By Amanda Durish Cook

Great Plains Energy has pulled back from its attempted acquisition of Westar Energy, recasting the move as a “merger of equals” after the two companies last week asked Kansas regulators for permission to merge under a tax-free share exchange.

The Kansas Corporation Commission blocked an earlier version of the deal in April, criticizing the $60/share purchase price as too high. (See Westar Shares Fall as Kansas Regulators Block Great Plains Deal.) Shareholders are poised to gain less in the new, stock-for-stock proposal.

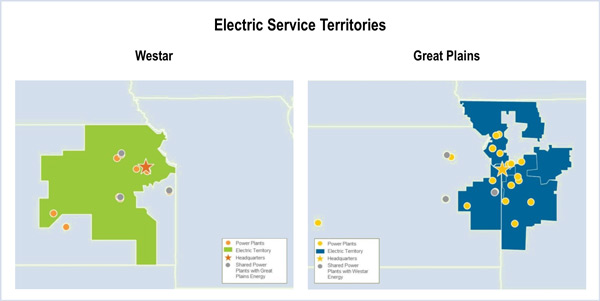

Under the new proposal, Great Plains would no longer become Westar’s parent company. Instead, the two companies would combine under a $14 billion holding company operating in Kansas and Missouri. Westar shareholders would own about 52.5% of the company with Great Plains shareholders holding the rest, according to the amended merger application (18-KCPE-095-MER).

The new deal would entail no cash exchange or transaction debt, and retail customers would receive $50 million in upfront bill credits across all rate jurisdictions. The combined company would serve about 1 million customers in Kansas and almost 600,000 customers in Missouri.

The two companies are expected to retain their original names after the merger, and Westar will continue to maintain an operating headquarters in Topeka, Kan., staffed by 500 employees. The companies have pledged not to lay off any employees. Corporate headquarters for the merged company would be located in Great Plains’ Kansas City, Mo., location.

The plan requires approval from both the KCC and the Missouri Public Service Commission. The companies will also file applications before FERC and the Nuclear Regulatory Commission as early as this week and will seek respective shareholder approval during the fourth quarter. If approved, the deal is expected to close in the first half of 2018.

The CEOs of both companies say the revised agreement represents savings for customers and an opportunity for long-term growth for shareholders, while better positioning the companies to invest in infrastructure.

“We carefully listened to the KCC’s concerns with our original transaction and crafted a new merger agreement using the KCC’s earlier order for guidance to bring better value to customers and shareholders of both utilities compared with remaining standalone,” said Great Plains CEO Terry Bassham.

Westar CEO Mark Ruelle called the merger “a long and unpredictable path” during a second-quarter earnings call in early August: “We spent a lot of time in May and June confirming that there wasn’t just a stop sign in the order, but also road map to approval. … It wasn’t the course on which we first set out, but I’m pleased where it’s taken us and encouraged by the value it creates for our customers and our shareholders. The KCC order was clear that a big premium deal was going to be problematic.”

Fewer Future Rate Cases

In testimony to support the filing, Ruelle said that without a merger, Westar’s “flat sales and rising costs” will translate into higher prices. Bassham testified along similar lines, saying that “costs to serve … customers will continue to rise unchecked” and absent a merger, Great Plains “would need to seek higher prices and more frequent price increases as the remedy for any unmitigated higher costs.”

Both CEOs claim the merger will lessen the need for future rate cases.

“With the merger savings, we’ll no longer be as dependent on rate cases to produce earnings,” Ruelle said during the earnings call.

In early August, Great Plains posted a second-quarter loss of $22.1 million ($0.10/share), while Westar announced earnings of $72 million ($0.50/share), in line with last year’s second-quarter results.