In the absence of clear national policies and strategies, action for transitioning to a net-zero economy is being mobilized through investors and financial markets, financial institutions, insurance companies, regulators and courts, Maryam Golnaraghi said at a Cornell University webinar Monday.

“This was mobilized not because the world realized that climate change was the biggest problem but … with the 2007-2008 financial crisis … which compromised the financial stability of governments and financial institutions,” said Golnaraghi, director of climate change and emerging environmental topics at the Geneva Association, an international think tank of the insurance industry. A Cornell alumna, she has worked for more than 25 years in senior advisory positions in industry, government and the U.N., and was the lead author of the Geneva Association’s February 2021 report on climate risk assessment.

Central banks, she said, started thinking about whether there were other factors that could lead to similar economic instability.

Despite the science becoming more widely available through the U.N.’s Intergovernmental Panel on Climate Change, “only in the last five years has the debate about climate change shifted from skepticism about the science … to a real foundation for socioeconomic development; to a real topic around financial stability, about innovation around labor and trade,” Golnaraghi said.

Among the most prominent risks the World Economic Forum has identified are climate change and its associated financial and socioeconomic risks. Transitioning will affect every sector, most importantly the energy sector, she said.

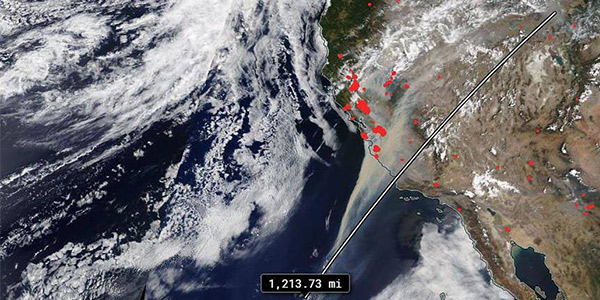

“If we continue to rely on carbon-intensive agriculture, transportation and production of chemicals, ultimately we bring our climate system to a point where the risk, particularly from increasing severity and frequency of extreme events, becomes so high that it becomes an existential risk to the society,” Golnaraghi said.

She said it is “very important” to reform the financial system to transition to a net-zero economy and encourage investors to think long-term. The No. 1 priority is to be able to quantify the risks and then map out a way to go from experience to forward-looking climate risk modeling.

Material Risk

The key to government and industry collaboration on climate change is accessibility to risk information, Golnaraghi said. For emerging economies, the insurance industry has pulled in the U.N. and World Bank Group to avail these kinds of risk analytics and development of risk information in developing economies.

Canada, through the engagement of the banking and insurance sectors and the government, is reforming its post-disaster aid and is thinking about reforming its risk management, she said.

“I’m also facilitating these discussions in the United States and similarly in England, Australia and Germany, just as examples,” Golnaraghi said. “Now, when you see five major, mature economies start through ever-stronger industry-government collaboration to address these issues, other economies will follow.”

Building capacities to withstand extreme risk is becoming the norm, she said. While international businesses have incorporated climate change into their core planning, she added, the U.S. still does not have a carbon tax or a clear policy around climate change.