By Michael Kuser

NYISO’s Power Trends 2017 report shows an electric system of flat peak demand adapting under pressure from both public policy requirements and changes in consumption patterns. However, stark regional differences make the ISO “a tale of two grids,” CEO Brad Jones said in a media briefing on the annual report May 18.

“Not surprisingly, there are distinct differences between downstate and upstate in terms of power resources and consumer demand,” Jones said. “We have high demand and a concentration of fossil fuel generation downstate, while upstate has an abundance of clean energy resources and very low demand.”

The report, which is based on data from the ISO’s 2017 Load & Capacity Data report, or “Gold Book,” also highlights the emergence of distributed energy resources, which, in addition to serving the owners’ needs, can also provide benefits to the larger wholesale market.

The report forecasts peak demand in New York to grow at an annual average rate of 0.07% from 2017 through 2027, a decrease from the 0.83% annual growth projected in 2014 and the 0.21% predicted in 2016. Absent the impacts of energy-efficiency programs and DER, the 2017 peak demand growth rate is 0.73%.

Energy Efficiency and DER Change the Grid

The report projects energy efficiency will reduce New York’s peak demand by 230 MW in 2017 and by 1,721 MW in 2027 with annual energy usage cut by 1,330 GWh in 2017 and 2,533 GWh in 2027.

NYISO projects distributed solar resources in New York to reduce peak demand by 450 MW in 2017 and by 1,176 MW in 2027, and to lower annual energy usage by 1,845 GWh in 2017 and by 5,324 GWh in 2027. Other behind-the-meter resources may reduce peak demand by 233 MW in 2017 and by 375 MW in 2027, while possibly cutting annual energy usage by 1,584 GWh in 2017.

Pricing Carbon to Reduce Emissions

Jones said that at FERC’s May 1-2 technical conference on how to integrate state policy with wholesale electric markets, “there was a consensus that did emerge at times from the diverse interests [on] the need to price carbon in the wholesale markets.”

“This is good news, as we have already been looking at that very issue,” Jones said. “A study is underway … and the Public Service Commission and the [Department of Environmental Conservation] have both expressed a willingness to consider those options with us.” (See Carbon Adder to Test FERC’s Independence, IPPNY Panelists Say.)

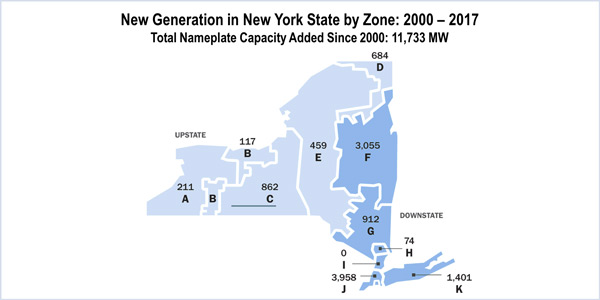

Since 2000, private power producers and public power authorities have added 11,733 MW of new generating capacity in New York, or approximately 30% of the state’s current generation. The report says more than 80% of that new generation is in southern and eastern New York, where power demand is greatest.

Jones said New York’s wholesale market design, which includes locational-based pricing and regional capacity requirements, is encouraging investment in areas where the demand for electricity is highest. He also said that energy efficiency and market improvements have saved $7.8 billion in New York since 2000.

Divide Between Assessment and Planning

NYISO Executive Vice President Richard Dewey took over the report briefing for Jones, who had to leave. RTO Insider asked Dewey about recommendations to improve NYISO’s energy market made the previous day by the grid operator’s Market Monitoring Unit while presenting the 2016 State of the Market report to the Business Issues Committee. (See Gas Price Spreads Made NYC Generation More Economic in 2016.)

In suggesting improvements, how closely had the MMU worked with The Brattle Group, which is conducting the carbon-pricing study referred to by Jones?

“David Patton’s [of Potomac Economics and head of the MMU] responsibilities under our Tariff and what he’s attempting to provide in a State of the Market report is essentially an economic assessment of the market functions themselves and how efficiently they’re working, how effective they are and how fair they are,” Dewey said. “It’s less about a forward projection of other forces that might cause us to want to upgrade either the rules within our market or how we operate the grid. It’s probably premature right now to have a tight intersection between the State of the Market that David Patton does and some of this forward-looking work.”