By Amanda Durish Cook

CARMEL, Ind. — MISO transmission planners last week outlined three possible congestion-busting projects in Louisiana and a “skeleton” of potential projects from a long-term overlay study.

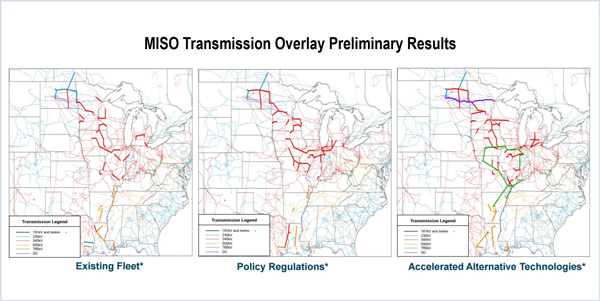

The overlay study, which used the MISO Transmission Expansion Plan 2017 futures, is designed to identify long-term transmission needs under a shifting resource mix, including possible paths for a line to link MISO South and MISO Midwest.

Preliminary results using an existing fleet projection show several 345-kV line additions in MISO Midwest, a handful of 500-KV lines in — and one leading into — MISO South, and a couple of new 230-kV lines in the Dakotas. (See MISO Begins 3-Year Tx Overlay Study.)

The policy regulations future shows a few of the 230- and 500-kV lines in the existing fleet future swapped for 345-kV ratings. The accelerated alternative technologies future depicts a large network of 765-kV lines in Central, including two 765-kV paths connecting South, and a direct current line across North Dakota and Minnesota in addition to the proliferation of 345-kV lines in Midwest and 500-kV lines in South.

MISO cautioned that “no conclusion has been reached on whether or how many projects may ultimately be recommended by the 2019 targeted completion date.”

Some stakeholders asked why MISO created preliminary overlays using MTEP 17 at all, when MTEP 18 futures consensus is close. Lynn Hecker, manager of expansion planning, said the RTO will begin examining MTEP 18’s distributed and emerging technology and see if the fourth future’s assumptions suggest the need for additional projects.

Louisiana Projects

Meanwhile, the RTO’s MTEP 17 Market Congestion Planning has produced three possible projects in MISO South: one market efficiency project and two economic projects.

All three project candidates are near the West of the Atchafalaya Basin (WOTAB) load pocket in southwest Louisiana and MISO’s control area in eastern Texas. No other areas in the RTO’s South met the RTO’s criteria for a possible project; the annual congestion planning study focused exclusively on South this year.

The projects are:

- A new $122.7 million, 500-kV line from Hartburg to Sabine in southeastern Texas with a 500-kV substation and new 500/230-kV transformer at Sabine. The lone market efficiency project candidate has a 1.28 benefit-to-cost ratio;

- A $2.8 million uprate of the Sam Rayburn-Fort Creek-Turkey Creek-Doucett 138-kV line in southeastern Texas with a 7.45 B/C ratio; and

- A half-million-dollar upgrade of terminal equipment at southwestern Louisiana’s Carlyss substation that would increase the current 230/138-kV autotransformer capacity to 300 MVA at a 15.97 B/C ratio.

Arash Ghodsian, MISO manager of economic studies, said project candidates should be finalized by July.

Footprint Diversity Study

On the other hand, the RTO’s footprint diversity study, specifically designed to identify transmission for transfers between MISO Midwest and MISO South, will spend extra time in the suggestion-gathering step.

Ghodsian said 26 of the 32 stakeholder-submitted ideas involved connecting South and Midwest through coordination with neighboring regions.

He said MISO is seeking more projects that it can implement alone, asking stakeholders to focus only on suggestions that would connect one substation to another.

“Maybe let’s take it a notch higher and look for more technical discussion,” Ghodsian said.

MTEP 18 Futures

MISO said the four MTEP 18 futures generally received stakeholder support.

The RTO revealed proposed futures in early April, introducing a distributed and emerging technology 15-year future that captures more localized siting and storage. (See MISO Introduces Distributed Energy Future for 2018 Tx Planning.)

MISO has not studied anything like this future before. It envisions new renewables largely serving their local resource zones while rising storage capability — hitting 2 GW by 2032 — is placed near buses and two-thirds of all solar additions are distributed energy resources. The RTO usually assumes one-third of all new solar additions are distributed for planning purposes.

Policy studies engineer Matt Ellis admitted that the RTO isn’t modeling all combinations of possibilities and said nine stakeholders submitted about 13 suggested futures themselves, but he added that MISO’s proposed four futures “capture the highest and lowest bookends” and said stakeholders have indicated support.

“We do agree with stakeholders that we’re not studying all combinations, but we want this to be feasible. How many can we actually study and do the in-depth sensitivities on?” he said at the April 19 Planning Advisory Committee meeting.

Stakeholders also asked if MISO would change any of its nuclear assumptions given the recent bankruptcy filing by Westinghouse Electric, which has threatened the completion of new nuclear plants in Georgia and South Carolina. All MTEP 18 futures assume zero nuclear retirements.

“All [existing nuclear plants] have licenses through the study period. So that’s where we landed at, but we’re open to revising that,” Ellis said.

MISO will hold a more in-depth conversation at the July PAC meeting, he said.