By Peter Key

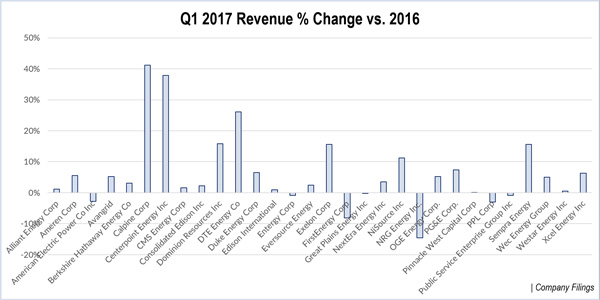

The RTO Insider Top 30 got off to a good start in 2017, with more than two-thirds of companies posting year-over-year revenue and net income increases in the first quarter. All but three were profitable in the quarter.

Collective net income for the Top 30 rose 30% to $9.84 billion on a 6.3% increase in revenue, to $81.81 billion.

NRG Energy and Exelon, which are on opposite sides of the debate over subsidies for nuclear plants, had notable —though notably different — quarters.

NRG was the worst performer in the quarter, losing $203 million after earning $47 million a year earlier. Its revenue fell 14.6% from $3.23 billion to $2.76 billion. The other companies recording losses were Calpine, which lost $52 million and has reportedly hired investment bankers to shop the company, and Great Plains Energy, which lost $9.6 million during a quarter in which its bid to acquire Westar Energy was rejected by Kansas regulators. (See Westar Shares Fall as Kansas Regulators Block Great Plains Deal.)

CEO Mauricio Gutierrez attributed three-quarters of NRG’s earnings decrease to the roll-off of expensive hedges that it executed after the so-called “polar vortex” of 2014, lower capacity revenues in the East and a few one-time items. (See Generation Woes Drive Down NRG Q1 Earnings.) The company’s revenue drop was largely attributed to a fall in its generation revenue to $1.34 billion from $1.7 billion.

| Company | Market Cap ($ billions) | Revenue Q1 2017 ($ billions) | % change vs. 2016 | Net income Q1 2017 ($ millions) | % change vs. 2016 |

| NextEra Energy Inc | $64.25 | $3.97 | 4% | $1,591.00 | 143% |

| Duke Energy Corp | $58.35 | $5.73 | 7% | $717.00 | 3% |

| Dominion Resources Inc | $49.43 | $3.38 | 16% | $632.00 | 21% |

| American Electric Power Co Inc | $33.79 | $3.93 | -3% | $594.20 | 18% |

| PG&E Corp. | $33.49 | $4.27 | 7% | $579.00 | 426% |

| Exelon Corp | $32.47 | $8.76 | 16% | $981.00 | 698% |

| Berkshire Hathaway Energy Co | NA | $4.17 | 3% | $563.00 | 14% |

| Sempra Energy | $27.72 | $3.03 | 16% | $441.00 | 25% |

| PPL Corp | $26.52 | $1.95 | -3% | $403.00 | -16% |

| Edison International | $25.48 | $2.46 | 1% | $392.00 | 28% |

| Consolidated Edison Inc | $24.54 | $3.23 | 2% | $388.00 | 25% |

| Xcel Energy Inc | $23.28 | $2.95 | 6% | $239.28 | -1% |

| Public Service Enterprise Group Inc | $22.26 | $2.59 | -1% | $114.00 | -76% |

| Wec Energy Group | $19.25 | $2.30 | 5% | $356.90 | 3% |

| Eversource Energy | $19.05 | $2.11 | 2% | $261.34 | 6% |

| DTE Energy Co | $19.02 | $3.24 | 26% | $394.00 | 64% |

| Avangrid | $13.63 | $1.76 | 5% | $239.00 | 13% |

| Entergy Corp | $13.58 | $2.59 | -1% | $86.05 | -63% |

| Ameren Corp | $13.49 | $1.51 | 6% | $102.00 | -3% |

| CMS Energy Corp | $12.91 | $1.83 | 2% | $199.00 | 21% |

| FirstEnergy Corp | $12.53 | $3.55 | -8% | $205.00 | -38% |

| Centerpoint Energy Inc | $11.84 | $2.74 | 38% | $192.00 | 25% |

| Pinnacle West Capital Corp | $9.43 | $0.68 | 0% | $23.31 | 424% |

| Alliant Energy Corp | $9.06 | $0.85 | 1% | $103.00 | 4% |

| NiSource Inc | $8.02 | $1.60 | 11% | $211.30 | 13% |

| Westar Energy Inc | $7.37 | $0.57 | 1% | $63.48 | -8% |

| OGE Energy Corp. | $6.83 | $0.46 | 5% | $36.00 | 43% |

| Great Plains Energy Inc | $6.15 | $0.57 | 0% | $(9.60) | NA |

| NRG Energy Inc. | $4.97 | $2.76 | -15% | $(203.00) | NA |

| Calpine Corp | $4.96 | $2.28 | 41% | $(52.00) | NA |

| Total | $81.81 | 6% | $9,842 | 30% |

Exelon posted the largest increase in net income among the Top 30, earning $981 million versus $123 million in Q1 2016. Contributing were its Pepco Holdings Inc. subsidiary, which earned $140 million in the first quarter after losing $309 million a year ago, and Exelon Generation, which posted net income of $423 million, up from $310 million a year earlier. Exelon Generation realized a $226 million (after-tax) “bargain purchase gain” on its acquisition of the James A. FitzPatrick nuclear plant from Entergy.

Pacific Gas and Electric posted the second-largest gain in net income, earning $579 million, compared to $110 million in 2016. Much of the difference was because of one-time expenses the company incurred in the first quarter of 2016: $381 million (pre-tax) that it had to pay out for a wildfire caused by one of its power lines and disallowed capital charges of $87 million (pre-tax) imposed on it by the California Public Utilities Commission for the San Bruno gas pipeline accident.

NextEra Energy had the fourth largest net-income gain in the quarter, earning $1.6 billion from $654 million in the same period last year. A large portion of that came from the sale of its FiberNet telecom subsidiary for $1.5 billion.