nine parties intervening in KCP&L’s, the commission said Great Plains and Westar would quickly lose control of the proposal, and promises to not charge ratepayers could be broken, the commission said. “Allowing the joint applicants to seek recovery of the acquisition premium if any party in any future Westar or KCP&L rate case proposes a different capital structure renders the … promise not to seek the acquisition premium from ratepayers hollow. An exception that is so easily triggered is an empty commitment,” the commission decided. “The exception is so open-ended as to render the joint applicants’ commitment not to seek recovery of the acquisition premium meaningless.”

The commission, which ruled after taking seven days of testimony, noted that of the 28 parties that intervened, all but the applicants opposed the merger.

Great Plains and Westar officials said they were reviewing the order to consider their next steps.