By Rory D. Sweeney

VALLEY FORGE, Pa. — American Municipal Power last week continued its criticism of PJM’s grid spending, grilling utility officials during a marathon Transmission Expansion Advisory Committee meeting.

Scheduled for four hours, Thursday’s meeting lasted closer to five as Ryan Dolan, AMP’s director of transmission planning, asked technical questions about nearly every project presented and at one point accused American Electric Power of attempting to increase its revenue by overbuilding.

“The reason I was hired at AMP was to control their transmission costs,” said Ed Tatum, AMP’s vice president of transmission, who joined the company two years ago from Old Dominion Electric Cooperative. In September, he hired Dolan — from AEP — to aid his effort.

“AMP has put in place the human and transmission modeling resources to enable us to review and assess PJM and the Transmission Owners’ plans and ask the necessary technical questions to support the need for a project,” Tatum said.

‘Minimum’ Information Required

The TEAC session followed a Planning Committee meeting at which AMP presented templates illustrating the “minimum” information it needs to evaluate projects.

Tatum said he did not “try to orchestrate” the long meeting or “filibuster” to make his point. Without the information requested, he said, “we’re not going to have any choice but to ask those questions” and “we’re probably going to be here until 6 o’clock” next month as well, he said. “The meetings could be done in a couple hours if the information on the examples we provided was available sufficiently in advance.”

The TEAC meeting was surprising for its length, but not its content. Dolan and Tatum have led a customer pushback on the more than $1 billion in transmission projects that get discussed at monthly TEAC meetings before being authorized for construction by PJM’s board through the Regional Transmission Expansion Plan. Their frustration is also on display at meetings of the Transmission Replacement Processes Senior Task Force, where they argue for increased engagement with TOs on when to determine that transmission infrastructure needs to be replaced and how to do it. (See New Wave of PJM Transmission Upgrades Rankles AMP.)

TOs argue that their networks are theirs to maintain as they see fit, but AMP, ODEC and other customers contend that as the ones paying the bills, they should have a say.

Tatum had proposed presenting the project information templates at the TEAC, but PJM moved it to the PC because that is where all discussions on the planning procedure take place. Tatum hopes the move indicates that PJM will organize a discussion on the topic.

“At this point, I’d like to see how that discussion goes,” Tatum said after the meeting. “We would hope that we be able to get more transparency.”

PJM appeared amenable to discussing AMP’s information demands. Staff agreed to add the issue to next month’s PC agenda.

“Clearly what we’re doing now is not sustainable,” said Paul McGlynn, PJM’s administrator of the TEAC.

Confidentiality

TOs have previously raised legal concerns with discussing confidential details of transmission projects in open meetings and did so again on Thursday. Alex Stern of Public Service Electric and Gas said that because issues involving PJM and TO compliance with FERC Order 890 are awaiting a FERC decision, there is a limit on how much TOs can discuss. (See Load Blocks TO Effort to Extend Hiatus of PJM Transmission-Replacement Talks.)

“All of this raises some legal issues as well, so before we go back to the PC, you might want to confer with” PJM’s legal team, he said.

Dolan and Tatum said they understand confidentiality and security concerns and suggested that when there are multiple projects with Critical Energy Energy/Electric Infrastructure Information (CEII) information, PJM could hold meetings restricted to stakeholders with CEII clearance so that the information can be discussed.

Layering Impacts

The pair said several AEP and PSE&G projects discussed at the TEAC highlight their concerns.

AEP is planning to replace its Tidd 345/138-kV transformer on the Ohio-West Virginia border, about 45 miles west of Pittsburgh. The 150-MVA unit, which was manufactured in 1957, was taken out of service in March. The new unit will be increased to 450 MVA and include a series reactor on the low side to mirror a parallel transformer, at a cost of $7.8 million.

Dolan said the project description failed to explain whether the proposal sizes the reactor appropriately for future short-circuit changes. “Are we going to see an issue in five years? Four years? Two years?” he asked. Tatum later questioned whether AEP planned ahead when it replaced the facility’s breakers to account for a second breaker.

AMP argues that TOs’ supplemental projects — which are based on their internal criteria and don’t require PJM authorization — can create reliability issues that necessitate baseline projects, which are directed by the RTO’s criteria and do require board authorization. The lack of information makes it impossible to evaluate how a supplemental project impacts individual equipment on the system because stakeholders are only made aware after a piece of equipment is overloaded, AMP said. (See Report Decries Rising PJM Tx Costs; Seeks Project Transparency.)

“The lack of this information concerns us because by putting in a bunch of supplemental projects, the transmission owners can be bringing the system up to a point where the [NERC criteria] would soon require baseline reliability upgrades,” Tatum said.

PJM has said its abiding principle in planning for increased grid resiliency is “do no harm.”

“What do you consider ‘do no harm’?” Dolan asked. “The only organizations that are aware of the impacts, power-flow-wise, of these supplemental projects are the TOs that are submitting them and PJM.

“Stakeholders are not getting an opportunity to review the impact of these projects. The only time that there is any sort of review done is if those projects actually create overloads,” he said. “What we are interested in is to understand the incremental [system power flow changes associated with these projects]. … We have concerns about the layering of projects … which change system impedances and responses that drive [future baseline] overloads.”

Selective Criteria

At the Broadford station in southwestern Virginia, AEP is planning to spend $102 million installing six new breakers and replacing seven breakers, a reactor and two transformers that are showing signs of imminent failure. Dolan argued the additional breakers were unnecessary and will protect nothing that isn’t already protected by the existing breakers.

AEP has similar situations at its Kenzie Creek, Cloverdale and Desoto stations, he said, but chose not to increase protection there. Kenzie Creek is in Michigan about 20 miles north of South Bend, Ind., Cloverdale is in Virginia and Desoto is northeast of Muncie, Ind.

“You’re willing to spend money when you’re able to get away with it,” Dolan said to AEP representatives who called into the meeting. They denied the accusation and said they use discretion when applying their criteria.

“Even though the projects involve circuit breakers’ replacement, the optimal solution for each is unique,” AEP’s Kamran Ali said in an email to RTO Insider.

The difference, he said, is that nearly all the 138-kV breakers need to be replaced at Broadford, so it makes sense — from a cost, reliability and outage perspective — to build a new 138-kV yard. Adding the “separation of protection zones” at that time is both cost effective and efficient, whereas the other projects only require individual equipment replacements that make separation of protection zones “neither prudent nor cost effective,” Ali said.

Dolan wasn’t satisfied.

“They are not being consistent, and they are not being consistent about information they do not provide to the public,” Dolan said. “I’m starting to notice that this is unique to certain states.”

Dolan said AEP is planning similarly excessive breaker installs at the Axton station, also in Virginia.

“It is most cost-effective to tailor the asset replacement solution to the scope of the project and the specific site conditions. This is not the result of inconsistent approaches, but a commitment to deliver solutions that address the need in the most cost-effective manner for our customers,” Ali said in his email. “Applying a rigid approach that does not recognize the differing situations could lead to higher costs, lower reliability, and less efficient projects for our customers.”

Maintenance Questioned

Other stakeholders joined Dolan in questioning PSE&G’s $546-million rebuild of its 53-mile Roseland–Branchburg–Pleasant Valley corridor. David Mabry, who represents the PJM Industrial Customer Coalition, noted that two of the photos of degraded equipment included in PSE&G’s documentation were date-stamped September 2013. Stakeholders questioned why PSE&G waited four years to present the violation of its FERC Form 715 criteria, which allow TOs to determine what factors indicate when its facilities should be replaced.

Dolan argued it might be because the shortened repair timeline designates the project as “immediate need,” which ensures PSE&G will be able to replace the infrastructure itself and the project won’t be eligible for competitive bidding.

“One of two things is happening: We’ve either chosen not to address it back then and customers could have been put at risk [of service interruptions], or we waited until we could make the determination that it is immediate need,” Dolan said. “By driving everything to immediate need … you’re preventing opportunities for competition. … When we have a lack of competition, we have an excessive amount of costs.”

Stern and PSE&G colleague Esam Khadr disagreed with the “immediate need” characterization, saying it went through a condition assessment as outlined in Form 715 procedures, including independent analysis by an outside consultant.

“These particular pictures may have been from 2013, but the line continued to be maintained and provide service while condition assessments per the FERC Form 715 procedures were only recently completed,” Stern explained.

Dolan said this is a pattern with PSE&G projects.

“I have yet to see a [Form 715] project come forward that is not immediate need when they bring it forward,” he said.

In an email to RTO Insider, Stern responded that “AMP can’t have it both ways.”

“They can’t profess to want TOs to maintain facilities for as long as viable, performing assessments and maintenance for as long as possible and then when condition assessments indicate that that is no longer viable, assert that the project should have been brought sooner. The Roseland-Branchburg-Pleasant Valley line is one of the original lines dating back to the formation of PJM 90 years ago. It has been maintained for decades and provided steady, reliable service on behalf of customers through that entire time. It has certainly done its job. However, condition assessment clearly reveals that it is in need of replacement, and replacement under these circumstances is the correct and cost-effective approach for customers.”

Stakeholder Support

Sharon Segner of LS Power also questioned the timing of the proposal, saying the project should be opened for competitive bidding under FERC Order 1000.

“It very well may be the solution,” she said. “What I’m questioning is the process.”

Stern later noted that “FERC Form 715-driven projects are exempt from competitive bidding processes pursuant to FERC orders.”

AMP’s proposed project information templates received endorsement from Greg Poulos, the executive director of the Consumer Advocates of the PJM States (CAPS).

“The consumer advocate offices are well aligned with AMP,” Poulos said.

PJM Response

PJM staff attempted to divert project questions to its newly formed online Planning Community, providing a refresher on the group’s purpose.

“It’s not a dead letter office,” PJM’s Fran Barrett said.

But Dolan disagreed, complaining that he hasn’t received responses in that forum.

“I’ve submitted a whole slew of questions [to both the planning community and directly to PJM], and just writing them down doesn’t get them answered. My question is: Even if we write them down are they going to get answered?” he said. “I have not received a response to everything [asked], and in fact, we’ve been told we’re not getting an answer” to some questions.

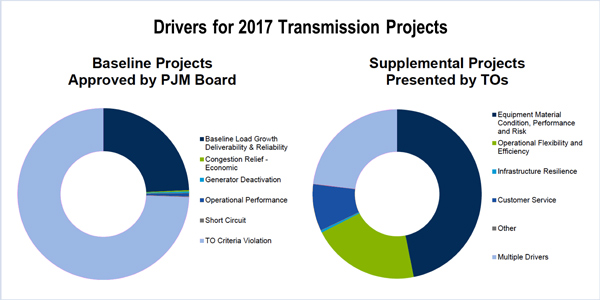

PJM presented several charts documenting transmission projects including one that showed AEP, Dominion Energy and PSE&G proposing many supplemental projects, which are not competitively bid.

“I understand the visuals here, but I don’t think this is enough information to draw conclusions about individual transmission owners and their [Form] 715 criteria,” PJM’s Sue Glatz said.