The North Carolina Utilities Commission’s public hearing on Duke Energy’s integrated resource plans was originally set for 7 p.m. on March 16. However, a record-breaking 211 groups and individuals signed up to speak, and the single meeting multiplied into a series of six to be held throughout April and May.

The intense interest in the plan reflects the high stakes involved. North Carolina has committed to cutting its carbon emissions 40% by 2025, and 21 cities and counites and 66 companies across the state have made similar or more ambitious pledges. But critics argue that the incremental approach Duke favors won’t get them there.

“In the 21st century, the fact is that the energy system is transforming,” said Tyler Fitch, Carolinas regulatory director at Vote Solar. “If we continue to have these 15-year plans that pretend like everything is going to be the same, it’s going to lead to problems.”

Initially submitted to the NCUC last September, the essentially identical IRPs for Duke’s two subsidiaries in North Carolina, Duke Energy Carolinas and Duke Energy Progress, detail how the utility would meet customers’ energy demands over the next 15 years while meeting its goal of being carbon neutral by 2050. Duke’s proposed IRPs included six pathways with different carbon reduction strategies.

The options range from a business-as-usual scenario that continues to slowly retire coal, invest little in renewables and buildout natural gas, to a high carbon reduction strategy that heavily invests in wind, solar and battery storage, with no new gas plants.

In public comments filed thus far, only the NCUC’s Public Staff, the commission’s consumer advocate, has supported Duke’s IRPs. Its filing recommends that the commission accept both Duke’s business-as-usual and business-as-usual plus carbon policy pathways as reasonable for planning purposes.

Many more of the comments voice opposition. Top concerns are that coal plants won’t be decommissioned fast enough; continuing to build natural gas plants would raise costs for ratepayers; and renewable energy sources weren’t accurately priced.

“Duke Energy Carolina’s IRP does not account for all the benefits of renewables, assigns inaccurate costs to the adoption of renewable, and fails to address the benefits that might be associated with market reform,” wrote representatives from Apple, Facebook and Google in a public comment. “Its proposed base case appears to be largely modeled on a ‘status quo’ approach, reflecting additional investment in capital-intensive, non-renewable generation for at least the next decade.”

Mark Oliver, the vice president of integrated system planning at Duke, said in a recent statement that all six of the pathways keep Duke on track to meet its climate goals. But many remain skeptical.

In three of the pathways, Duke would retire its coal plants under its deemed “most economic” time rather than the “earliest practicable” time. The utility’s “most economic” scenario, which would be used in three of the six pathways, has four of its 10 coal-fired power plants in operation after 2030, with two plants that have dual coal and gas systems operating until the end of their economic lives.

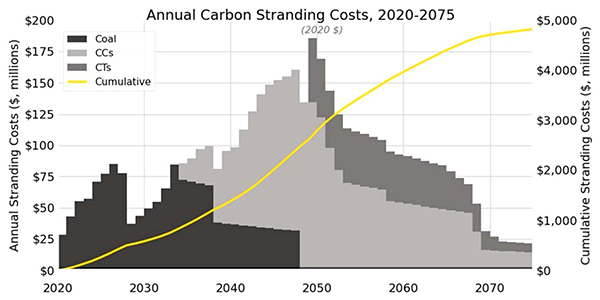

A big concern for many critics is what would replace coal. In all pathways except for “no new gas,” Duke plans to add between 6,000 and 9,600 MW of natural gas. In a report Fitch authored for the Energy Transition Institute, he calculated that if Duke built 9,600 MW of new gas plants, the cost for ratepayers in North and South Carolina would be $4.8 billion, or $900 per family, based on Duke retiring these plants early to meet climate goals.

In his statement, Oliver claimed that the “no new gas” pathway would be the most expensive option for customers, would delay coal retirement and would threaten the reliability and affordability of the power supply.

However, an analysis conducted by Synapse Energy Economics found that Duke could economically meet customer needs without adding gas. Synapse provided alternate dates for coal retirements, increased energy efficiency programs and added renewable resources and battery storage to show that Duke could follow a low-emissions pathway that meets demand while maintaining the utility’s 17% planning reserve margin.

Another frequent criticism was that renewable resources were not fairly priced in the IRPs. A filing from NC WARN, a nonprofit focused on climate change, and the Center for Biological Diversity disputes Duke’s claim that a net-zero plan using battery storage would cost three to four times more than a plan that relies on gas. The groups analyzed trends in battery cost decline, which they found are expected to cost half as much as Duke projected by 2023. The filing also found that Duke’s cost assumptions for gas plants are less than half of actual costs of past plants. Between these two findings, the filing states, Duke’s claim is “negated when accurate pricing is used.”

“What we are talking about here is locking ourselves into a fossil fuel economy for the next 40 or 50 years,” Fitch said. “If we move forward with these plans, we’re going to pay a big premium to catch up.”

Local Governments Rely on Duke’s Efforts

For North Carolina municipalities such as Durham, meeting their climate goals is easier said than done. North Carolina is not considered a home rule state, which means that the state legislature must provide authority to local governments first before they can pass certain legislation.

In this context, Duke could make an enormous difference for local governments. Eleven cities submitted a joint comment to the NCUC, and Raleigh, Charlotte and Asheville submitted additional comments individually. The joint statement said that while the 11 local governments see Duke as an essential energy partner, they have concerns regarding the submitted IRPs.

“It’s new for us local governments to provide comments,” said Tobin Freid, the sustainability manager for Durham County. “We wanted to because what Duke does, the decisions they make, affect our ability to meet our greenhouse gas emissions reductions.”

Durham County has set a goal of reducing county operation emissions 50% from 2005 levels by 2030 and reaching net zero by 2050.

“If Duke met its own climate goals, we’d be golden,” Freid said. “We would still have to be electrifying our fleet, but then if we were plugging those vehicles into a clean grid, we’re good. Our local tax dollars could instead be spent on people who don’t have food or affordable housing or our K-12 schools, I mean a million other priorities.”

If Duke decides not to pursue one of its high carbon reduction pathways, it may be impossible for Durham to reach net zero emissions by 2050, Freid said.

“Even if we’ve maximized all of our roof potential, electrified our fleet and got rid of natural gas in our buildings, there is still some percentage that we’re buying from Duke,” she said. “If they don’t clean what they’re doing, we won’t meet our goals.”

Equity Concerns Sidelined

Another concern for local governments and other stakeholders was the minimal attention Duke paid to equity concerns in the IRPs.

“I don’t think any of the plans that Duke Energy put forth [will] forward environmental justice or equity in the state,” said Claire Williamson, energy policy advocate at North Carolina Justice Center.

Williamson identified energy efficiency and better home weatherization as key strategies to improve quality of life for low-income North Carolinians, but she does not see Duke prioritizing such programs.

“We just don’t have incentives that are lined up for the utilities to really push for energy efficiency,” she said.

While Duke’s IRPs include some energy efficiency efforts in each of the pathways, the local governments said that it was unclear how historically disadvantaged communities were engaged in developing the plans. “Successful and durable low-income programs engage these communities so that programs benefit all,” they wrote.

Especially during COVID-19, Williamson said, Duke’s failure to acknowledge equity in its IRPs is a glaring omission.

“Access to basic utilities is a real struggle for hundreds of thousands of households right now,” she said. “Building natural gas power plants that are going to become inoperable within their lifespan risks raising costs drastically for those who are already struggling.”

Decision Lies with the Utilities Commission

Other utilities in the Southeast have faced similar public criticism about how effectively their IRPs address climate goals. In February, the Virginia utilities commission deemed Dominion Energy’s IRP insufficiently clear on how Dominion will comply with the Virginia Clean Economy Act. (See Virginia Grades Dominion IRP Incomplete.) Dominion’s proposed IRP was also unanimously rejected by South Carolina regulators in 2020, leading them to file a new plan last month that models an early retirement of its coal fleet.

In North Carolina, the seven-member Utilities Commission will determine whether Duke can proceed with its IRPs as submitted or if the utility will have to address public concerns. All but one of the commissioners was appointed by Gov. Roy Cooper (D), who has spearheaded North Carolina’s climate efforts.

During a technical conference in March, the NCUC heard about Duke’s plans to integrate new technology and automate grid processes to support a future advanced grid. The NCUC has also directed Duke to present in April on how it will increase the distributed energy resource load on the grid. (See NC Looks at Holistic Approach to Planning.)

Whether such actions signal that the NCUC might require Duke to pursue one of its high carbon reduction pathways remains uncertain. The NCUC is not under a deadline for approving the IRPs, according to commission staff.

Meredith Archie, a spokesperson for Duke, says that the utility welcomes increased public interest. “The public hearing gives us an opportunity to hear directly from our customers,” she said. “And we look forward to hearing their thoughts on the IRPs.”

Durham’s Freid hopes the extensive input will persuade the commissioners to send Duke back to the drawing board.

“It would be surprising to me if all of that attention doesn’t change something,” she said. “We hope that it will result in a much more climate-friendly IRP than what has been submitted so far.”